Corporate Income Tax Rate Philippines 2020

Let s break this one by one.

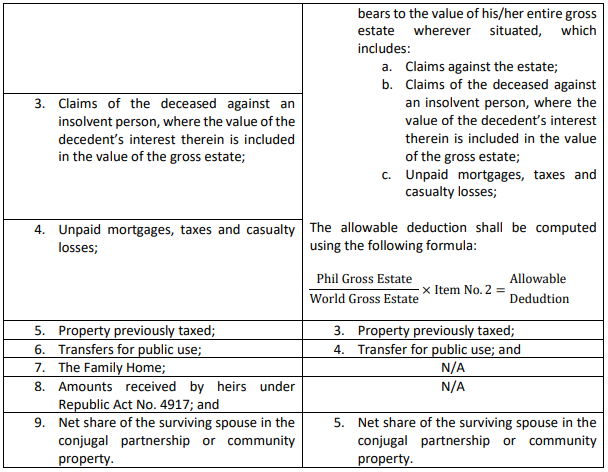

Corporate income tax rate philippines 2020. Cit rate in general on net income from all sources. Those earning annual incomes between p400 000 and p800. The content is straightforward. Keep up to date on significant tax developments around the globe with ey s global tax alert library here.

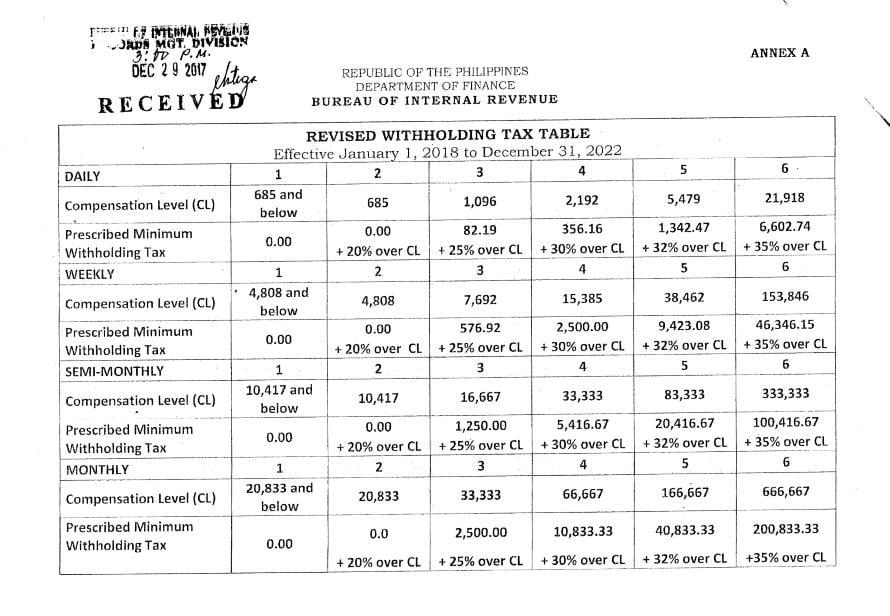

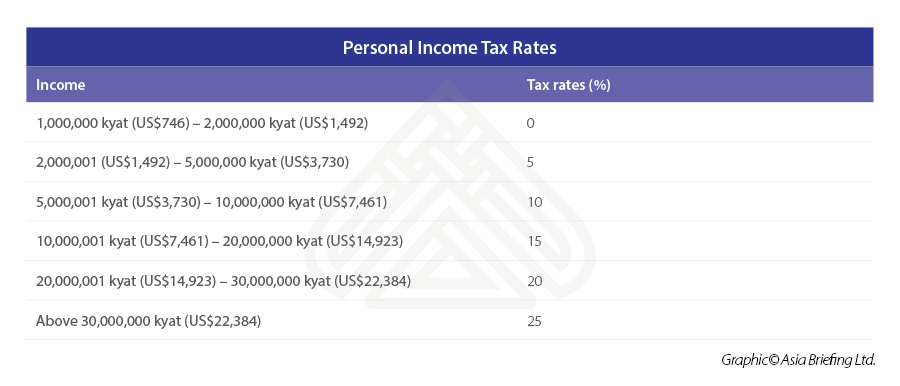

How to compute your income tax based on graduated rates. Interest from currency deposits trust funds and deposit substitutes. Compute your income tax base on your salary taxable income and income tax rate. In the approved tax reform bill under train from the initial implementation in the year 2018 until the year 2022.

