Impact Income Statement Depreciation

Unlike other expenses depreciation expenses are listed on income statements as.

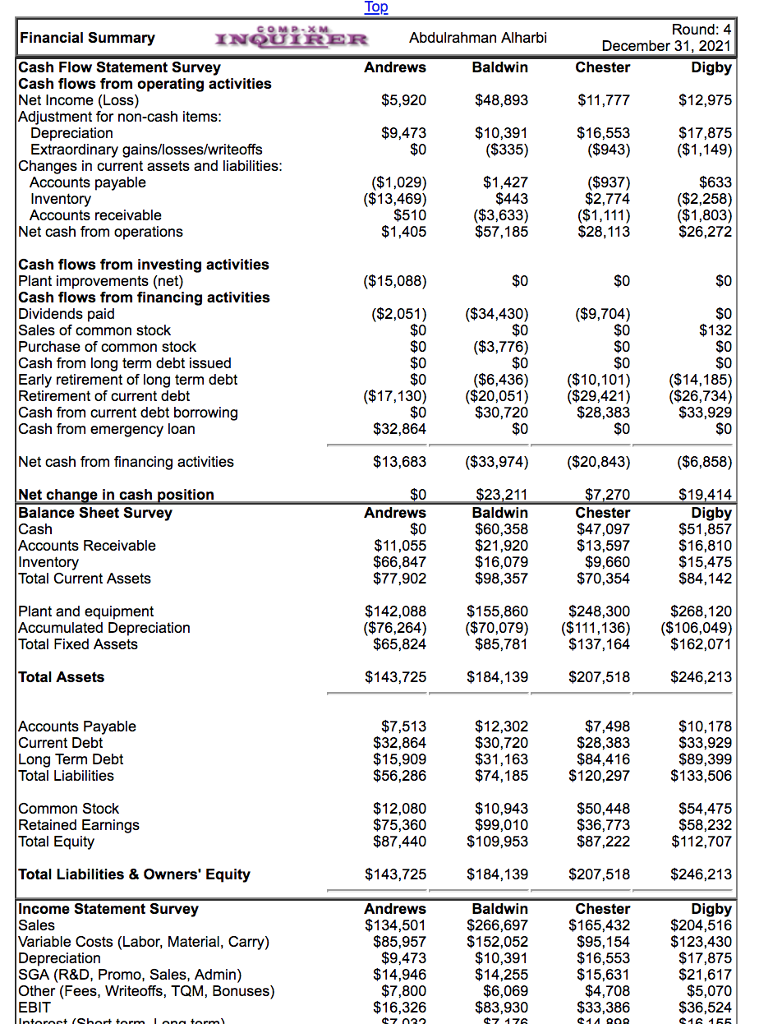

Impact income statement depreciation. To examine the effect of depreciation on net income of united bank for africa uba plc. A depreciation expense has a direct effect on the profit that appears on a company s income statement. The broad objective of this project work is to examine the effect of depreciation on the income statement of with particular reference to united bank for africa uba plc. Profit or net income is all of the company s revenues minus the cost of doing business which can include expenses interest taxes and depreciation.

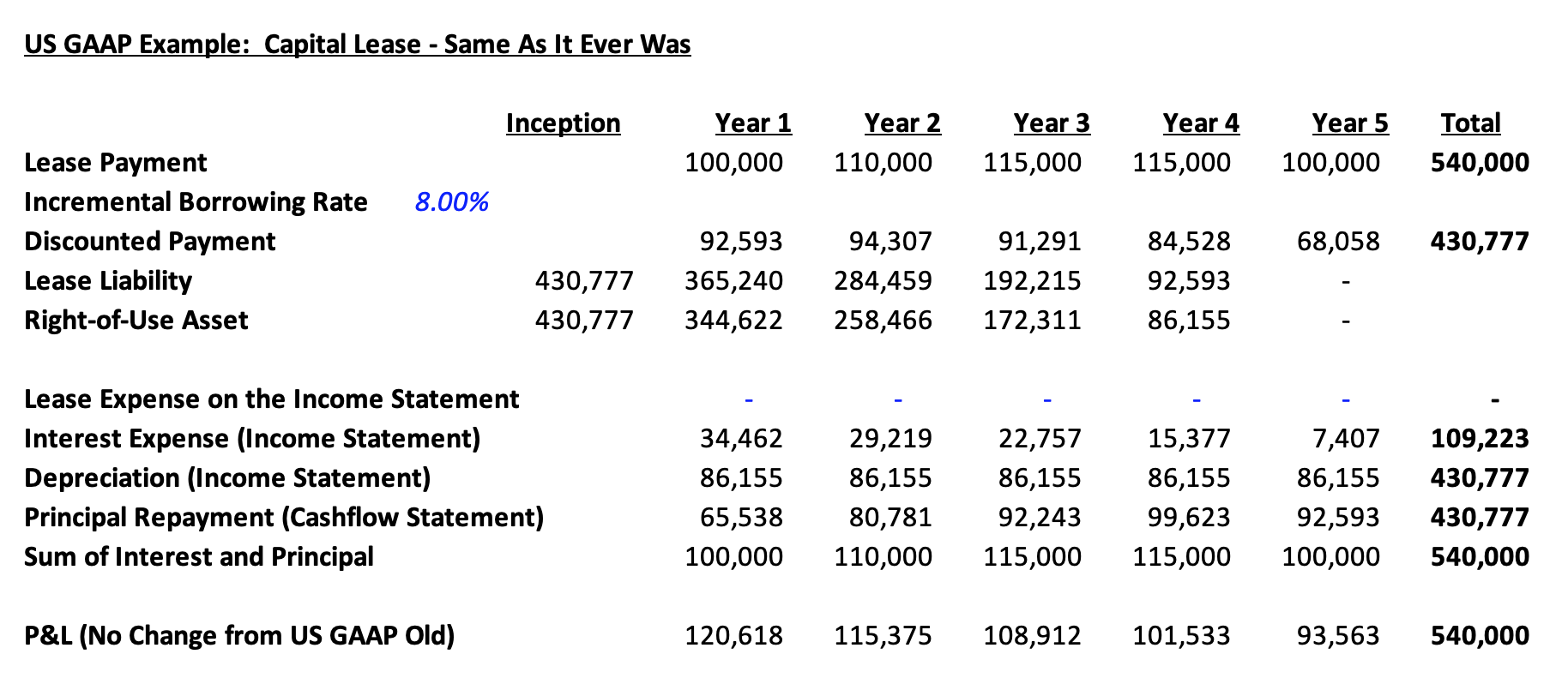

The specific objectives of this research work includes the following. The monthly journal entry to record the depreciation will be a debit of 1 000 to the income statement account depreciation expense and a credit of 1 000 to the balance sheet contra asset account accumulated depreciation. The straight line method of depreciation will result in depreciation of 1 000 per month 120 000 divided by 120 months. How depreciation affects the income statement since depreciation is an expense it has a direct effect on the profit that appears on a company s income statement.

It is accounted for when companies record the loss in value of their fixed assets through depreciation. It can thus have a big impact on a company s financial performance overall. Physical assets such as machines equipment or vehicles degrade over time and reduce in value incrementally.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)