Colorado Income Tax Withholding Worksheet For Employers

This worksheet can also be used for 2019 and earlier w 4s.

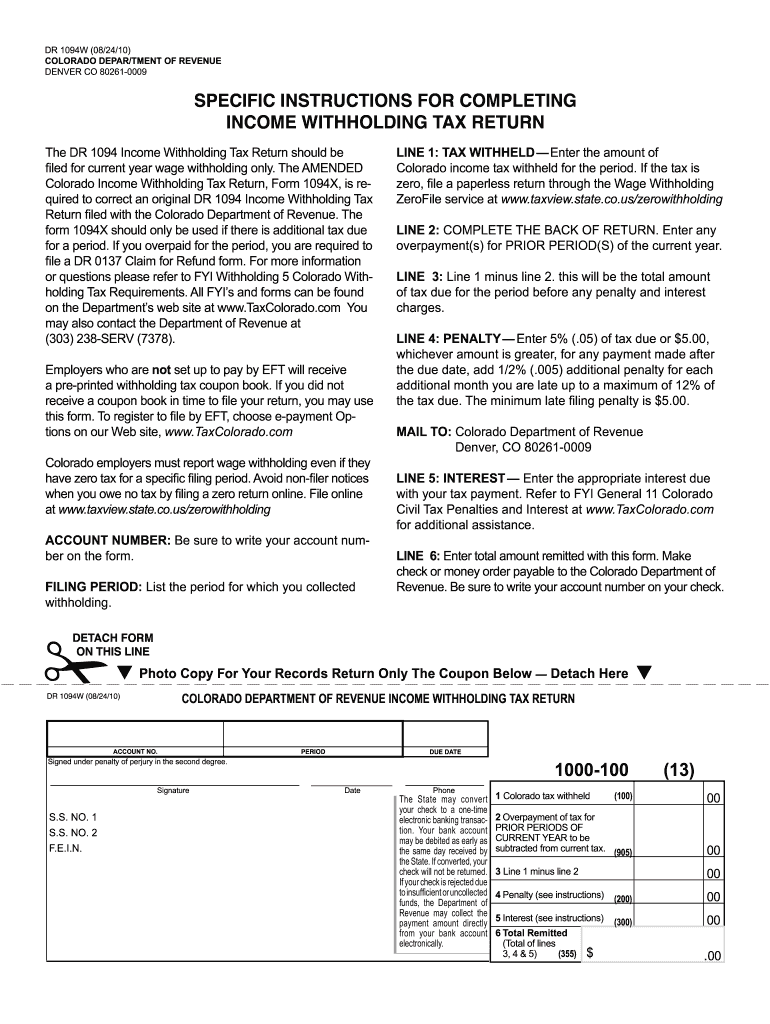

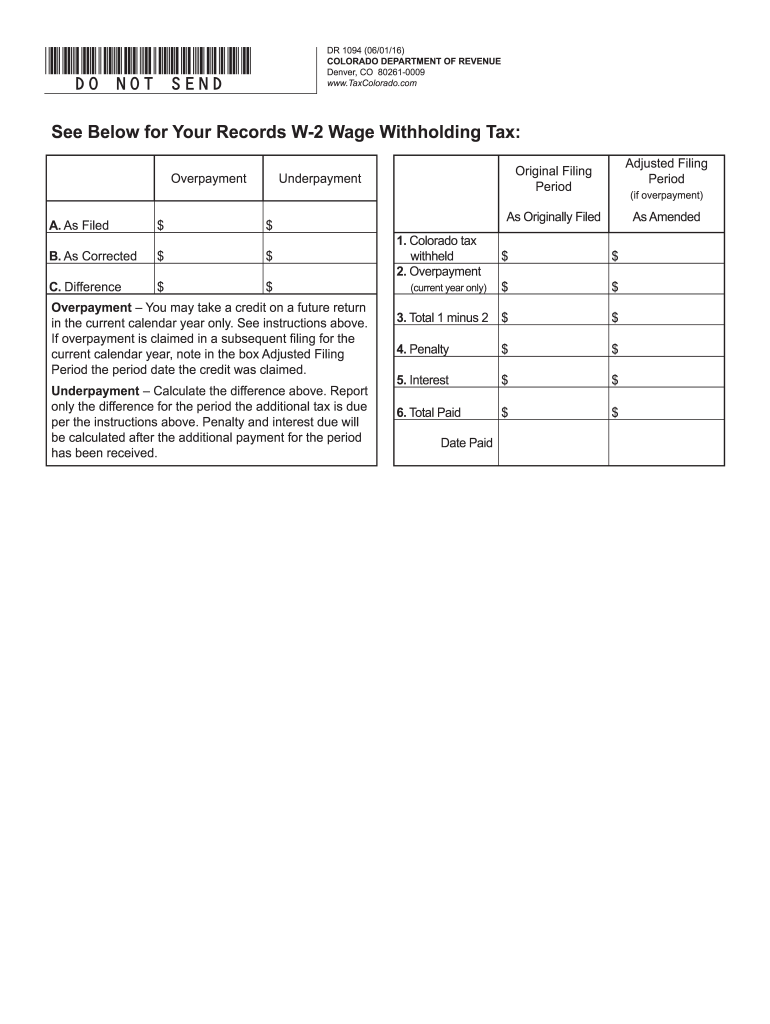

Colorado income tax withholding worksheet for employers. For any employee who has completed a 2020 irs form w 4 the employer must calculate the required colorado wage withholding using the 2020 income tax withholding worksheet dr1098 2020 the withholding worksheet calculator may assist employers with completing the withholding worksheet. This worksheet must be used for 2020 and later w 4s. To address the impact of changes to the federal form w 4 starting in 2020 and colorado income tax withholding that relies on the federal form w 4 the colorado department of revenue released a new withholding instruction worksheet that must be used by employers to calculate colorado income tax withholding for employees that submit a federal form w 4 in 2020 or later years. Colorado withholding amount per pay period.

Department in the colorado income tax withholding tables for employers dr 1098 colorado income tax withholding worksheet for employers instructions. The unhighlighted cells are auto calculated. This worksheet must be used for 2020 and later w 4s. This worksheet can also be used for 2019 and earlier w 4s.

All employers can fill out the yellow highlighted cells in the worksheet below to determine colorado withholding. An e mployer who is required to withhold colorado income tax from employees wages is liable for the required withholding whether or not the employer actually withholds the tax.