Income Statement And Balance Sheet Approaches To Estimating Bad Debts

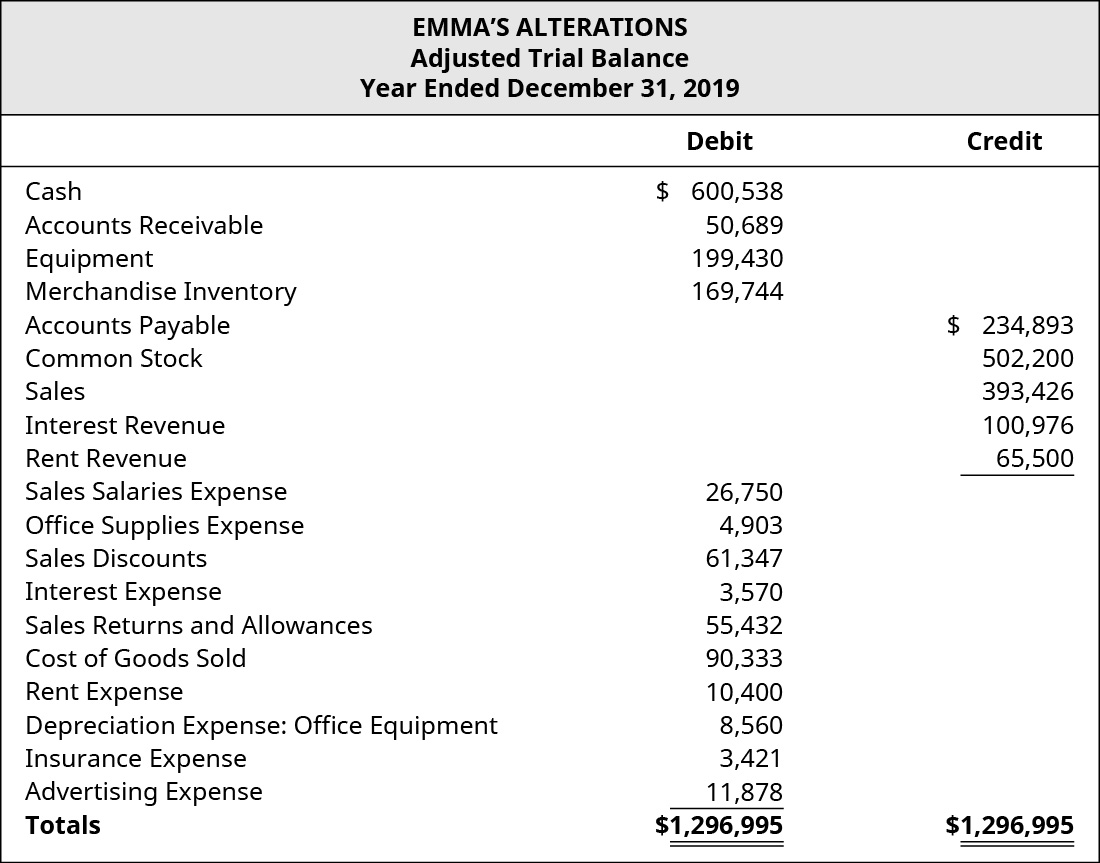

The first is an income statement approach that measures bad debt as a percentage of sales.

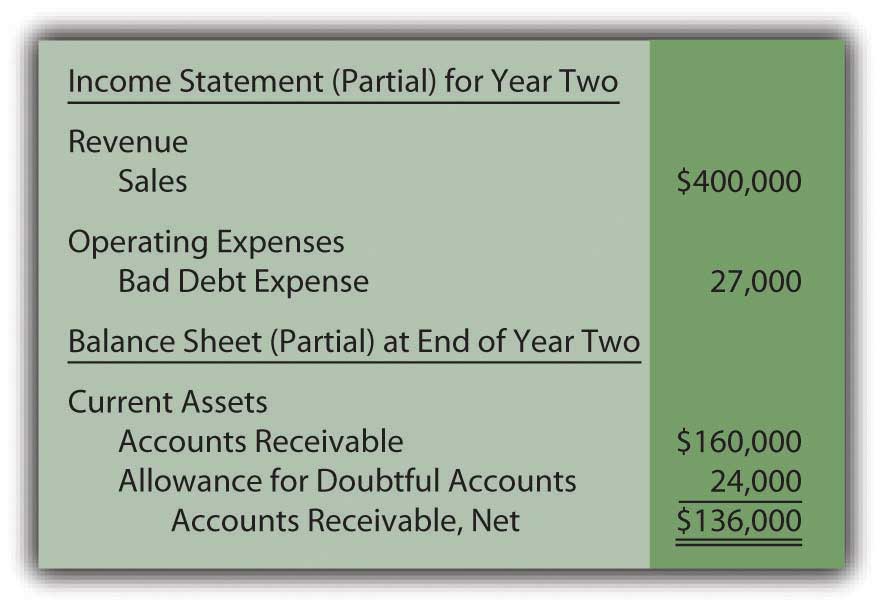

Income statement and balance sheet approaches to estimating bad debts. However the balance sheet would show 100 000 accounts receivable less a 5 300 allowance for doubtful accounts resulting in net receivables of 94 700. The direct write off method involves writing off a bad. It matches the revenue generated from credit sales with the expense incurred from them by recording a bad debt expense on the income statement. Estimating bad debts therefore serves two main purposes.

The estimate for bad debts reduces both net earnings on the income statement and the accounts receivable. Bad debt can be reported on the financial statements three financial statements the three financial statements are the income statement the balance sheet and the statement of cash flows. The adjusting entry would still be for 5 000. Record the year end adjusting entry for 2018 bad debt using the balance sheet method.

These three core statements are intricately using the direct write off method or the allowance method. There are two primary methods for estimating bad debt expense. On the income statement bad debt expense would still be 1 of total net sales or 5 000. Asset on the balance sheet.