Income Statement Approach To Estimating Uncollectibles

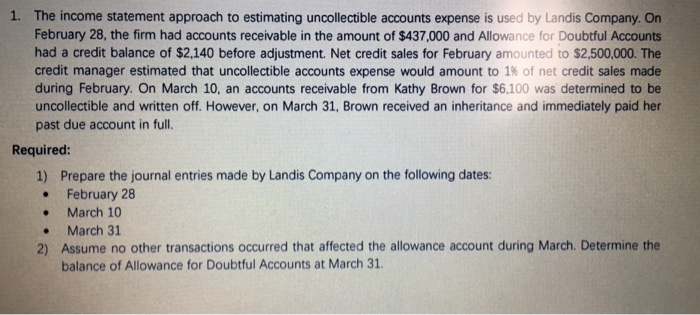

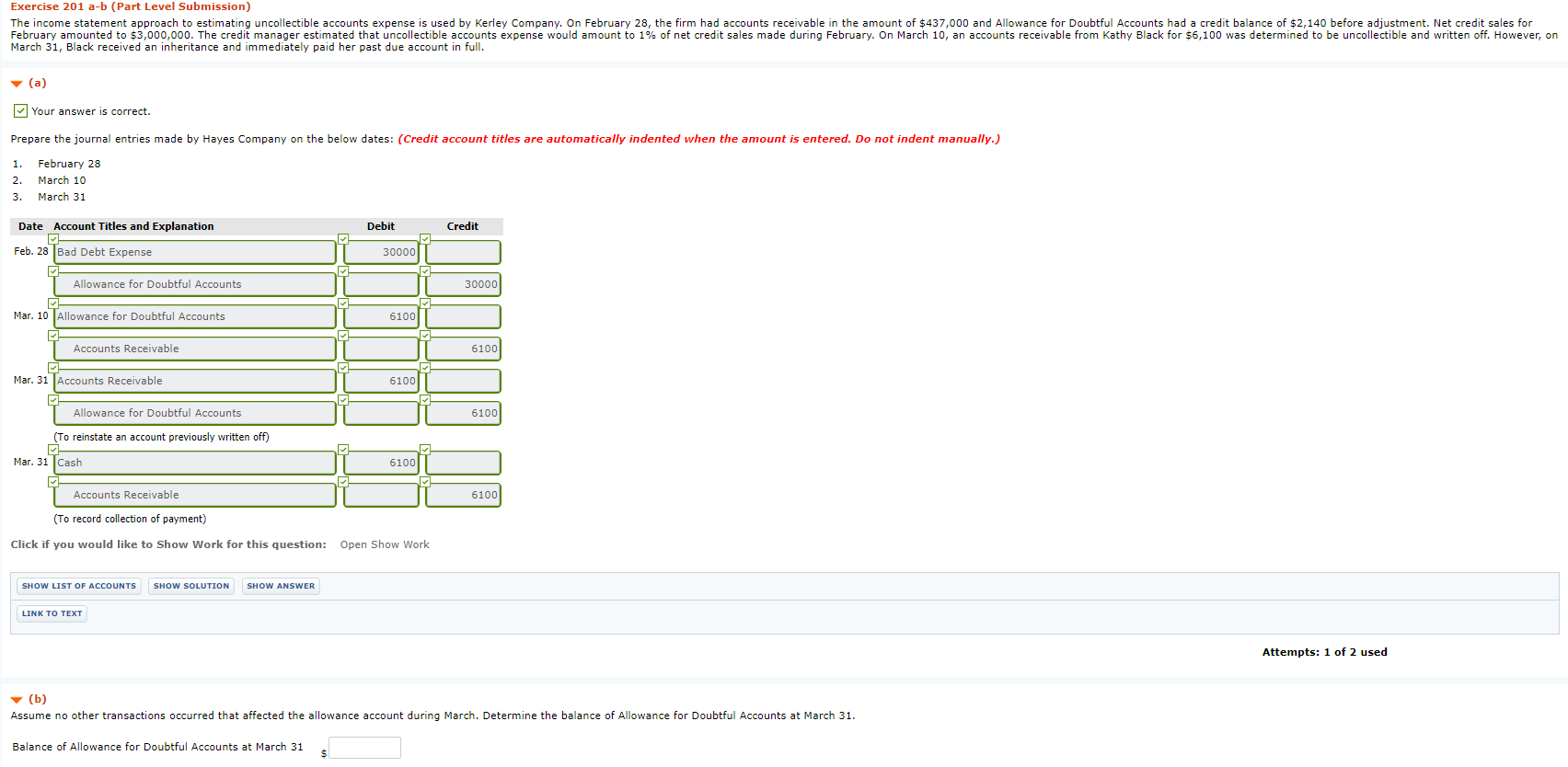

The income statement approach to estimating uncollectible accounts expense is used by kerley company.

