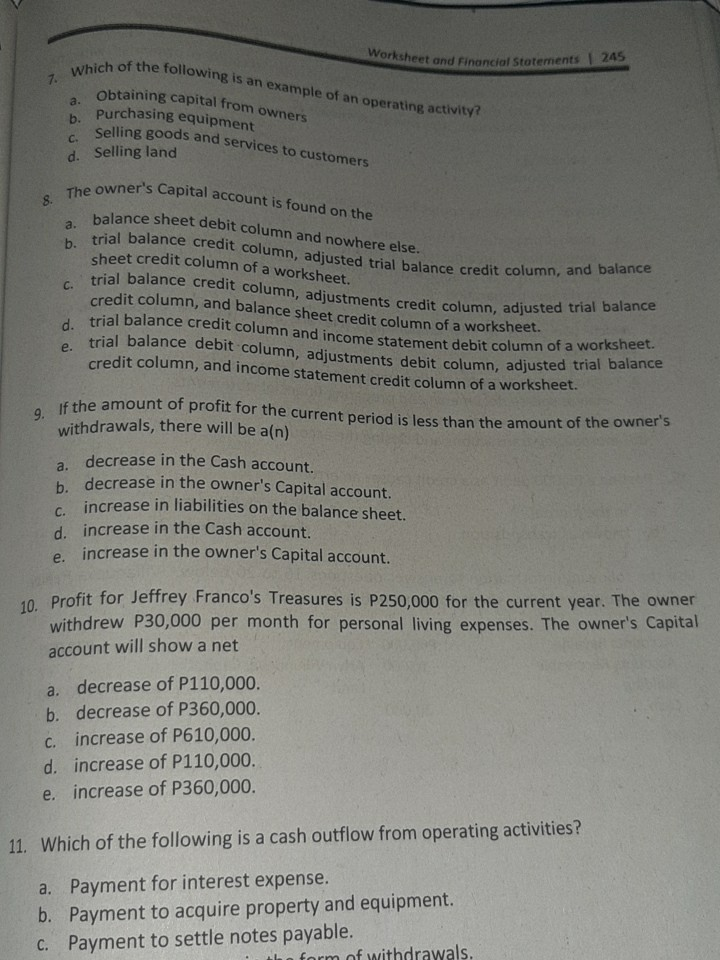

D Income Statement Debit Column And Statement Of Financial Position Credit Column

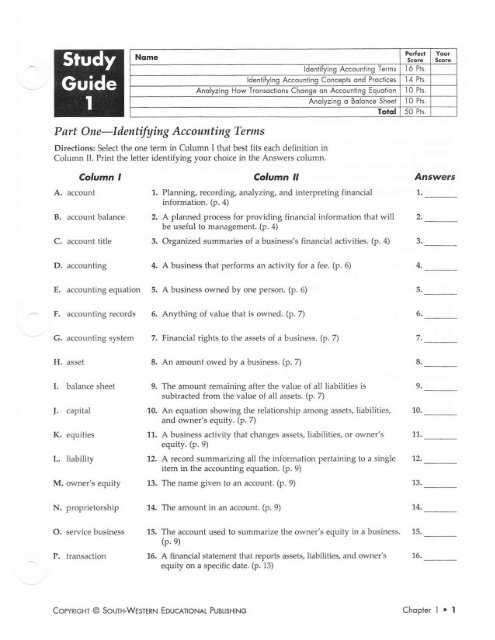

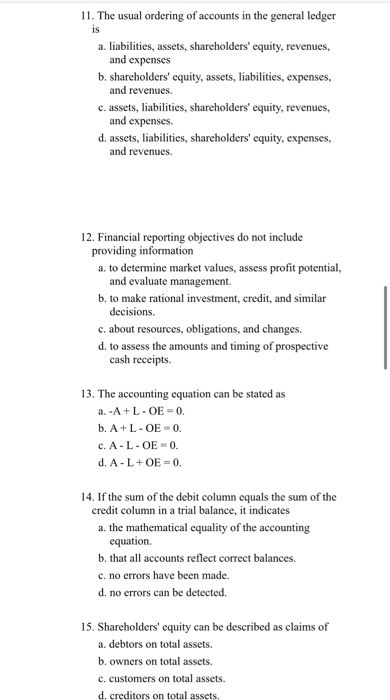

In other words it lists the resources obligations and ownership details of a company on a specific day.

