Deferred Tax Benefit Income Statement

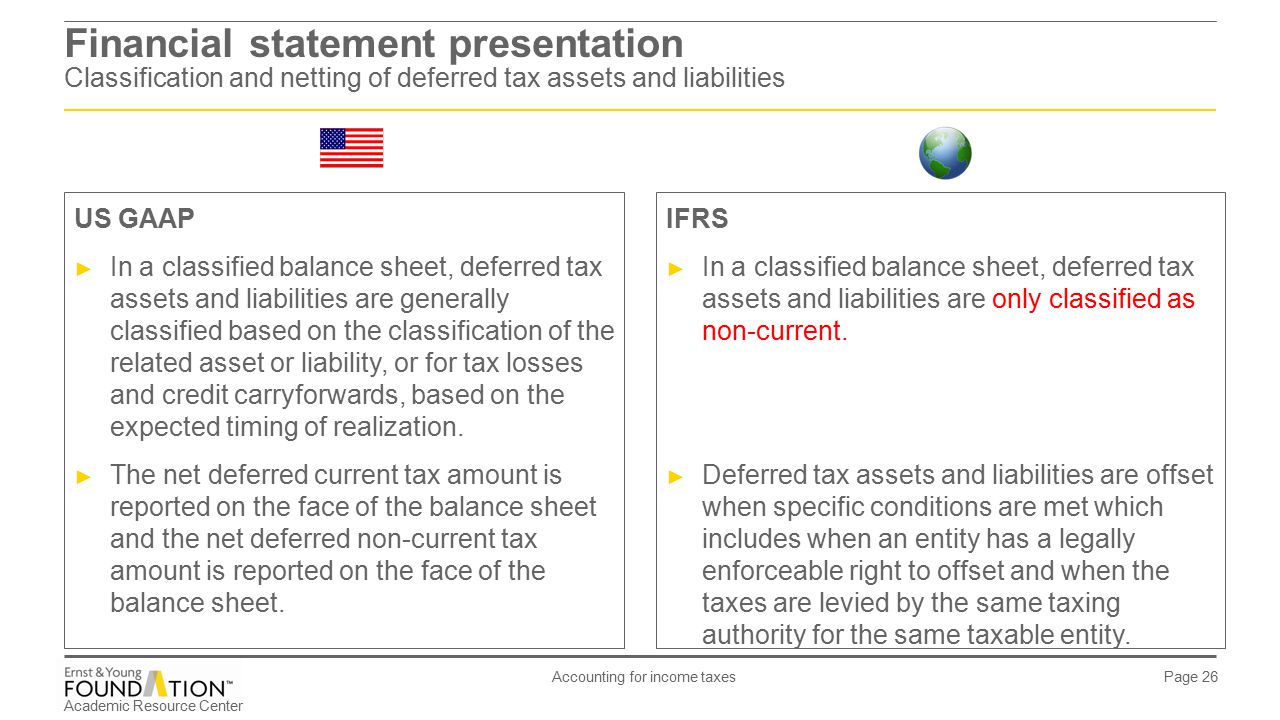

Components of income tax expense or benefit.

