How To Prepare An Income Statement Using Variable Costing

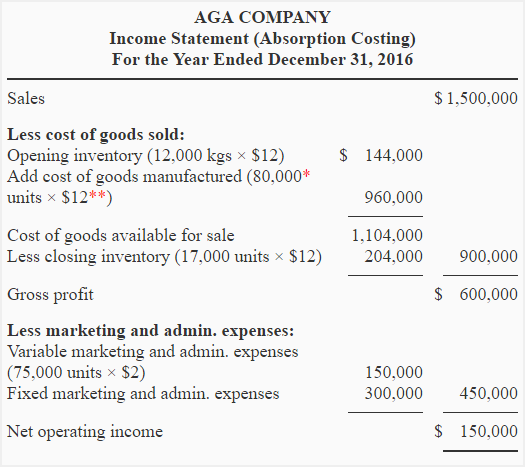

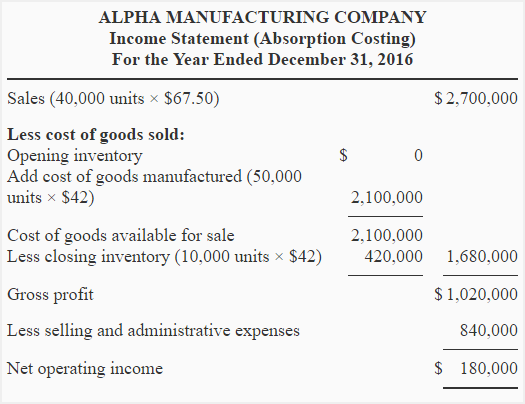

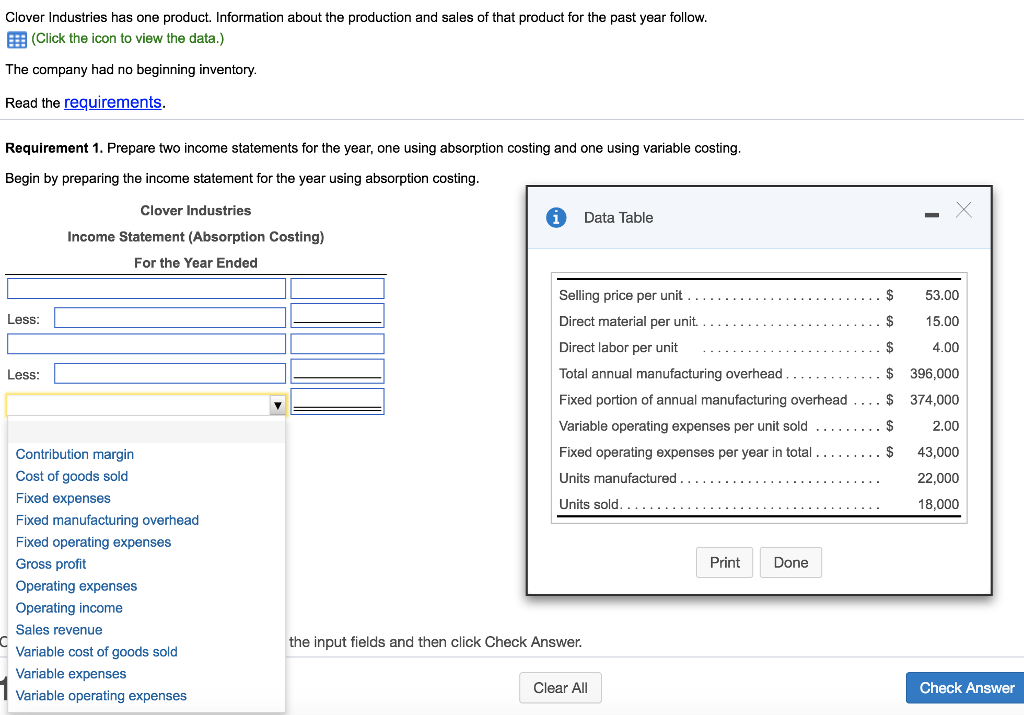

Absorption costing income statement.