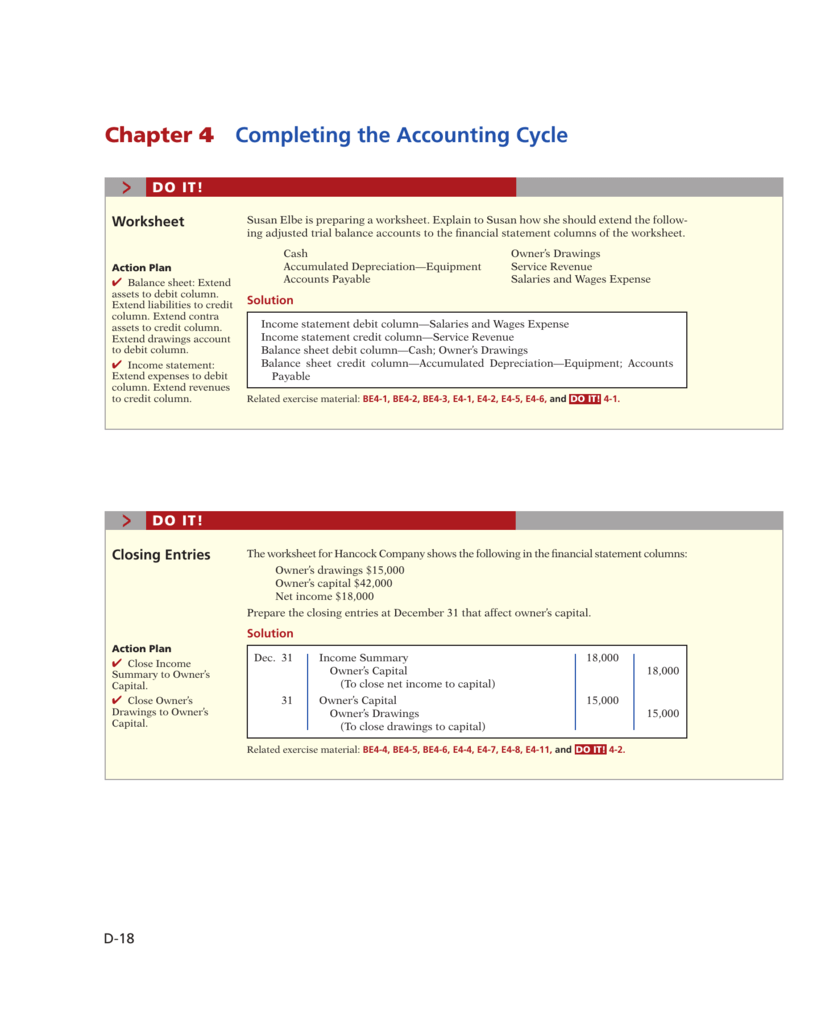

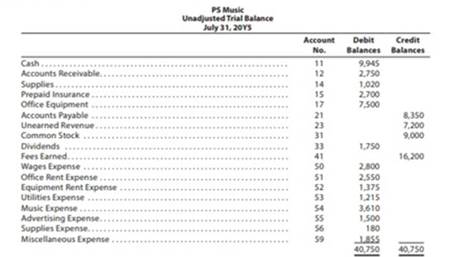

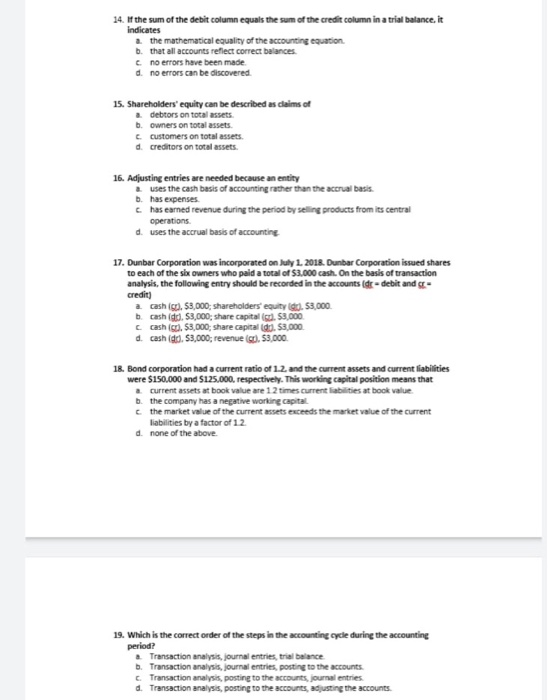

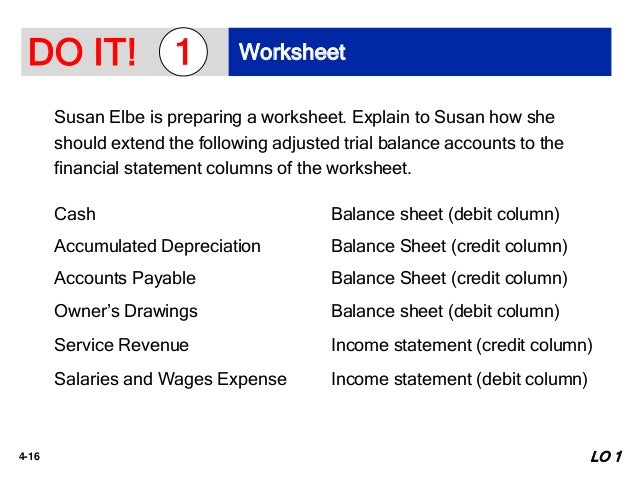

D income statement debit column and statement of financial position credit column. Steps in accounting cycle financial statement analysis fin621. After the worksheet is completed and after financial statements are prepared. Income statement statement of financial position dr. The statement of financial position often called the balance sheet is a financial statement that reports the assets liabilities and equity of a company on a given date.

Abbreviated as dr and cr every transaction consists of two entries that balance each other. The income statement and statement of financial position columns of pine company s worksheet reflects the following sub totals. Chapter 1 statement of financial position free download as powerpoint presentation ppt pptx pdf file pdf text file txt or view presentation slides online. For example when a writer sells an article for 100 she would enter a transaction into her accounting software that contained a debit to cash for 100 and a credit to sales for 100.

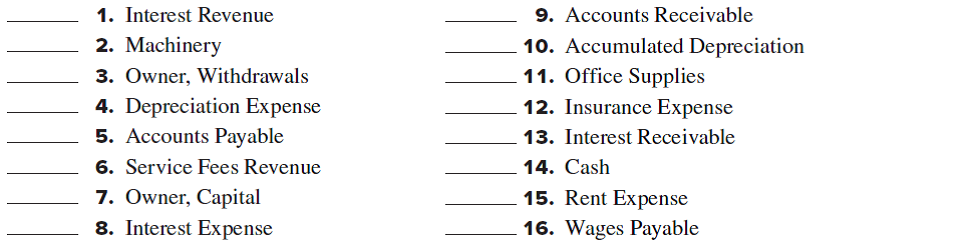

