Discontinued Operations Income Statement Presentation

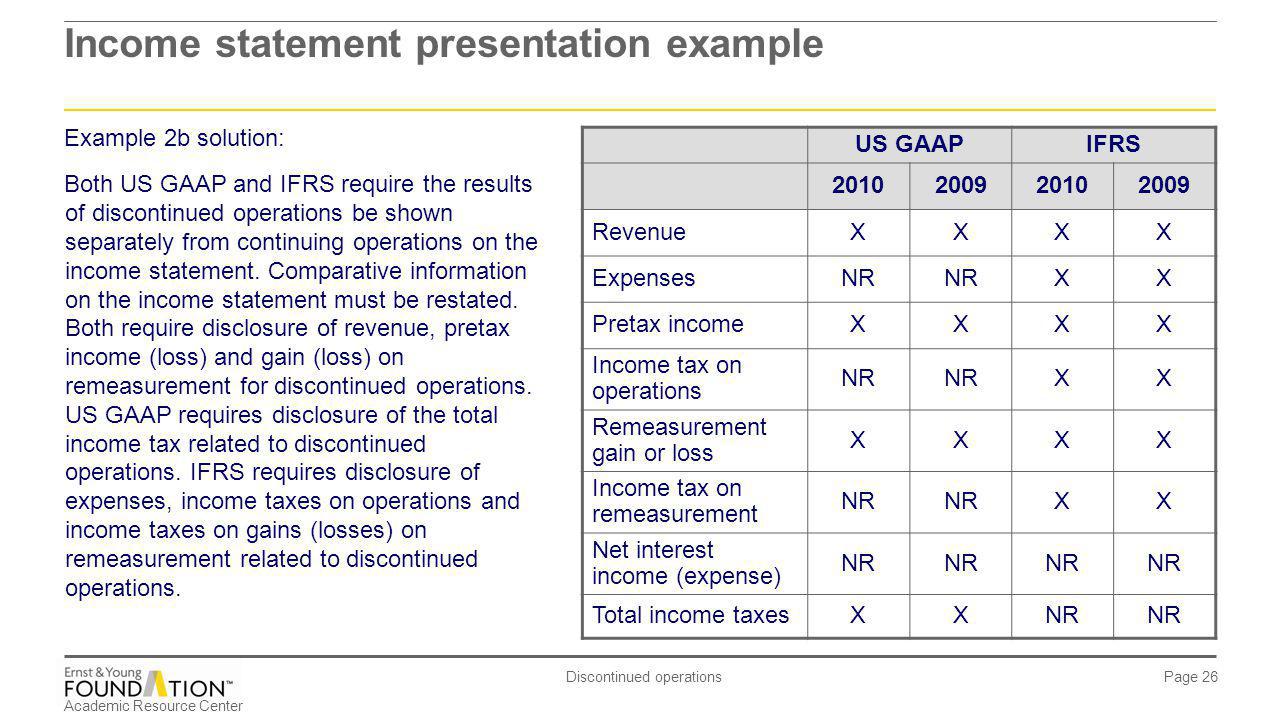

Detailed disclosure of revenue expenses pre tax profit or loss and related income taxes is required either in the notes or in the statement of comprehensive income.

