How To Prepare Income Statement Using Marginal Costing Method

The indirect costs are charged to products using a single overhead absorption rate which is calculated by dividing the.

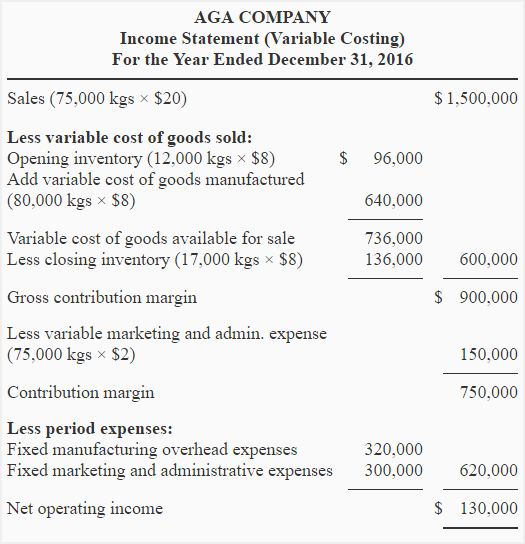

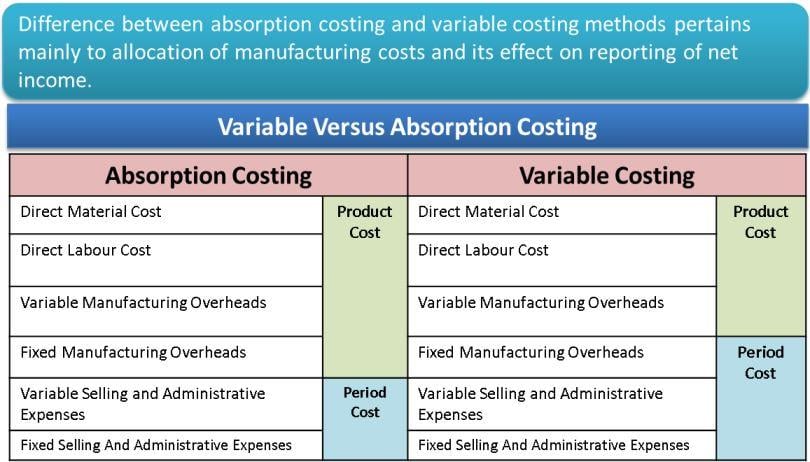

How to prepare income statement using marginal costing method. How to prepare an income statement under absorption marginal costing. In september 2016 it produced and sold 30000 units. It is assumed that the company uses the first in first out fifo method for valuing inventories. Marginal costing is used to know the impact of variable cost on the volume of production or output.

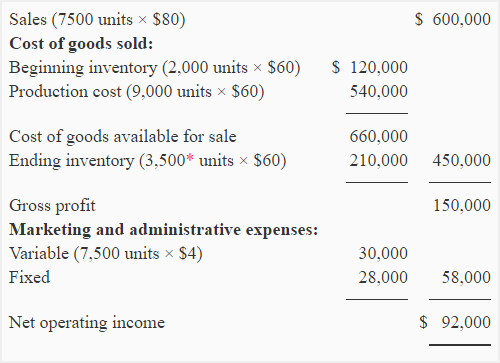

Contribution of each product or department is a foundation to know the profitability of the product or department. Absorption costing income statement. 1 30 000 is due to difference in valuation of closing stock. Prepare income statements for september 2016 by using.

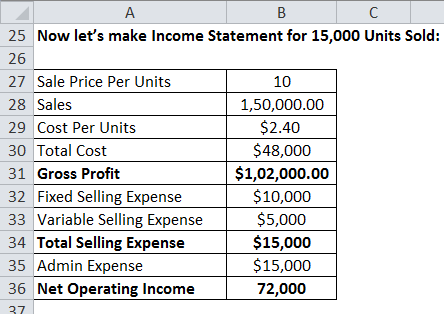

Here we will now examine a worked example to illustrate how a statement of profit can be prepared using marginal costing the question zambe ltd produces one product desks each desk is budgeted to require 4 kg of wood at 3 per kg 4 hours of labour at 2 per hour and variable production overheads of 5 per unit. The difference in profits rs. For the year ended 30 june 2016. Information for september 2016 was.

