How Does Bad Debt Expense Affect The Income Statement

Some companies identify the specific customers whose accounts are bad debts and calculate the bad debt expense each accounting period based on customers accounts.

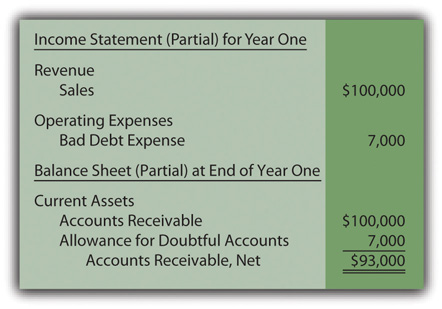

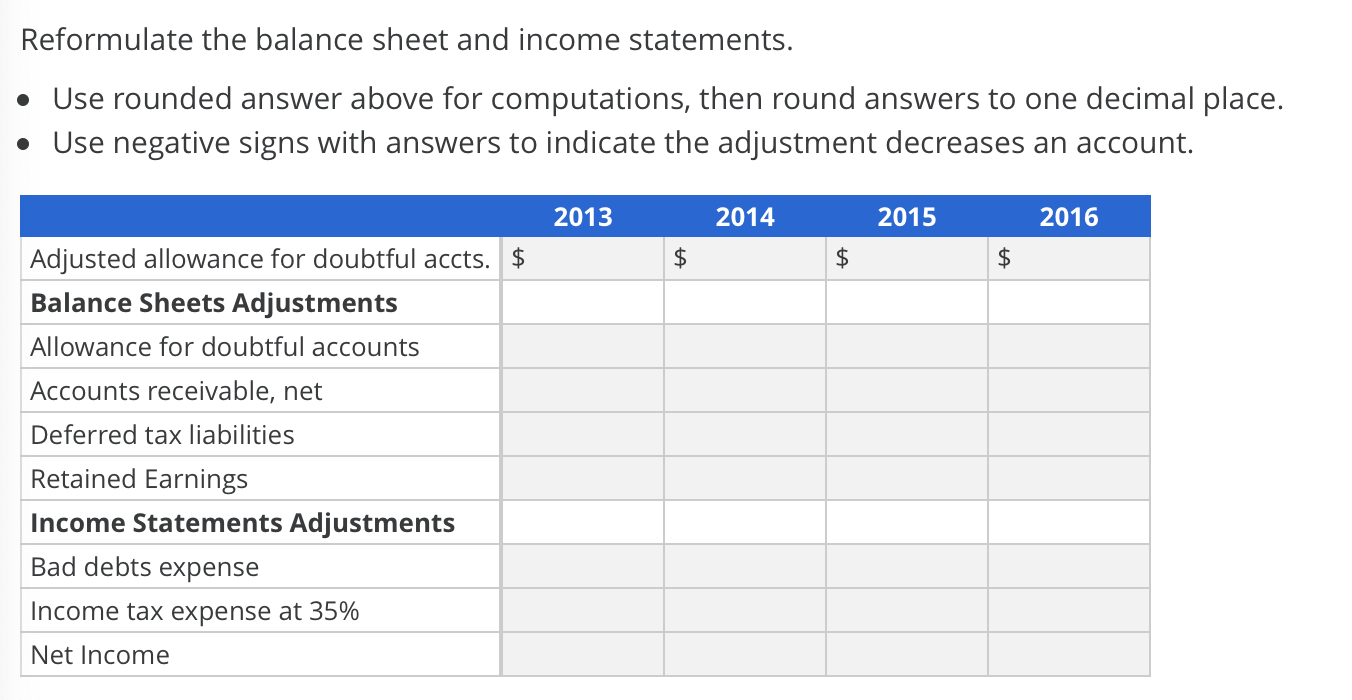

How does bad debt expense affect the income statement. This method is based on an evaluation of the collectibility of accounts receivable. Cash flow statement 14. Understanding bad debt expense bad debt expenses are generally classified as a sales and general administrative expense and are found on the income statement recognizing bad debts leads to an. As an example of the allowance method abc international records 1 000 000 of credit sales in the most recent month.

First let s determine what the term bad debt means. With both methods the bad debt expense needs to record in the income statement by a different time. Free financial statements cheat sheet 453 188 subscribers. The portion that a company believes is uncollectible is what is called bad debt expense the.

A debt such as an accounts receivable is shown as an asset on the balance sheet. The bad debt expense appears in a line item in the income statement within the operating expenses section in the lower half of the statement. Net income effect you would also charge 2 000 to bad debt expense which appears on your income statement. Some companies just write off a bad debt as an expense on the income statement.

Because the bad debt is no longer an asset you adjust the value of your accounts receivable to reflect the loss of that asset. Accounts receivable aging method. As your company uses up or spends down its bad debt reserve the release of that liability flows through your income. Hence the income statement is delaying the reporting of bad debts expense on its income statement until an account receivable is actually written off as uncollectible.

Inventory and cost of goods sold 19. Sometimes at the end of the fiscal period when a company goes to prepare its financial statements it needs to determine what portion of its receivables is collectible. Accounts receivable and bad debts expense 17. You can record bad debts in a couple of ways.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)