Income In Respect Of A Decedent Reporting

The gain to be reported as income in respect of a decedent is the 1 000 difference between the decedent s basis in the property and the sale proceeds.

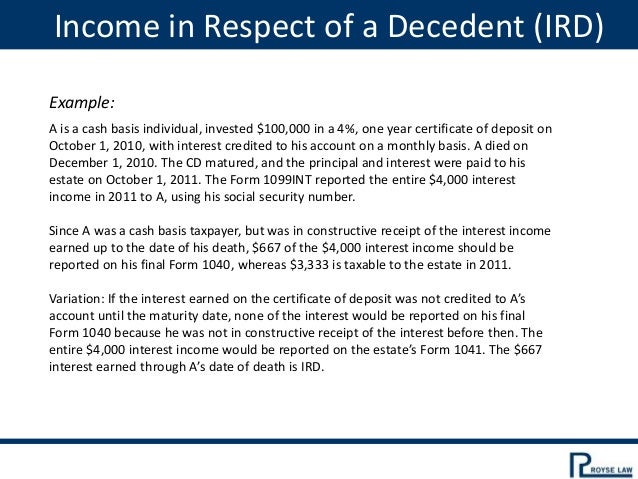

Income in respect of a decedent reporting. Deductions in respect to a decedent. Regardless of accounting method ird is subject to income tax when a triggering event generally the actual receipt of the income by the beneficiary occurs. For example if the ird would have been subject to capital gains tax rates for the decedent then it is considered capital gains for the beneficiary. It is an irs term that refers to inherited income that is subject to federal income.

One way to initially reduce the tax to the beneficiary is by claiming a deduction. Guinevere must report this income on her federal income tax return. In addition sam must report 2 000 of ird on his income tax return. If you failed to file nominee 1099s you can still let the irs know where the income you re reporting was originally reported to them.

Income in respect of a decedent ird is money owed to a person before they passed away like a salary or wages. The person or entity that inherits the income pays the taxes. In other words the income in respect of a decedent is the gain the decedent would have realized had he lived. George died on february 15 before receiving payment.

If you have questions regarding estate taxes and income a decedent s estate receives the. A an employer on wages and salaries of a decedent received by the decedent s estate. Distributions of the funds from horatio s ira are treated as income in respect of a decedent. High died on february 15 before receiving payment.

Use line 24e to claim a credit for any federal income tax withheld and not repaid by. Or c a payer of distributions from pensions annuities retirement or profit sharing plans iras insurance contract etc received by a. For example a form 1099 int reporting interest payable to the decedent may include income that should be reported on the final income tax return of the decedent as well as income that the estate or other recipient should report either as income earned after death or as income in respect of the decedent discussed later. Guinevere is allowed an income tax deduction for the estate taxes attributable to the ira.

In other words the income in respect of a decedent is the gain the decedent would have realized had he lived. The gain to be reported as income in respect of a decedent is the 1 000 difference between the decedent s basis in the property and the sale proceeds. B a payer of certain gambling winnings for example state lottery winnings.

/GettyImages-BA61273-883c9d0942db4168b8acd8b51acbe1bd.jpg)