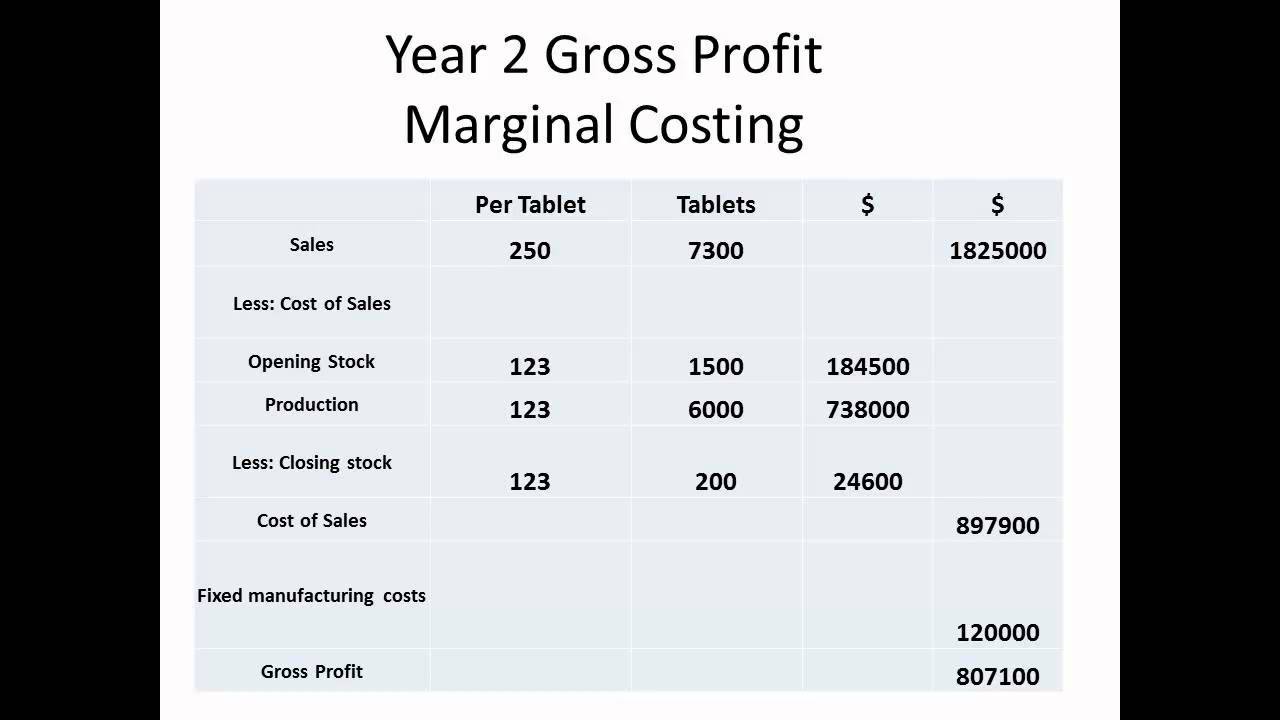

Quickly learn how to prepare profit statement for two quarters using marginal costing. There are a variety of ways to think about business costs. Marginal costing income statements are more useful for analyzing. You are required to present income statements using a absorption costing and b marginal costing account briefly for the difference in net profit between the two income statements.

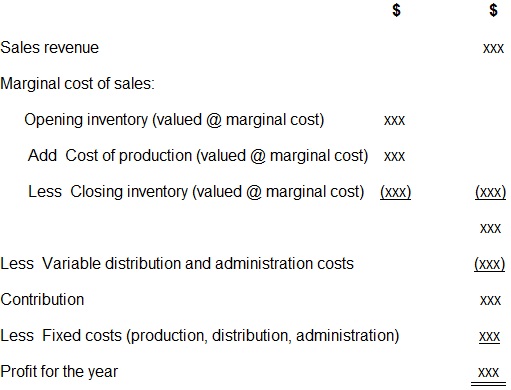

When income statements under absorption costing and marginal costing are. In order to be able to prepare income statements under absorptioncosting you need to be able to complete the following proforma. This paper aims at looking at how income statements are prepared using marginal and absorption costing. A marginal costing variable costing.

Topper plastic makes and sells a single product. Sections a and b below show the marginal and absorption costing income statements respectively for h ltd that manufactures and sells a single product during the years ending 2006 and 2007. It should be clearly understood that marginal costing is not a method of costing like process costing or job costing. Calculate sales variable production costs of sales and profit of a m.

Rather it is simply a method or technique of the analysis of cost information for the guidance of. Absorption costing income statement. Break even analysis is an integral and important part of marginal costing.