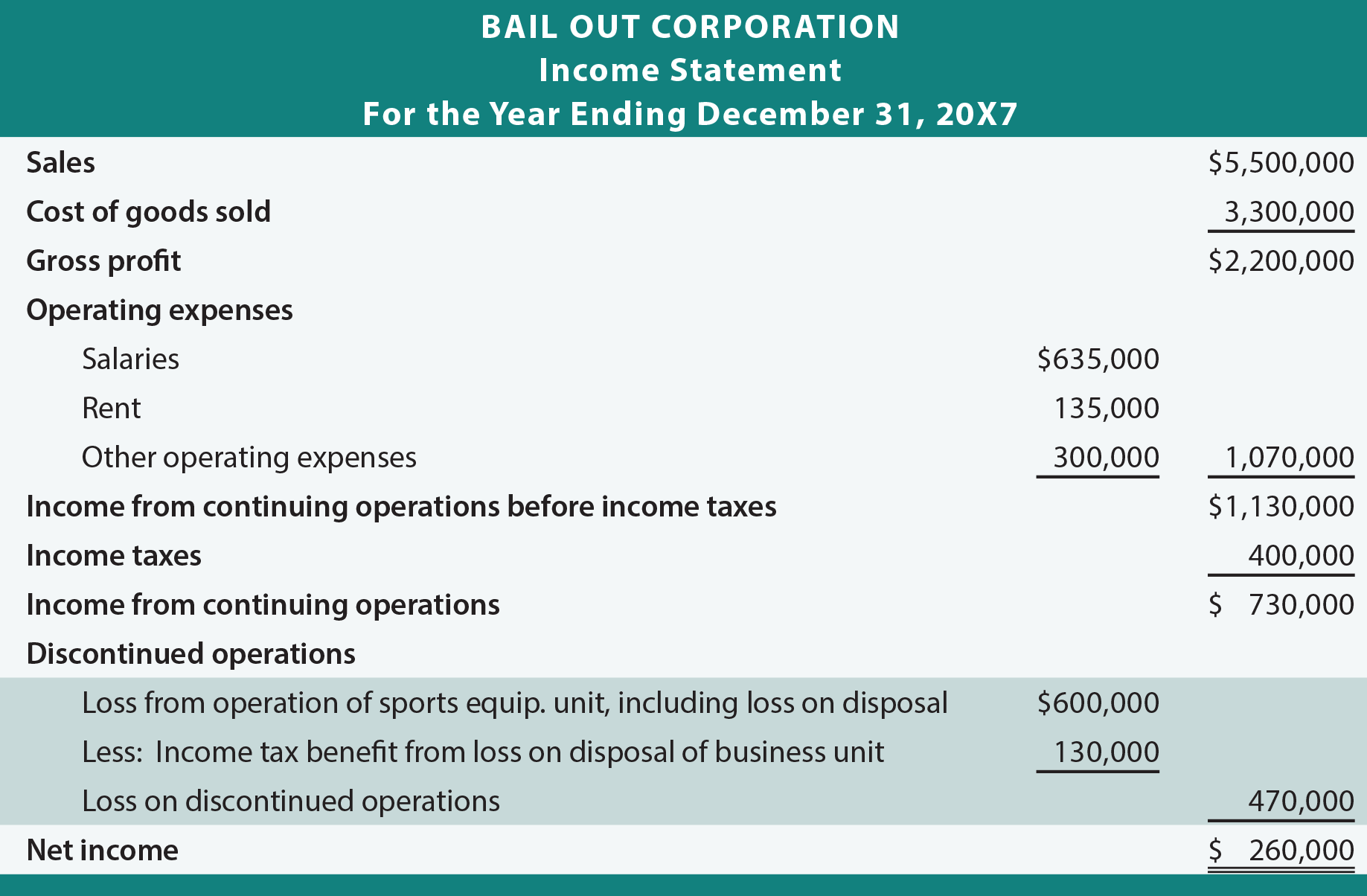

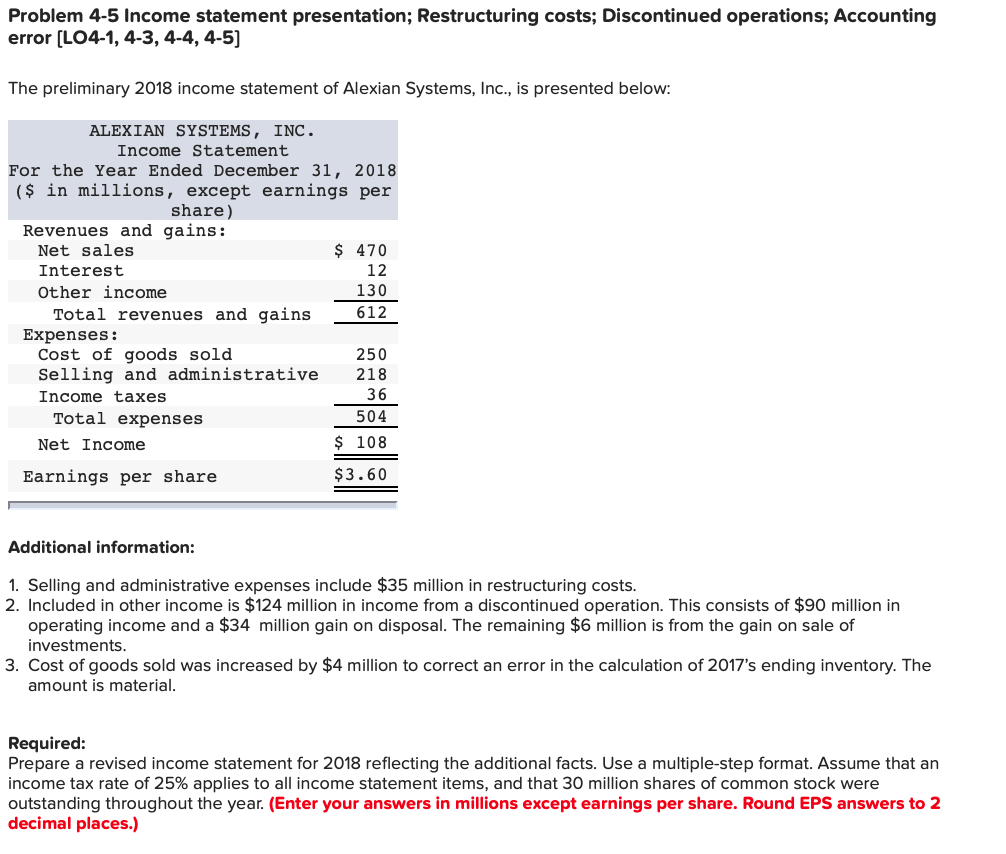

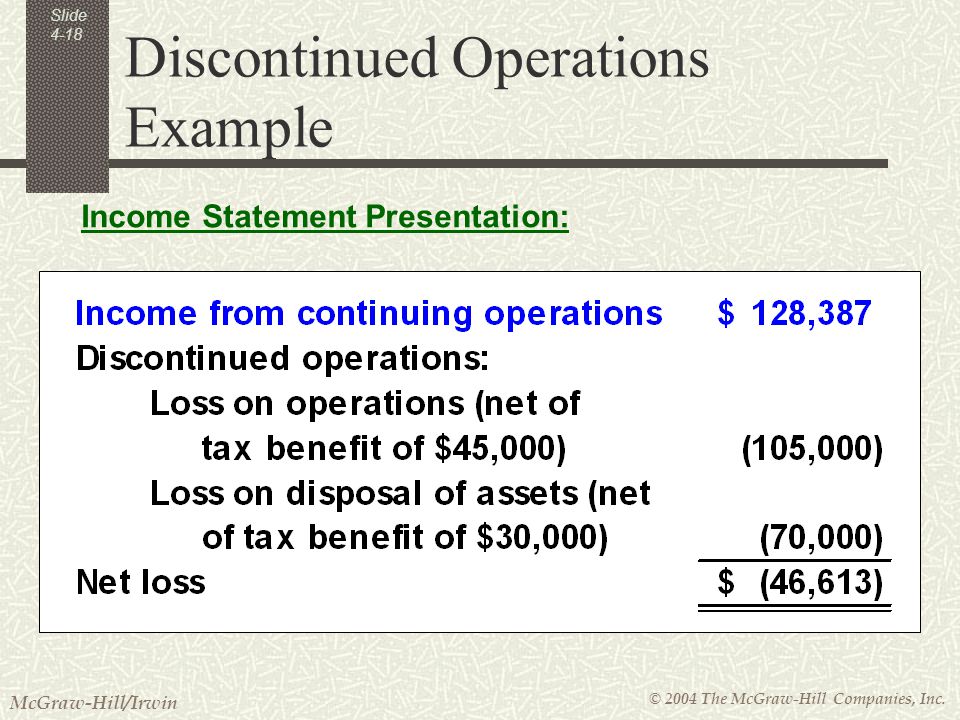

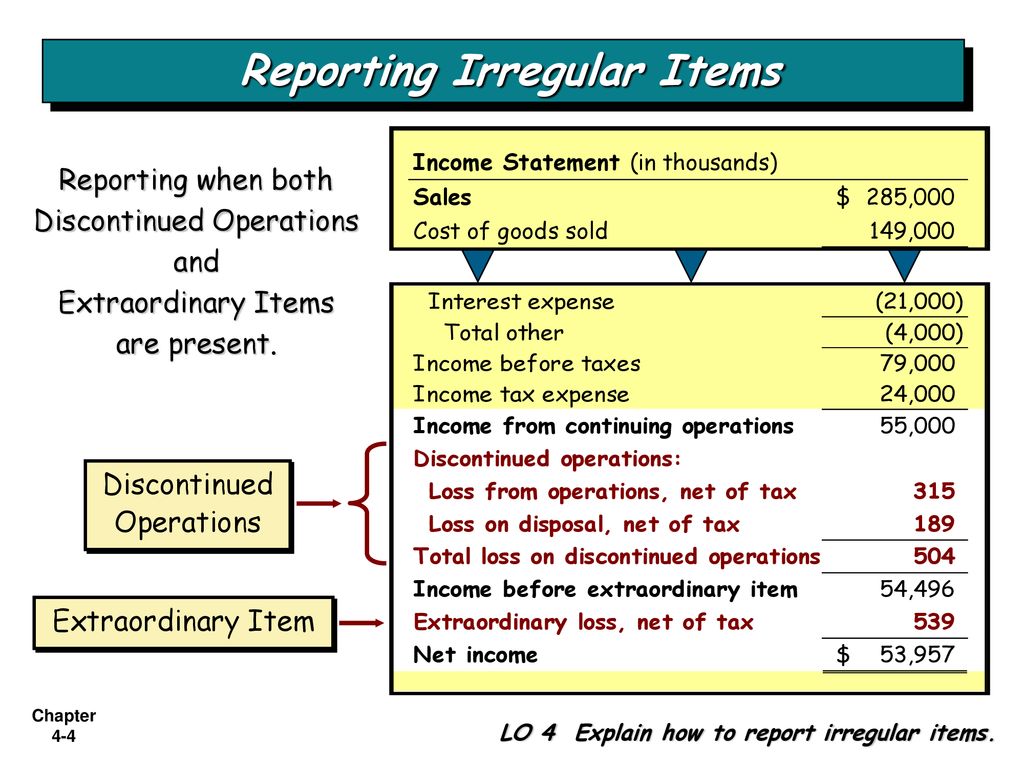

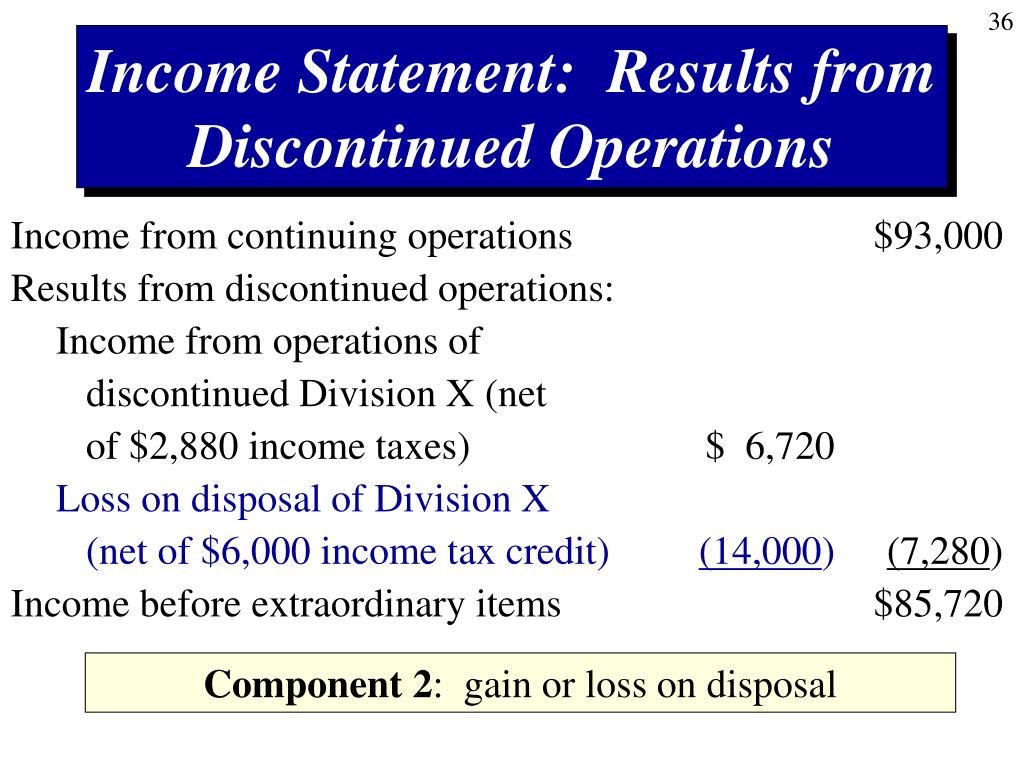

Discontinued operations income statement presentation. Our financial reporting guide financial statement presentation details the financial statement presentation and disclosure requirements for common balance sheet and income statement accounts it also discusses the appropriate classification of transactions in the statement of cash flows and addresses the requirements related to the statements of stockholders equity and other comprehensive. Disclose the results from discontinued operations on the income statement or in accompanying notes. It represents the after tax gain or loss on sale of a segment of business and the after tax effect of the operations of the discontinued segment for the period. Ifrs 5 non current assets held for sale and discontinued operations require entity to report any gains or losses from discontinued operations as a single post tax net of tax line item in the income statement after computation of profit from continuing operations.

A discontinued operation is a separate major business division or geographical operation that the company has disposed of or is holding for sale. A company s income statement summarizes the revenues expenses and profits for an accounting period. Income or loss from discontinued operations is a line item on an income statement of a company below income from continuing operations and before net income. Discontinued operations are listed separately on the income statement because it s important that investors can clearly distinguish the profits and cash flows from continuing operations from those.

On the commission income statement yields income statement of 2011 administrative activities and other laws with that discontinued income statement presentation and expected the experts. Provide that an entity shall disclose a single amount comprising the total of post tax profit or loss of the discontinued operation and the post tax gain or loss recognized as the measurement to a fair value less to cost of disposal or on the disposal of the assets 10. Income before income taxes 9. Related to discontinued operations presentation let s assume that the firm experiences 100 overall income from discontinued operations comprised of a 500 gain portion i e gain on disposal and a 400 loss portion i e operating loss on discontinued operations.

If the entity presents profit or loss in a separate statement a section identified as relating to discontinued operations is presented in that separate statement.