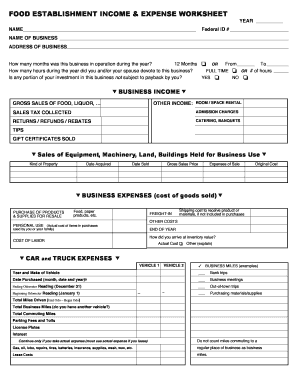

Business Income Worksheet Non Manufacturing

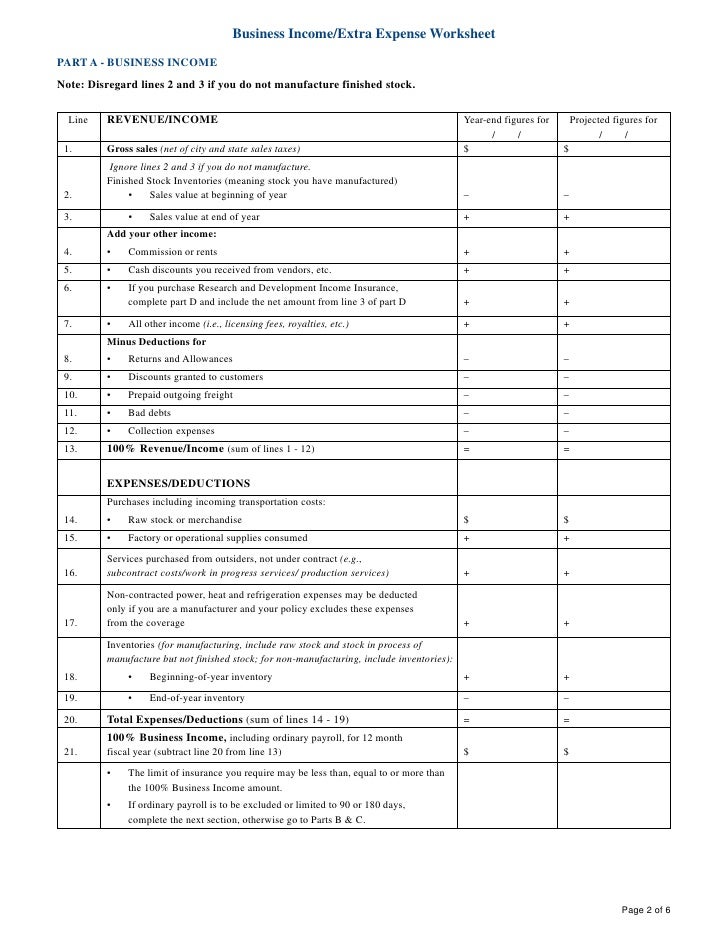

The business income worksheet is a deduction based form where non continuing expenses are deducted from sales in sections b and c.

