As Income And Wealth Rise We Would Expect

The same group of upper income families is now about 70 times wealthier than low income families.

As income and wealth rise we would expect. Bond prices and interest rates both rise. While income is generated wealth is created there is a big difference between two many think that these two terms are one and the same thing but in reality income is a stream of money which a person receives from different sources such as salary rent profit interest etc that helps in the creation of wealth and wealth is the total market value of all the assets possessed stored or. The notion of consumption smoothing means. Both of those numbers are all time highs as far back as records were kept.

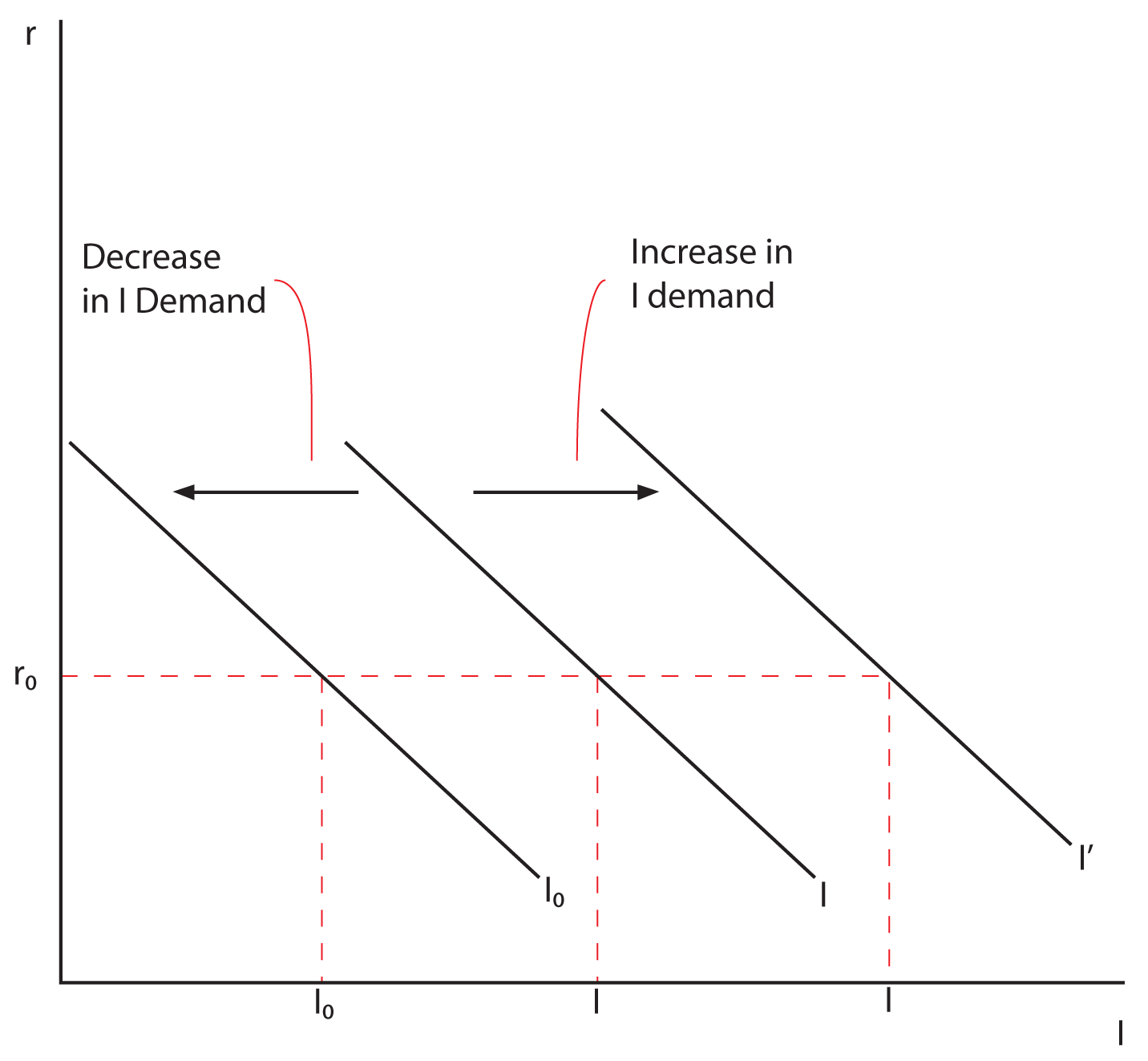

As wealth increase in the economy we would expect to observe a. Once income and wealth were combined. As income and wealth rise we would expect. Savings to increase as people save some of the extra wealth or income they have.

E ect of changes in wealth increase in wealth raises current consumption so lowers current saving. If time preferences increase. The ups and downs in the stock market are an important source of. As being of equal value then we have a very regressive tax system in the uk.

We thank nicolas hérault for preparing the individual level income data underlying the estimates that we use from jenkins 2017 we are grateful to alissa goodman ucl formerly of the institute for fiscal studies for providing tax unit micro data for 1961 to 1999 extending the series of goodman and webb to comments received at the ecineq2017 and iariw2018 conferences. As income and wealth rise we would expect savings to increase as people save some of the extra wealth or income they have your roommate arrives home and says i am so hungry i would give up my iphone for a bowl of chili right now. Bond prices fall and interest rates rise. The low income measure lim is a relative poverty measure that indicates the share of the population with income less than 50 percent of median income.

We would expect both measures to rise in recessions and decline in periods of buoyant economic growth. Consumption varies less than income over a person s lifetime. That s up significantly from even 2010 when it was 6 2 times greater. The median wealth of upper income families is now 6 6 times that of middle income families.

Bond prices and interest rates both fall. For example an increase in wealth from a unanticipated bequest has the same e ect on the consumer s available resources as the same amount increase in current income.