Income In Respect Of A Decedent Deduction 2018

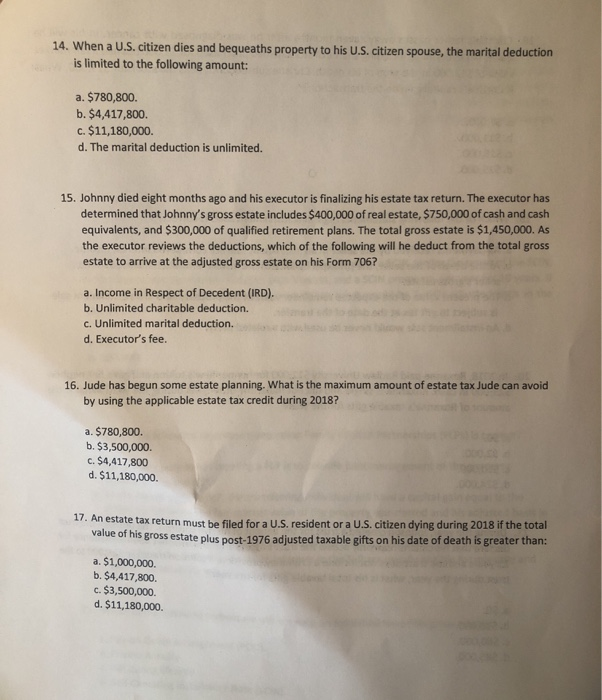

Estate tax a tax on the transfer of property.

Income in respect of a decedent deduction 2018. Guinevere is allowed an income tax deduction for the estate taxes attributable to the ira. What is an ird income in respect of a decedent deduction. With the high minimum threshold for federal estate tax liability and the comparatively low rate of the pennsylvania inheritance tax succession not tax liability on. If you have questions regarding estate taxes and income a decedent s estate receives the.

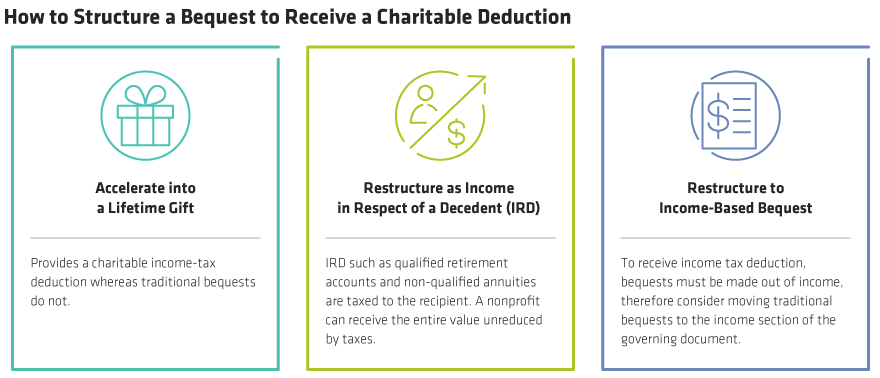

Deductions in respect of a decedent. Those income items are called income in respect of decedent. In other words the income in respect of a decedent is the gain the decedent would have realized had he lived. To compensate for this double taxation congress has instituted the estate tax deduction.

Guinevere must report this income on her federal income tax return. Items such as business expenses income producing expenses interest. For example if the ird would have been subject to capital gains tax rates for the decedent then it is considered capital gains for the beneficiary. An annuity received by a surviving annuitant under a joint and survivor annuity contract is considered income in respect of a decedent.

The tax is due because the balance is income in respect to a decedent ird. If the estate is large enough to pay an estate tax the income in respect of decedent items are taxed twice. The decedent or ird deduction stands for income in respect of a decedent deduction. An heir who because of the decedent s death receives income as a result of the sale of units of mineral by the decedent who used the cash method will be entitled to the depletion allowance for that income.

The character of the income in the hands of the beneficiary is the same as the character of the income would have been in the hands of the decedent. When an individual receives a 1099 r for a distribution that has code 4 the death code in box 7. The gain to be reported as income in respect of a decedent is the 1 000 difference between the decedent s basis in the property and the sale proceeds. Distributions of the funds from horatio s ira are treated as income in respect of a decedent.

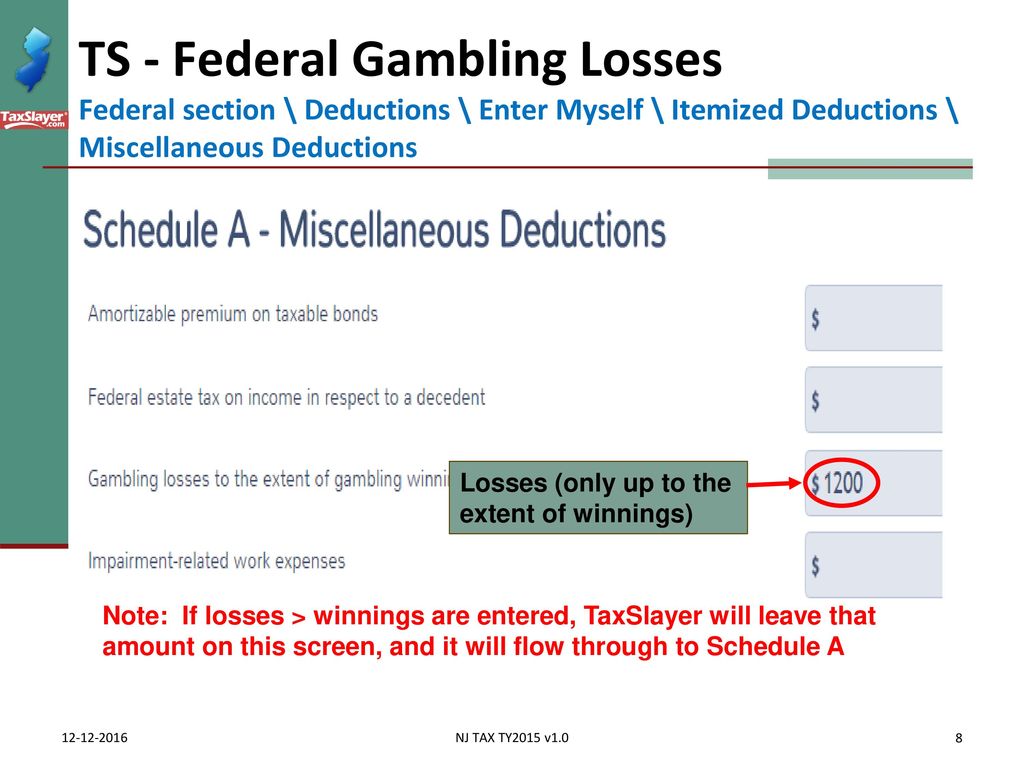

It s an income tax deduction for the beneficiary miscellaneous itemized deduction not subject to limitations. George died on february 15 before receiving payment. Publication 559 survivors executors and administrators other tax information. Don t expect the cpa to pick up on this.

The person or entity that inherits the income pays the taxes. It is an irs term that refers to inherited income that is subject to federal income.

/GettyImages-BA61273-883c9d0942db4168b8acd8b51acbe1bd.jpg)

:max_bytes(150000):strip_icc()/GettyImages-182219577-6ab97665cebd48b0912463655cc12347.jpg)