Income In Respect Of A Decedent State Tax Refund

Taxpayers who die in any given year will have one final tax return filed on their behalf.

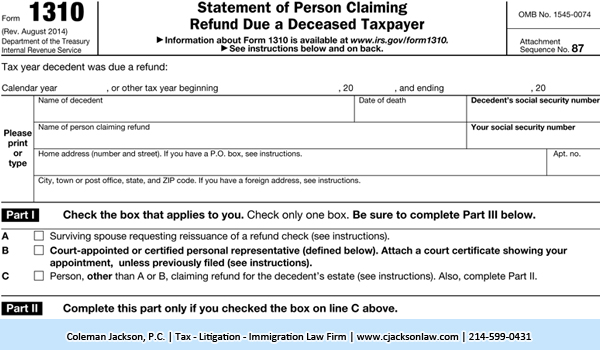

Income in respect of a decedent state tax refund. Income in respect to decedent ird defined. The final tax return filed for an individual in the year of that person s death. Often you will have to add the item to the final 1040 federal tax return of the decedent because the social security number on the tax document such as a w 2 1099 or k 1 will be the decedent s. If the gross estate exceeds 11 4 million per individual in 2019 then the ird will be taxed twice first at the estate level up to 40 then second as income to the beneficiary.

The state income tax refund is ird. Ird is counted within the gross estate of the decedent and as such may be subject to federal estate taxes in addition to federal income taxes. Final return for decedent. Publication 559 page 42 clearly shows the irs knows the state income tax refund is income to the decedent.

If there is a state tax refund that would have had to be included as taxable income on the decedent s tax return then it should be included on the estate tax return if received after the date of death. Both refunds are assets of the estate but only 1 of estates have to file form 706. Merely place a notation on the estate s tax return showing that the estate received the income in the name and social security number of the decedent. Income in respect of a decedent ird is the gross income a deceased individual would have received had he or she not died and that has not been included on the deceased individual s final income tax return.

Income in respect of a decedent ird is money owed to a person before they passed away like a salary or wages. Once the estate is probated the executor can retitle the retirement plans ee u s. Remember there is a form 1099 g floating around. So assuming the person itemized deductions on schedule a on the 2015 tax return that refund would be taxable income.

Savings bonds or. The person or entity that inherits the income pays the taxes.

/GettyImages-BA61273-883c9d0942db4168b8acd8b51acbe1bd.jpg)