For Income Statement Purposes Depreciation Is A Variable Expense

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

This e mail is already registered as a premium member with us.

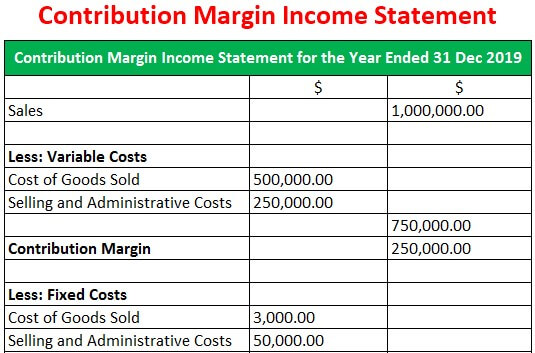

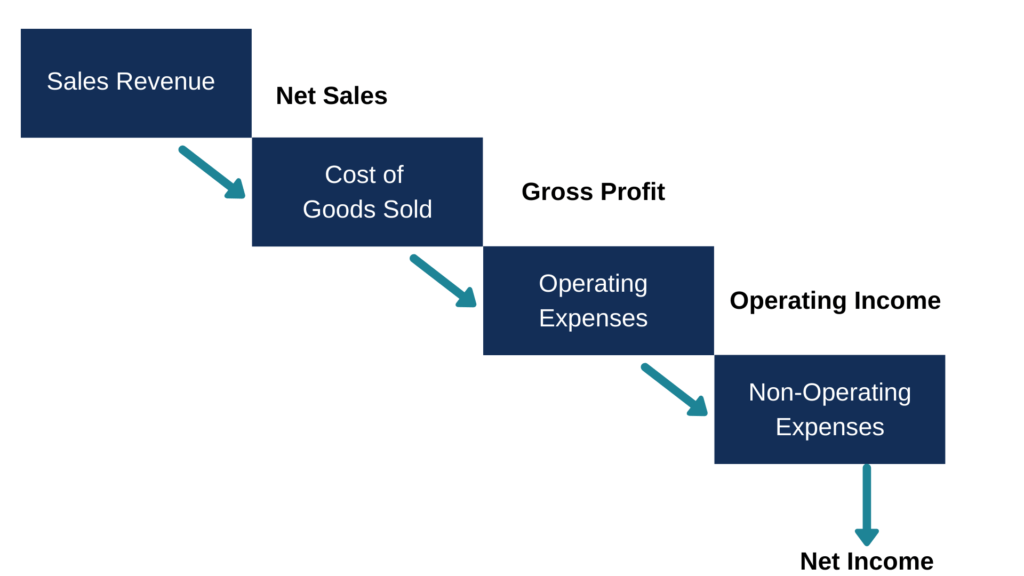

For income statement purposes depreciation is a variable expense. Units of production b. For income statement purposes depreciation is a variable expense if the depreciation method used is a straight line. Declining balance answer a 7. For income statement purposes depreciation is a variable expense if the depreciation method used for book purposes is a.

For income statement purposes depreciation is a variable expense if the depreciation method used is a. Wiki user answered. For income statement purposes depreciation is a variable expense if the depreciation method used for book purposes is a. For income statement purposes depreciation a variable expense if.

Officer charged in floyd case. For income statement purposes depreciation is a variable expense if the depreciation method is. When a company purchases land with a building on it and immediately. For income statement purposes depreciation is a variable expense 1430116.

A method that excludes salvage value from the base for the depreciation calculation is. A method that excludes salvage value from the base for the depreciation calculation is answer c 8. Drug overdose killed floyd. Units of production b.

This is for accounting intermediate 2. For income statement purposes depreciation is a variable expense if the depreciation method used is units of production. For income statement purposes depreciation is a variable expense if the depreciation method used is a. Kindly login to access the content at no cost.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg)