Contribution Approach Income Statement Means

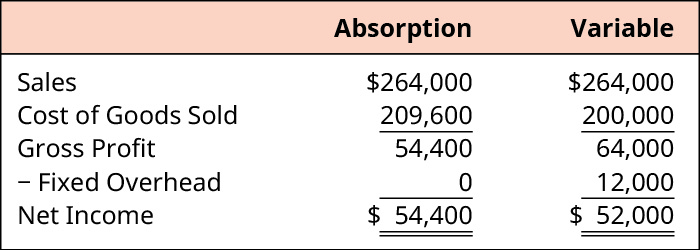

The contribution margin income statement by contrast uses variable costing which means fixed manufacturing costs are assigned to overhead costs and therefore not included in product costs.

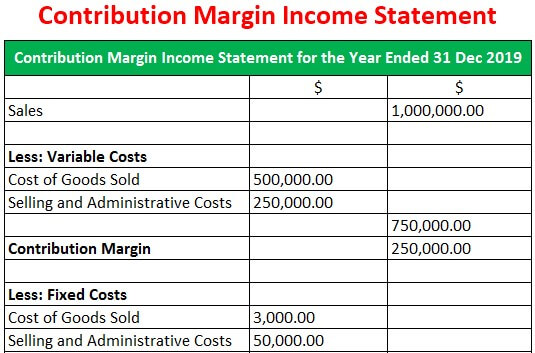

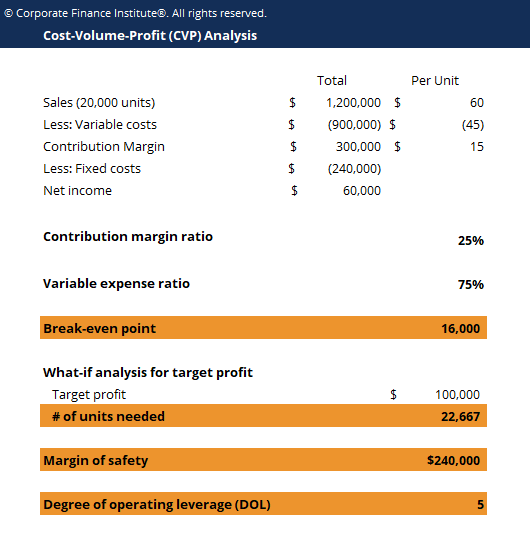

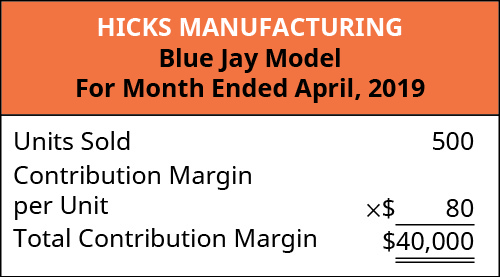

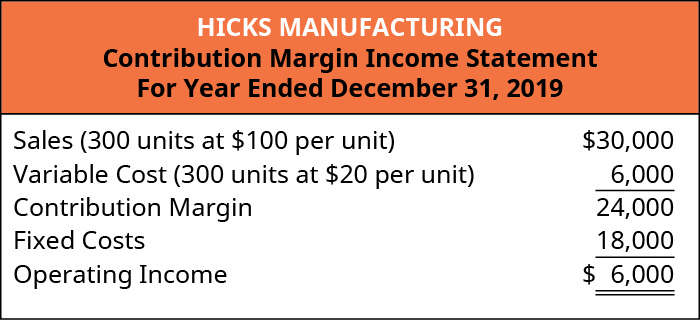

Contribution approach income statement means. Contribution format income statement financial statement that organizes costs by their behavior instead of their function is vary in total remain constant per unit. A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or net loss for the period. The contribution margin income statement separates variable and fixed costs in an effect to show external users the amount of revenues left over after variable costs are paid. An income statement is one of the three important financial statements used for reporting a company s financial performance over a specific accounting period with the other two key statements.

The contribution approach is a presentation format used for the income statement where all variable costs are aggregated and deducted from revenue in order to arrive at a contribution margin after which all fixed costs are deducted from the contribution margin in order to arrive at the net profit or loss. Contribution margin income statement is a type of presentation of the income statement wherein the contribution margin for the period is calculated as a separate line item before determining the. The contribution approach is an important one used during costing because it can help managers figure out how much the company must sell in order to exceed its fixed costs and make a profit.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)