Cash Basis Income Statement Formula

A cash basis income statement can contain results that are substantially different from those.

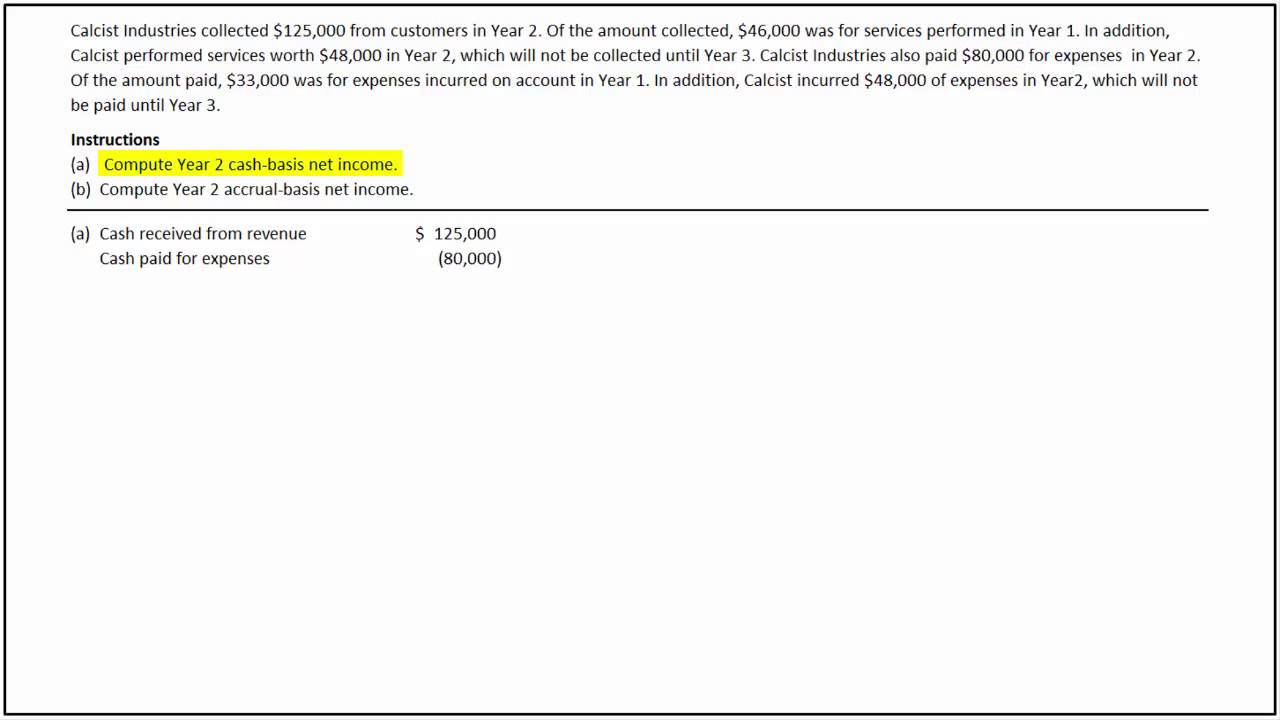

Cash basis income statement formula. But for small businesses in particular cash flow is also one of the most important ingredients that contributes to your business financial health. Under the cash method revenue is recorded when it. Cash basis accounting is less accurate than accrual accounting in the short term. Thus it is formulated under the guidelines of cash basis accounting which is not compliant with gaap or ifrs.

