Capital Receipts Vs Revenue Receipts Income Tax

The income tax act does not.

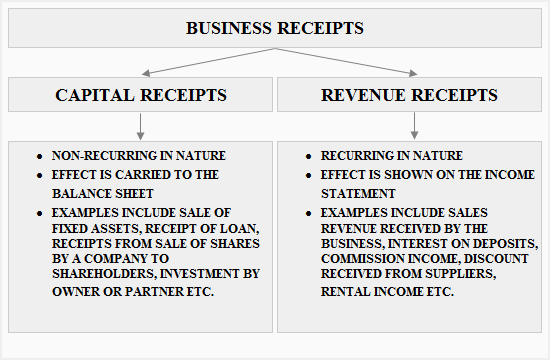

Capital receipts vs revenue receipts income tax. Capital losses vs revenue losses. Capital receipts are non recurring in nature. On the other hand revenue receipts are recurring in nature. Tax revenue is further classified into two parts.

In contrast revenue receipts are the result of firm s routine activities during the. Capital receipt and revenue receipt both are the very important components of accounting. 2014 221 taxman 323 the delhi high court has observed at page 341 that if the money paid related to structure of assessee s profit making apparatus and affected the conduct of business the sum received for cancellation or variation of agreement would be a capital receipt. A company s receipts refers to the.

The method of charging tax on different types of receipt is different. Hon ble bombay high court had an occasion to deal with issue relating to taxability of capital receipts in case of cadell weaving mill co. Income tax act 1961 provides a separate head capital gains for levying tax on capital receipts. On june 10 a company sells 4 000 of goods to one of its best customers with credit terms of net 30 days.

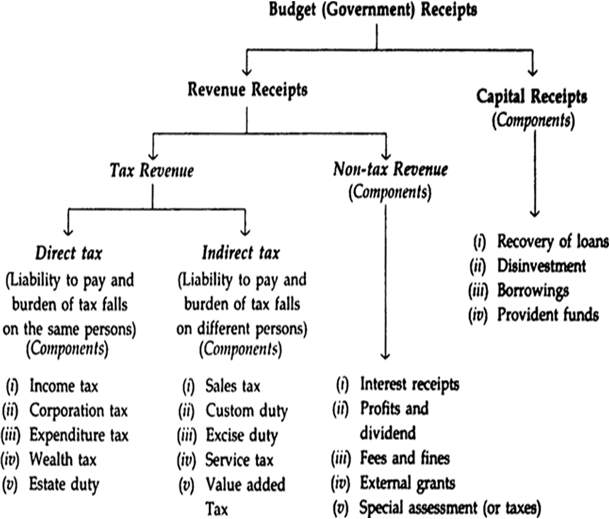

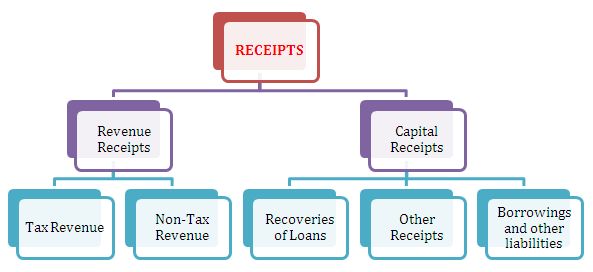

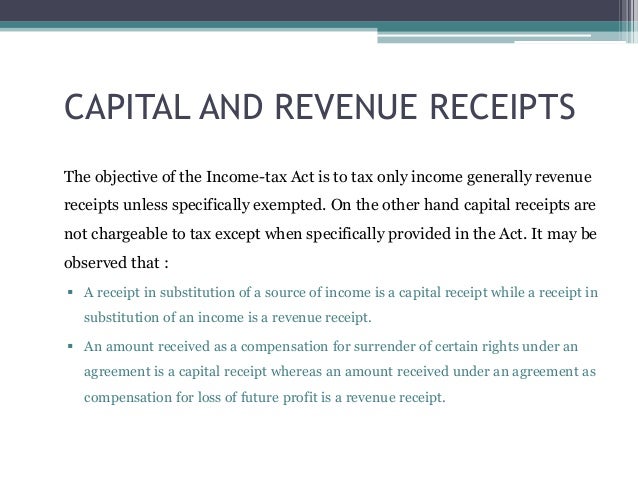

In general two types of receipts occur during the course of business. But this general rule is subject to certain exceptions. Commissioner of income tax 116 taxman 77wherein court has observed as under. Revenue from direct tax and revenue from indirect tax.

A receipt is taxable if it is of the nature of income. Advertisement continue reading below direct taxes are those taxes that are imposed by the government on the income and the property of an individual or a company and this tax cannot be transferred from one entity to another but one has to pay it directly to the government. Let s look at the most prominent ones. Income tax is levied on income of assessee and not an every receipt which he receives.

Let us learn more about them. On june 10 the company has revenues of 4 000 which will be recorded with a debit of 4 000 to accounts receivable and a credit of 4 000 to sales revenues. Without capital receipts a business can survive but without revenue receipts there is no chance that a business will perpetuate. The basic scheme of income tax is to tax income not capital and similarly to allow revenue expenditure.

Classification of these transactions reflects in the final statements of the company. Capital receipts are described as the money brought to the business from non operating sources like proceeds from the sale of long term assets capital brought by the proprietor sum received as a loan or from debenture holders etc.