Income Approach Vs Revenue

Income approach is a valuation method used for real estate appraisals that is calculated by dividing the capitalization rate by the net operating income of the rental payments.

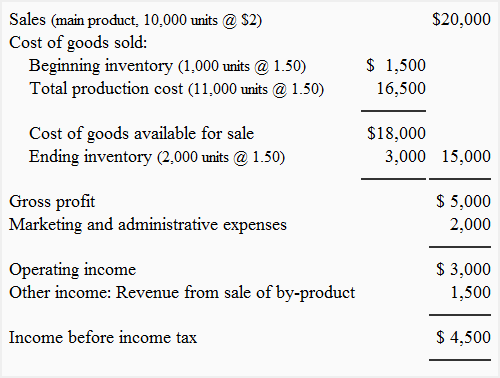

Income approach vs revenue. While revenue includes the gross earning from primary operations without any deductions profit is the resultant income after accounting for expenses expenditures taxes and additional income and costs in the revenue. Revenue is the top line of the income statement whereas the profit is the bottom line. What does income approach mean. This guide provides an overview of the main differences between revenue vs income.

Income revenue expenses. Revenue is the amount earned from a company s main operating activities such as a retailer selling merchandise or a law firm providing legal services. In the expenditure or output approach gdp refers to the market value of all final goods and services produced in an economy over a given period of time. Gross domestic product gdp has two different approaches.

The cost approach calculates the cost to construct new improvements on a site less any depreciation due to age or other factors. As for the income approach gdp refers to the aggregate income earned by all households companies and the government that operates within an economy over a given period of time. What is the difference between revenue income and gain. For individuals however income generally refers to the total wages salaries tips rents interest or dividend received for a specific time period.

When income is represented as a percentage of revenue it s called profit margin. Revenue is the sales amount a company earns from providing services or selling products the top line. The income approach and the expenditure or output approach. The income capitalization approach measures the present worth of a future income generated by a property and b its eventual resale value.

In accounting a gain is the result of a peripheral activity such as a retailer selling one of its old delivery trucks. Revenue is the total amount of income generated by the sale of goods or services while income is earnings or profit revenue minus expenses. This depreciated cost is then added to the value of the underlying land.

.png?width=780&name=Walmart%20Revenue%20vs.%20Profit(1).png)