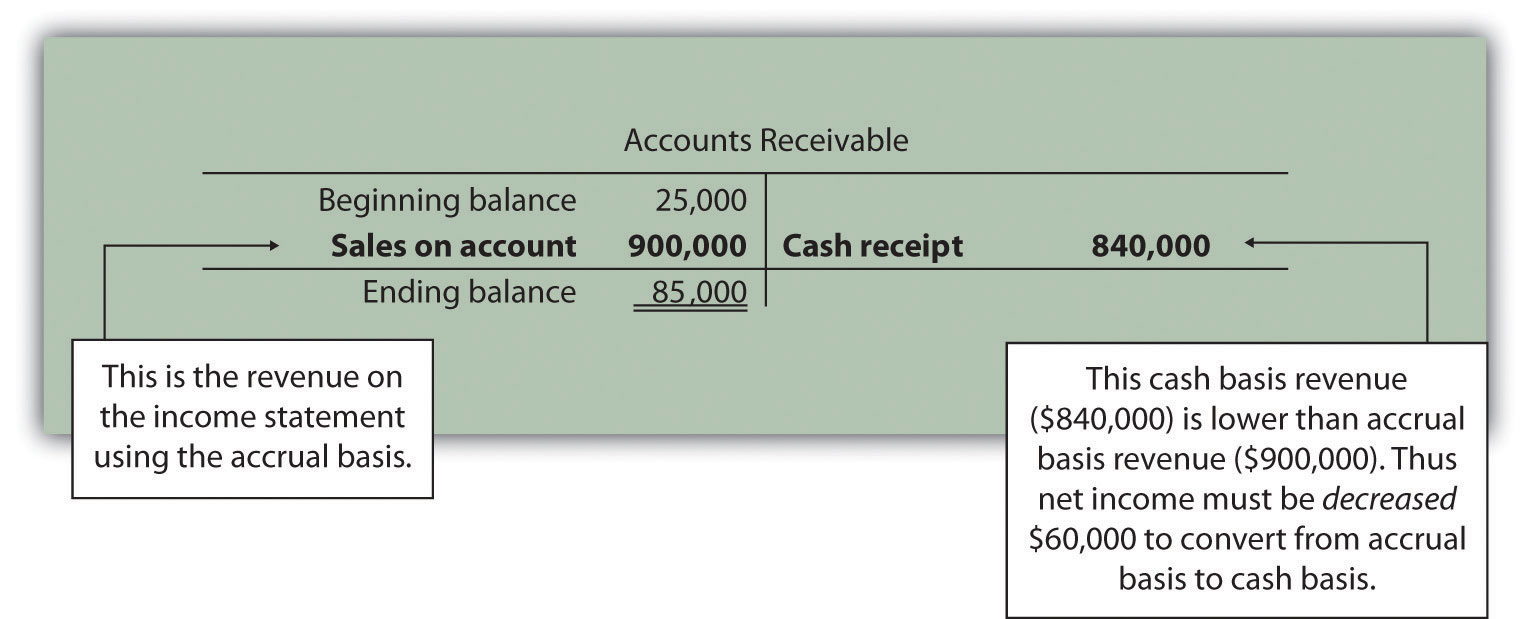

The increase in cash that is evident in the spreadsheet is mirrored as the cash basis income. Revenue however is not recorded until work is completed. Many sole proprietors and individuals who are self employed by irs standards use the cash basis because it is the easiest method to account for business income and expenses. There are two accounting methods for calculating income.

Cash basis is a major accounting method by which revenues and expenses are only acknowledged when the payment occurs. For example a carpenter who contracts a job for 2 000 and estimates his expenses to be 1 200 would also estimate his profit to be 800 or 2 000 minus 1 200. The information from this spreadsheet was used to prepare the following cash basis income statement. Thus you would record a sale under the cash basis when the organization receives cash from its customers not when it issues invoices to them.

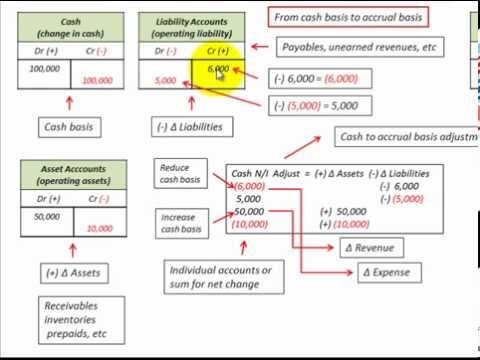

There s a lot more to it and that s where many entrepreneurs get lost in the weeds. The cash basis is commonly used in small businesses since it requires only a limited amount of accounting expertise. A cash basis income statement is an income statement that only contains revenues for which cash has been received from customers and expenses for which cash expenditures have been made. The accrual basis and the cash basis.

Ortiz has been approached by mega impressions a much larger web hosting and design firm. When all three statements are built in excel we now have what we call a three statement model 3 statement model a 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived by subtracting cost of goods sold from the total revenues second formula states that operating income of the company is derived by subtracting operating expenses from the total gross profit arrived and the last formula states that the net income of the. Calculating a cash flow formula is different from accounting for income or expenses alone.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-68758d3fa7644130a0b7e6a2383545a0.jpg)