Income statement credit column and the statement of financial position debit column when using a worksheet adjusting entries are journalized before the adjusted trial balance is extended to the proper financial statement columns. In accounting debit and credit mean left and right respectively. From our discussion up to this point we have established following rules for debit and credit. If the subtotal of the balance sheet debit column is 19 000 then the subtotal of the balance sheet credit column should be 9.

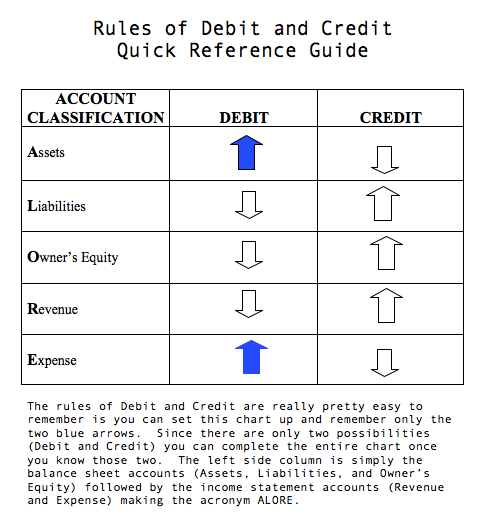

Debit and credit rules provide the framework for the balance sheet and income statement to work together and represent transactions accurately. Accounting cycle process continued rules of debit and credit. Rules of debit and credit dual aspect of transactions. When accounting for these transactions we record numbers in two accounts where the debit column is on the left and the credit column is on the right.

The asset account and the income account both increase by 100. Business transactions are events that have a monetary impact on the financial statements of an organization. In all cases a credit increases the income account balance and a debit decreases the balance. Before the adjustments are entered on to the worksheet.

Debit and credit definitions.