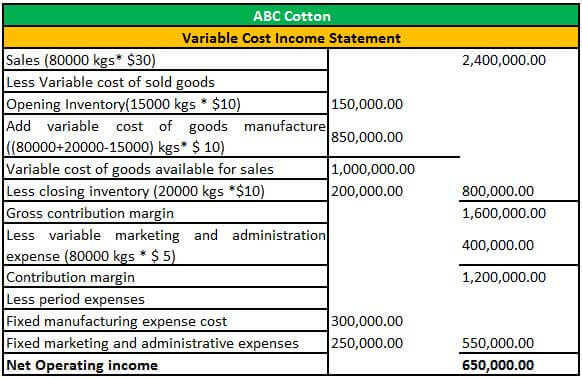

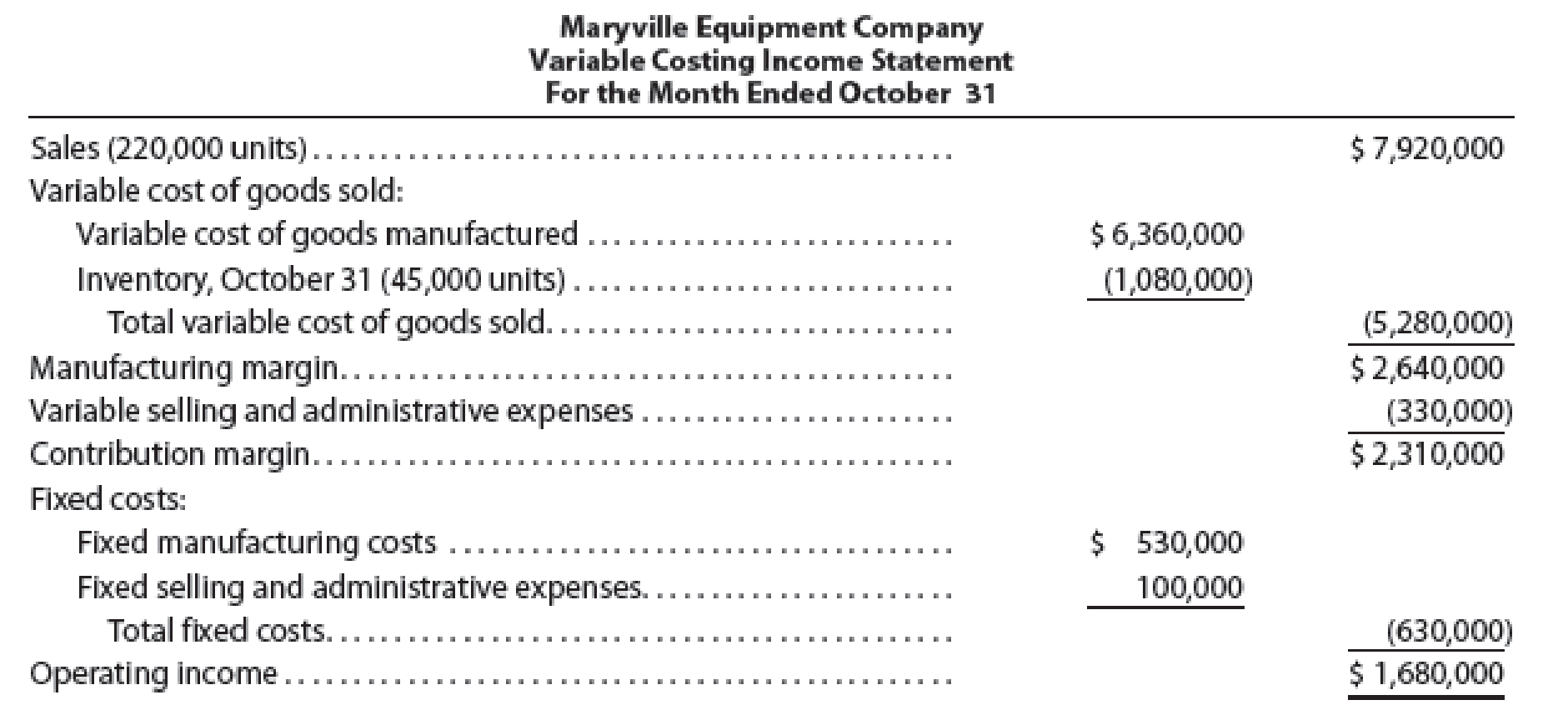

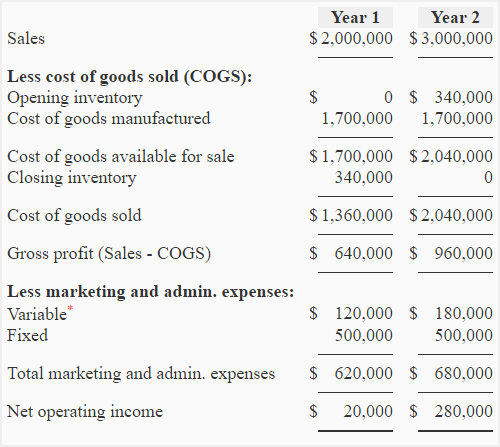

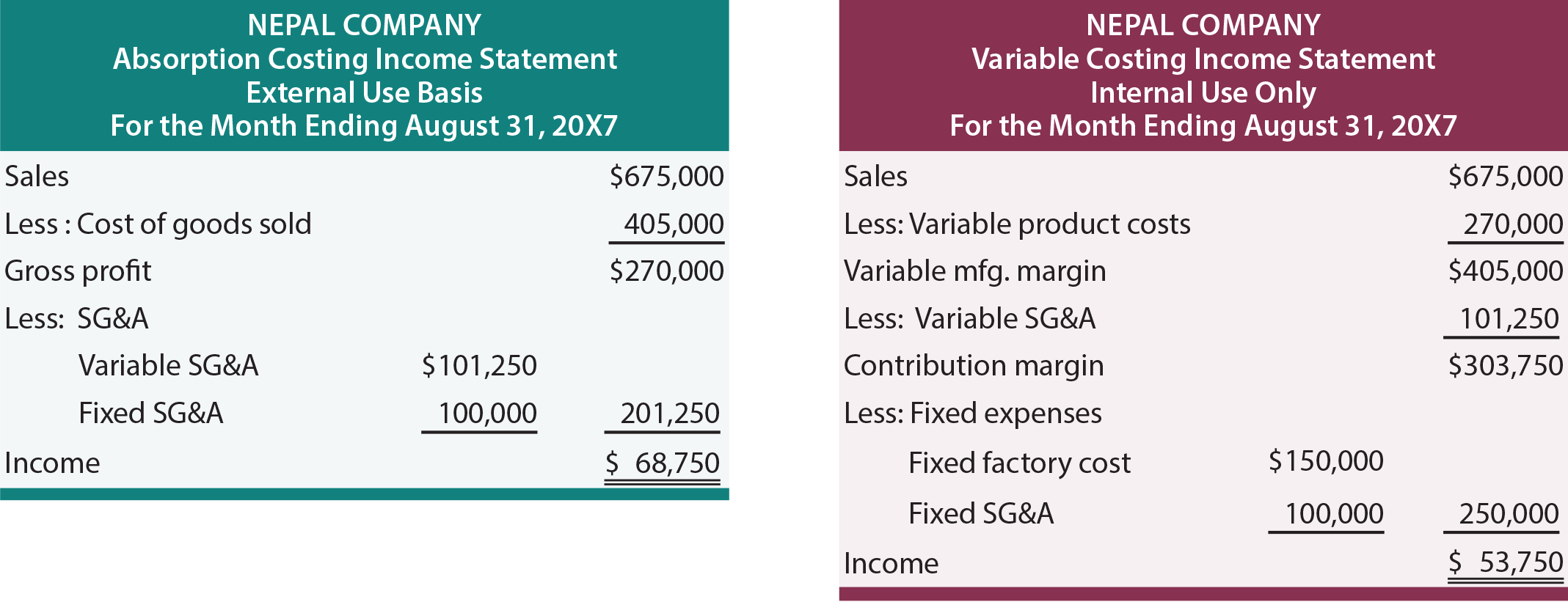

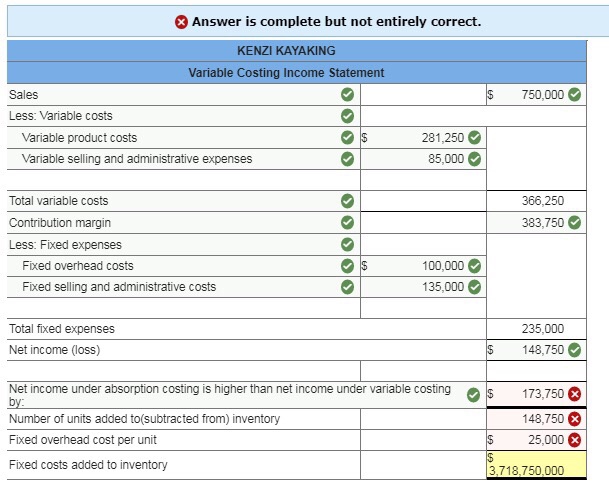

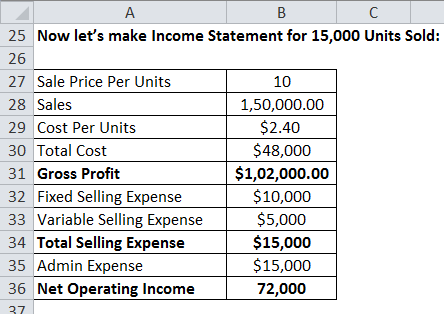

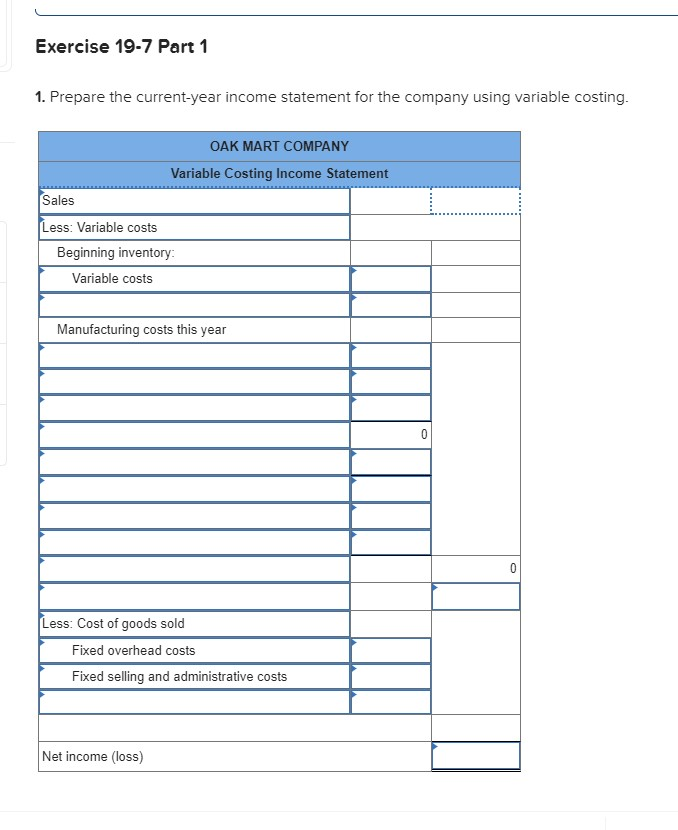

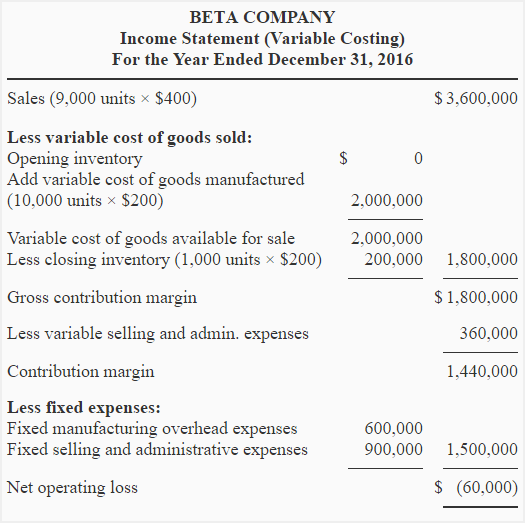

How to prepare an income statement using variable costing. Variable selling and administrative expenses are 6 per unit sold. A variable costing income statement is one in which all variable expenses are deducted from revenue to arrive at a separately stated contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. A marginal costing variable costing. Variable costingmorenike onibon liberty university abstract determining the actual valuation of manufactured assets has always been a major problem in the accounting field.

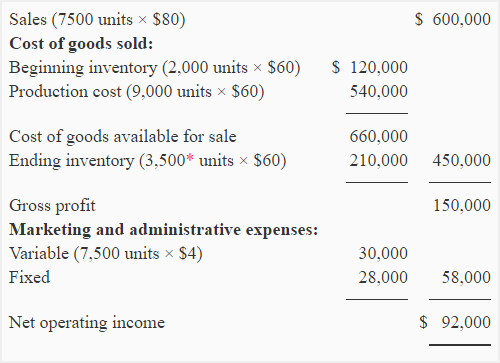

It is useful to create an income statement in the variable costing format when you want to determine that proportion of expenses that truly. Information for september 2016 was. Variable costing income statement. In september 2016 it produced and sold 30000 units.

Income statement prepared using the variable costing method. Fixed selling and administrative expenses are 600 000. The unit product cost under absorption costing is computed as follows. The real controversy exist in the decision regarding which costs are relevant to future periods and thus should be included in assets valuation and which should.

Topper plastic makes and sells a single product. The normal income statement has a gross margin whereas variable costing income statements have a contribution margin. Prepare income statements for september 2016 by using. In variable costing income statements all variable selling and administrative expenses group with variable production cost.