Any Income Or Profit Notepad Out To Shareholders Is Called

A dividend is a distribution of profits by a corporation to its shareholders.

Any income or profit notepad out to shareholders is called. Any amount not distributed is taken to be re invested in the business called retained earnings the current year profit as well as the retained earnings of previous years are available for. In a firm if both profit levels and growth rates are relatively equal the directors have a logical base for formulating dividend policies. But it is very popular in the uk. Ordinary shares also called common shares give their owners the right to vote at company shareholder meetings but have no guaranteed dividend.

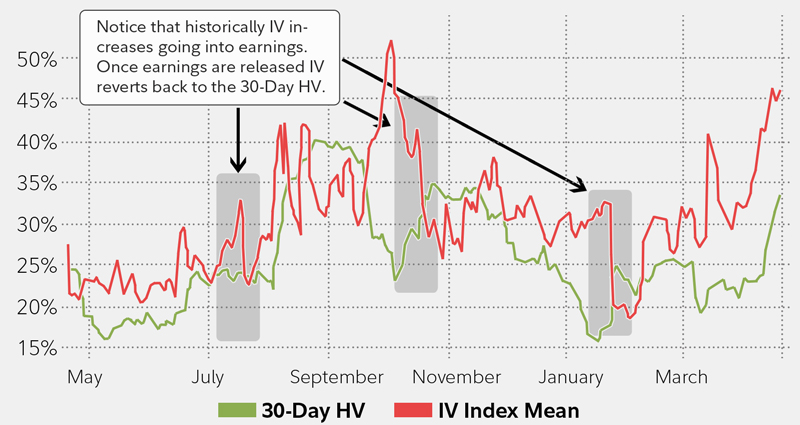

It should be borne in mind that if the dividend paid out of net income is based on highly subjective factors it is likely to be questioned more than if it is based on clear cut data. Any profit that is. There are three popular ways to do this. When a company generates a profit and accumulates retained earnings those earnings can be either reinvested in the business or paid out to shareholders as a dividend.

Earnings available for ordinary shareholders in a dictionary of accounting. When a corporation earns a profit or surplus it is able to pay a proportion of the profit as a dividend to shareholders. The company pays out cash to shareholders on a regular basis. Profit is a financial benefit that is realized when the amount of revenue gained from a business activity exceeds the expenses costs and taxes needed to sustain the activity.

Shareholders typically receive declared dividends dividend a dividend is a share of profits and retained earnings that a company pays out to its shareholders. Net income attributable to shareholders is the net income minus the non controlling interests sometimes called minority interests. Net profit margin is also used in the dupont method for decomposing return on equity roe return on equity roe return on equity roe is a measure of a company s profitability that takes a company s annual return net income divided by the value of its total shareholders equity i e. Some people provide other people with money to set up a business.

If the company does well and succeeds. Non controlling interests non controlling interests occur when there is a parent company and another partner or partners that own a subsidiary. The people who took the money are called management. The profit of a company that is available for distribution in the form of a dividend to the holders of ordinary shares.