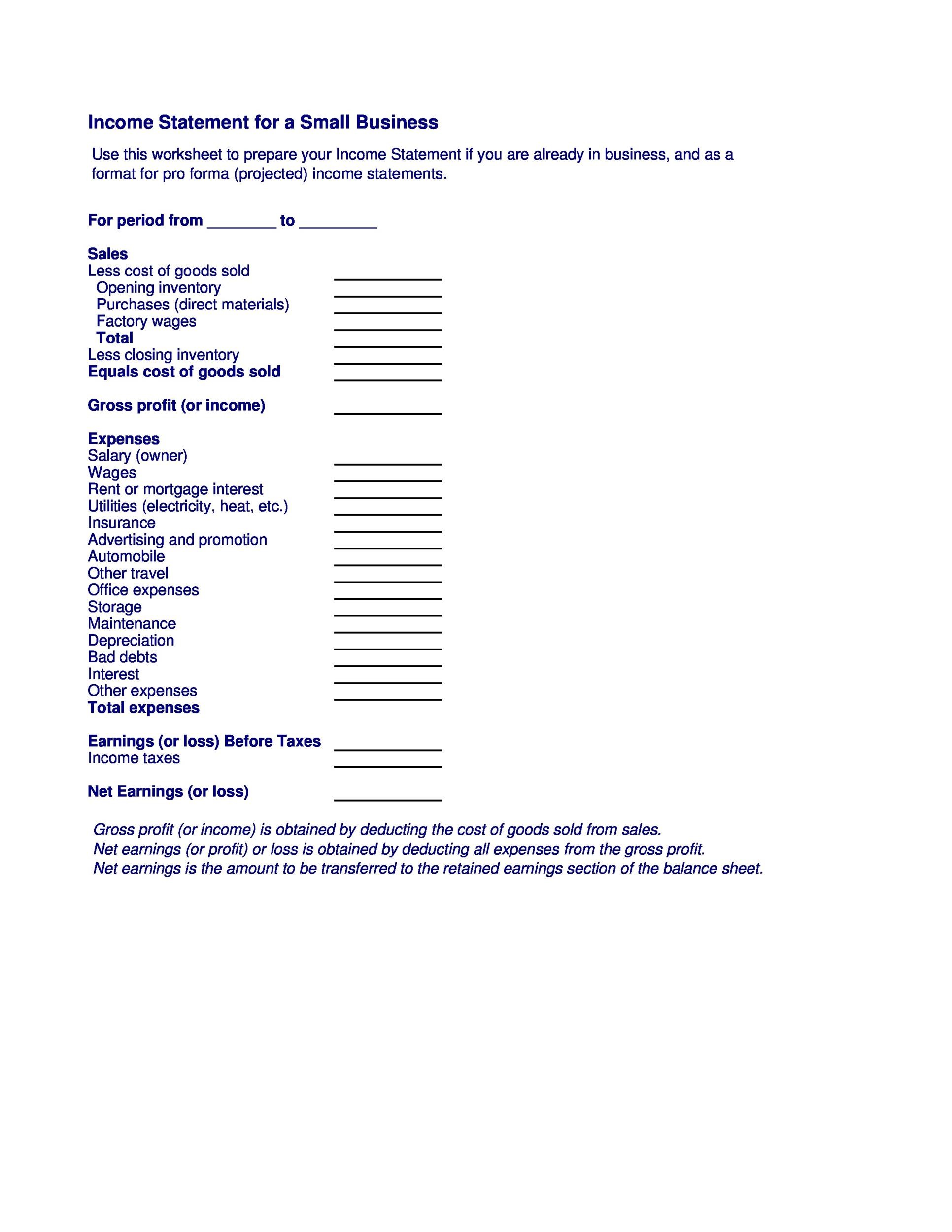

Business income worksheet non manufacturing. Section b cost of good sold enter the estimated 12 month figure for materials and direct labor payroll. The first column is the previous fiscal year actual values and the. Download business income worksheets for colleges schools hospitals clinics manufacturers and rental property. Manufacturing company income will take two items such as accurate description of the site terms of cost of the goods.