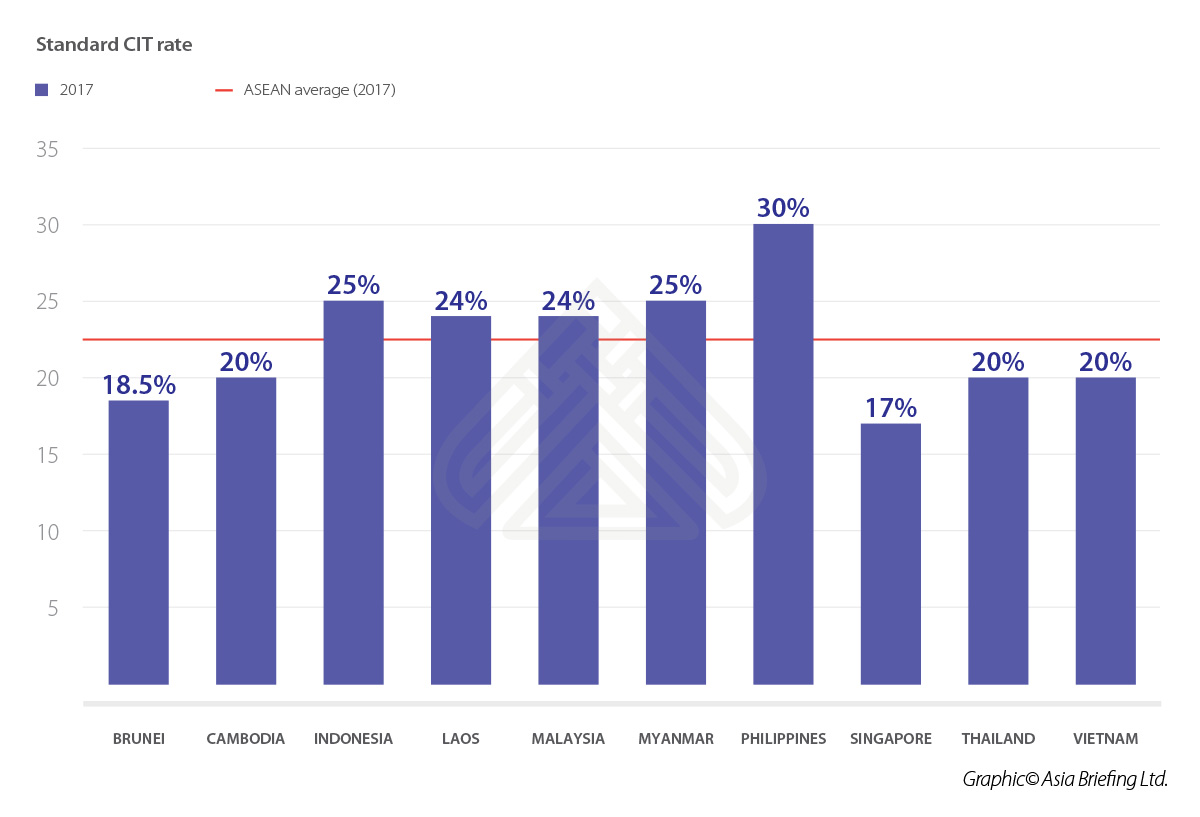

The corporate tax rate in philippines stands at 30 percent. Corporate tax rate in philippines averaged 31 63 percent from 1997 until 2020 reaching an all time high of 35 percent in 1997 and a record low of 30 percent in 2009. Sample income tax computation for the taxable year 2020. Royalties on books as well as literary musical compositions 10 in general.

Those earning an annual salary of p250 000 or below will no longer pay income tax zero income tax. This page provides philippines corporate tax rate actual values historical data forecast chart statistics economic calendar and news. Those earning between p250 000 and p400 000 per year will be charged an income tax rate of 20 on the excess over p250 000. Graduated income tax rates for january 1 2023 and onwards.

Graduated income tax rates until december 31 2022. Starting in 2020 corporate income tax will be reduced from 30 percent to 20 percent over a 10 year period through the citira initiative. Base on what s on the column 2 our prescribed minimum withholding tax is 0 00 20 over compensation level cl. United kingdom 16 15 boe mpc member cunliffe speaks forecast.

Relax this is relatively easy to compute. Philippines corporate tax rate was 30 in 2020. Chapter by chapter from albania to zimbabwe we summarize corporate tax systems in more than 160 jurisdictions. The content is current on 1 january 2020 with exceptions noted.

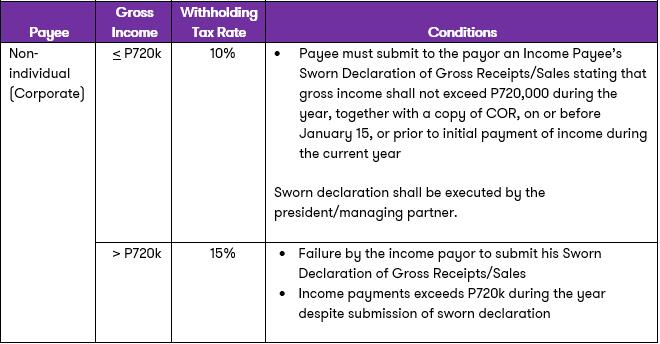

Winnings except from pcso and lotto amounting to p10 000 or less 20. Minimum corporate income tax mcit on gross income beginning in the fourth taxable year following the year of commencement of business operations. All registered domestic and foreign companies in the philippines are liable to pay corporate income tax. Mcit is imposed where the cit at 30 is less than 2 mcit on gross income.

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)