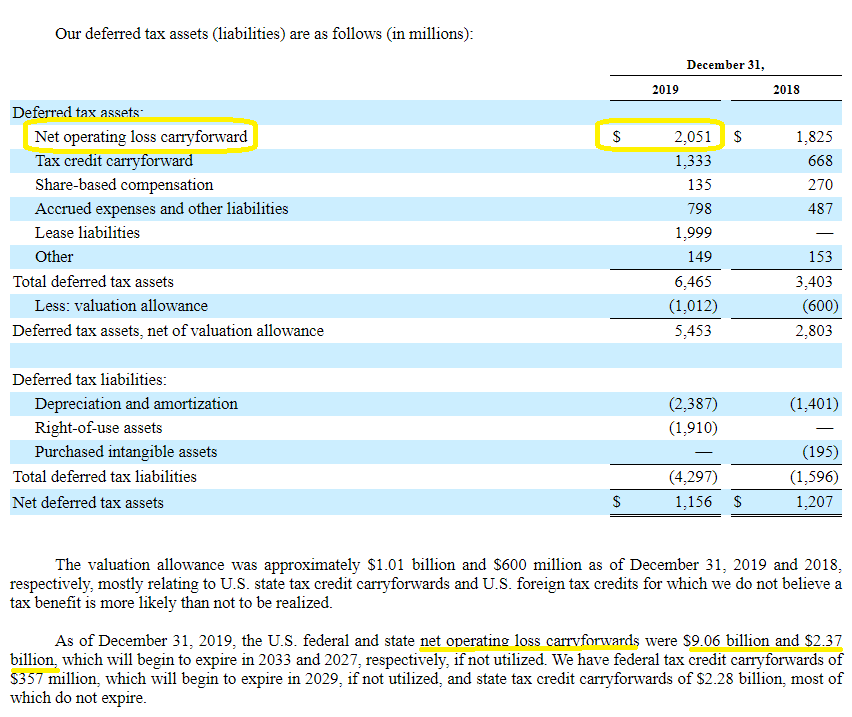

Deferred tax benefit income statement. A business receives a tax refund when it overpays its estimated income taxes throughout the year. Tax forms give the option to take the money as a refund or apply it to the following year s taxes. Now if you see in these three years total deferred tax liability 6 000 and total deferred tax asset 3 000 3 000 6 000 hence in the life of the asset deferred tax asset and deferred tax liability has nullified each other. However the exact timing and amount of the valuation allowance release are subject to.

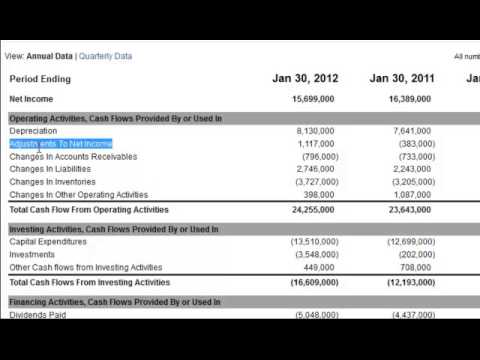

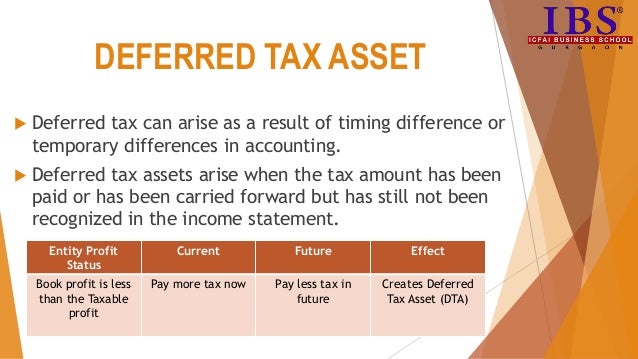

Deferred income tax is a balance sheet item which can either be a liability or an asset as it is a difference resulting from recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported. Deferred tax assets indicate that you ve accumulated future deductions in other words a positive cash flow while deferred tax liabilities indicate a future tax liability. In that post we recalled the basic formula determining the income tax provision. Similarly deferred tax is a non cash item and shall be treated accordingly in the operating activities section of the cash flow statement.

A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference. It s usually a good thing to find on a balance sheet because the company could receive a. Deferred income tax definition. If the tax rate for the company is 30 the difference of 18 60 x 30 between the taxes payable in the income statement and the actual taxes paid to the tax authorities is a deferred tax asset.

Microsoft corp is a us multinational company headquartered in washington. Would result in the recognition of certain deferred tax assets and a decrease to income tax expense for the period the release is recorded. In contrast the irs tax code specifies. Microsoft deferred income tax statement.

It is in the business of developing manufacturing and licensing software such as microsoft office. A few weeks ago you were introduced to the overall income tax provision in this blog post. If the business owner elects to take a refund a debit entry is made to accounts receivable for the refund due and a credit entry is made to the expenses account used for tax expenses. A deferred income tax liability results from the difference between the income tax expense reported on the income statement and the income tax payable.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)