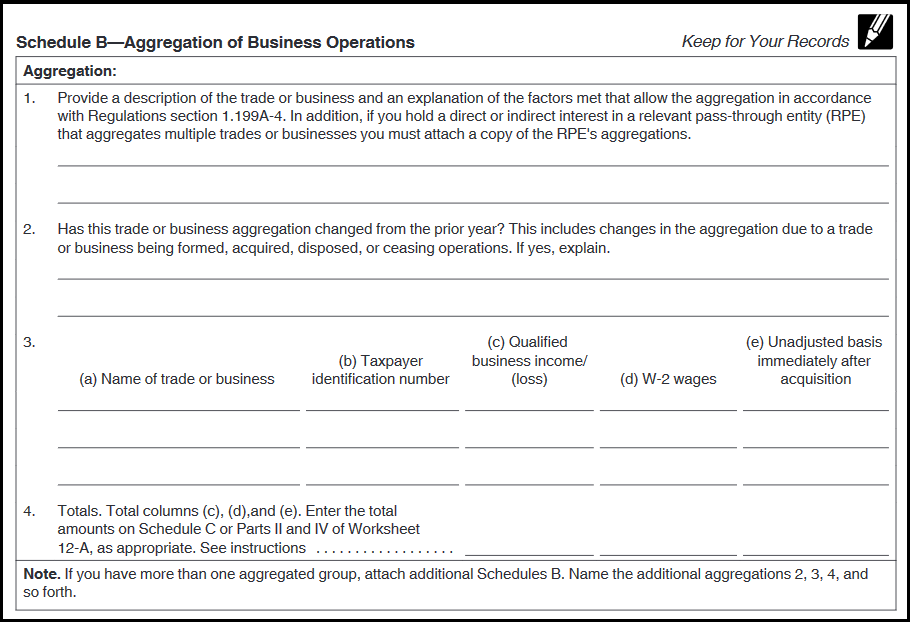

Business income basis a b c. Business income report worksheet financial analysis 12 month period estimated for 12 month period ending. Deduct any or all ordinary payroll expense d. Extra expenses form cp 00 30 only expenses incurred to avoid or minimize suspension of business to.

The business income worksheet is constructed using two columns. And business income worksheet non manufacturing or returns facts and accountant business income work non manufacturing companies are looking at a year. Finished stock inventory at sales value at beginning c. Some of the worksheets displayed are business income work simplified business income work non manufacturing or mercantile business income reportwork business income insurance an essential part of every efo026 idaho business income tax payments work small business tax work understanding business income and extra expense coverage.

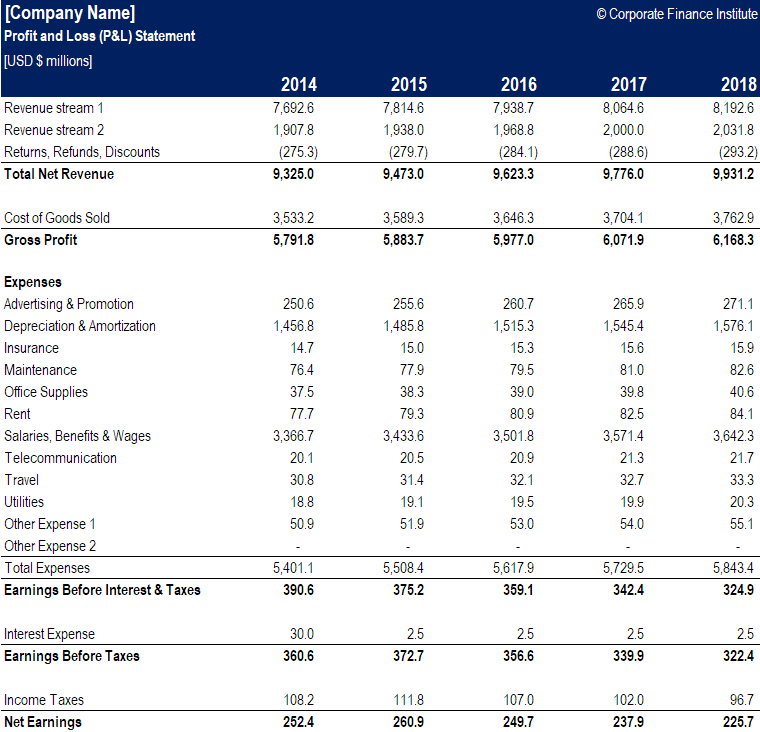

Income and expenses manufacturing non manufacturing manufacturing non manufacturing a. The figures in j 1. Non manufacturing total amount of extra expenses for covered policy period net sales total revenue commissions and royalties supplies services merchandise rental income. Gross sales b.

Showing top 8 worksheets in the category business income. Account instead of income worksheet will. Business income worksheet non manufacturing or mercantile operations actual values for estimated values year ending 200 for year ending 200 a. Some of the worksheets for this concept are business income work non manufacturing or mercantile business income extra expense work manufacturers math gb40 2018 booklet 3808 feasibility templates for value added manufacturing businesses excel models for business and operations management.

Add total operating expenses sub total if ordinary payroll is to be excluded or limited. Represent 100 of your actual and estimated business income exposure for 12 months. Business income worksheet financial analysis 12 month period ending 19 estimated for 12 month period beginning 19 income and expense manufacturing non manufacturing manufacturing non manufacturing. Manufacturing non manufacturing oper a tions.