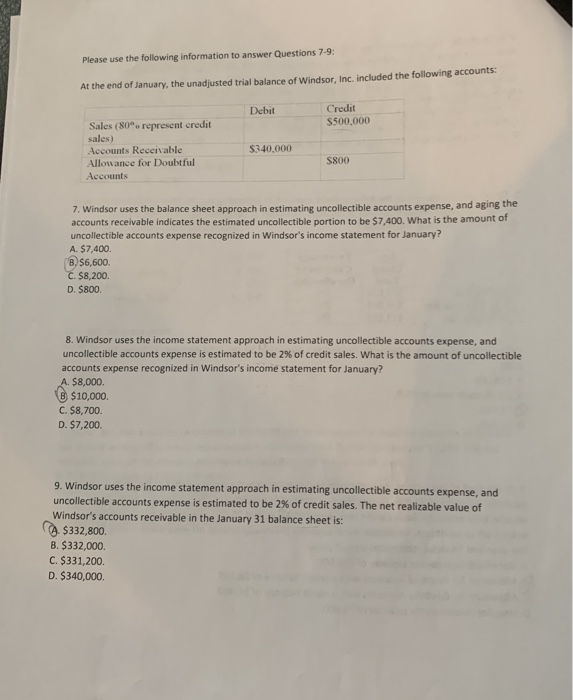

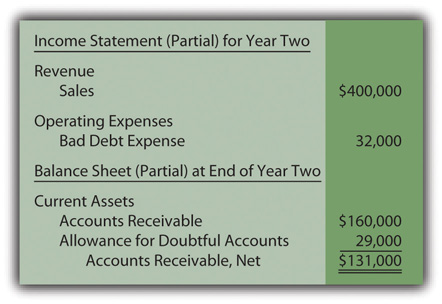

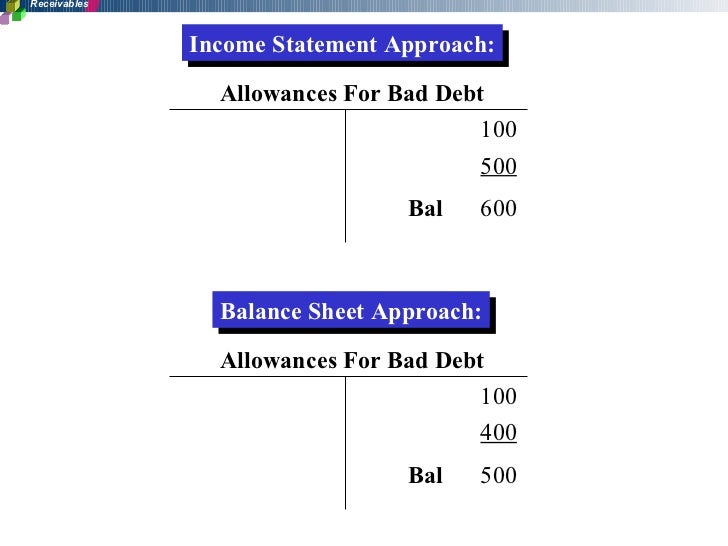

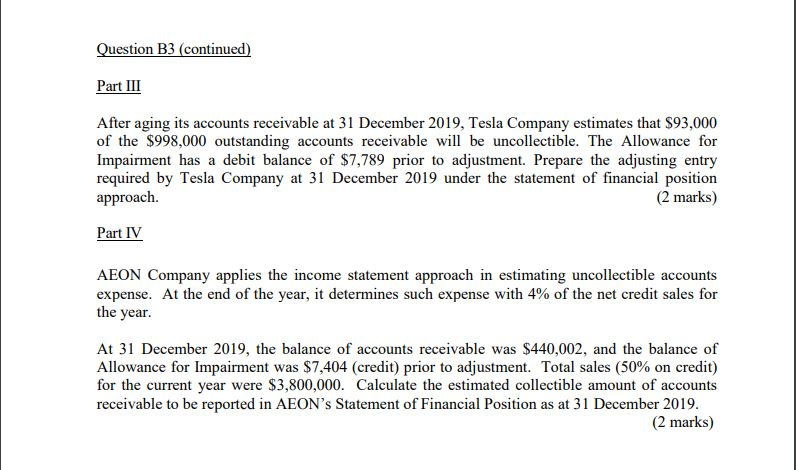

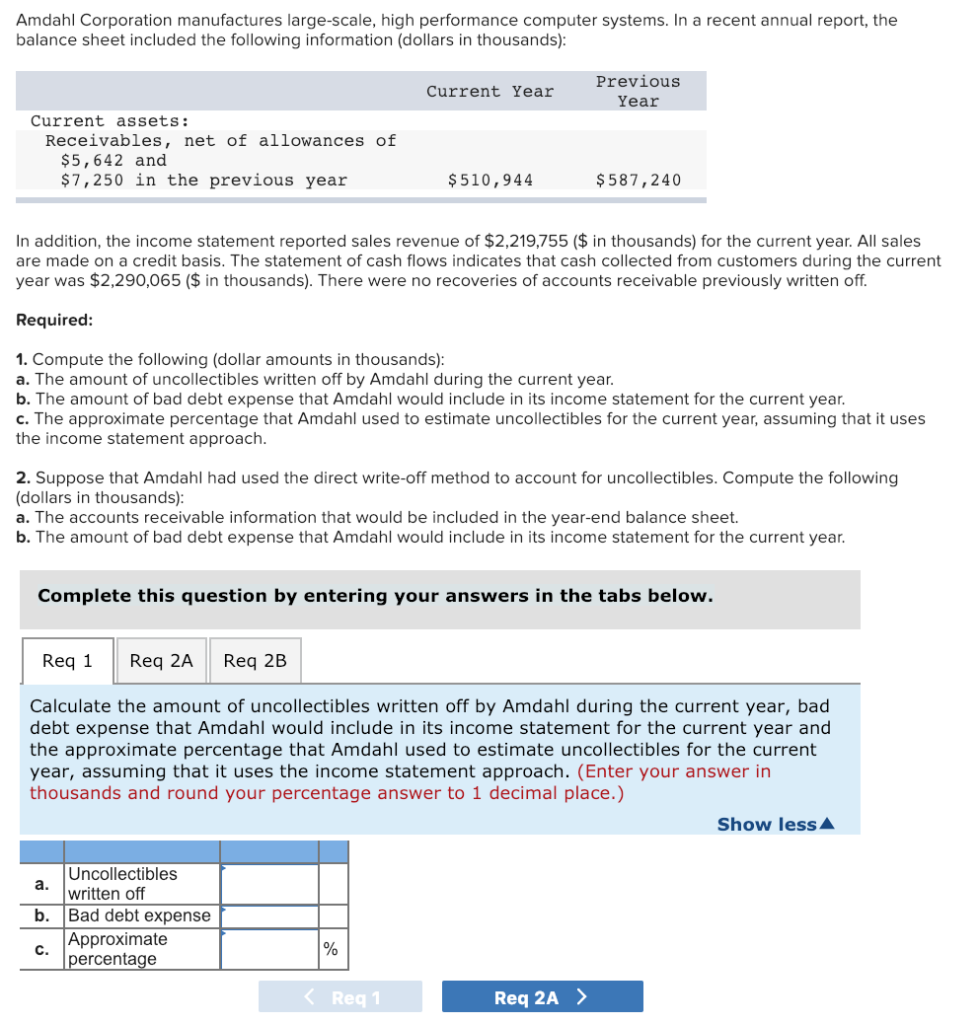

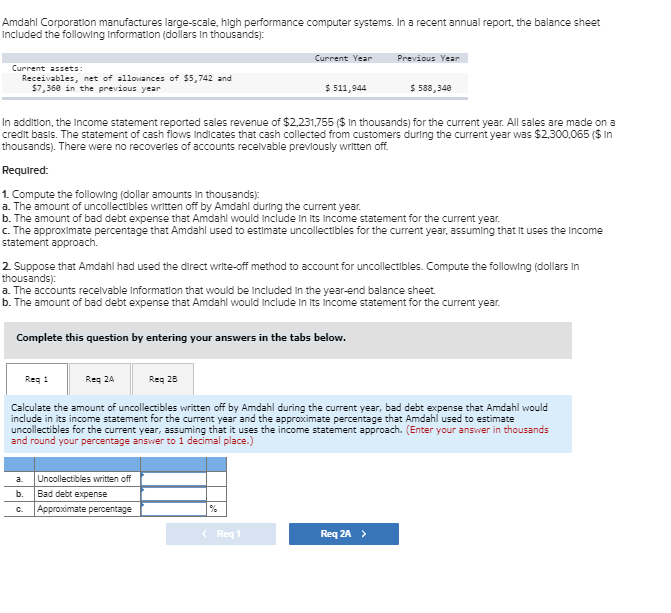

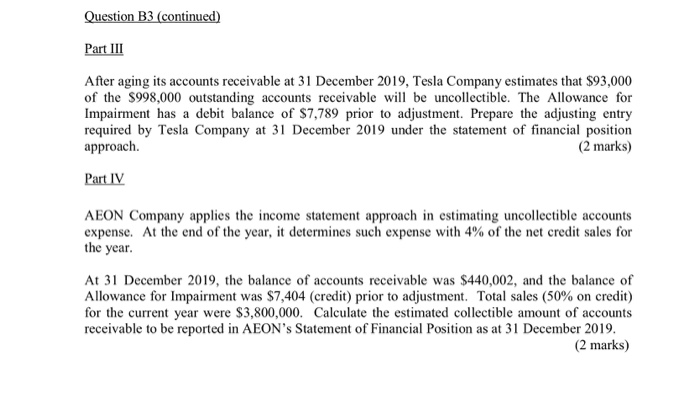

Income statement approach to estimating uncollectibles. Net credit sales for february amounted to 3 000 000. Compute bad debt estimation using the balance sheet method of percentage of receivables where the percentage uncollectible is 9. The second is a balance sheet approach that measures uncollectibles as a percentage of ending accounts receivable. Under the direct method your income statement approach any uncollectible amounts are recorded directly to the income statement when you become aware of the fact that it is no longer.

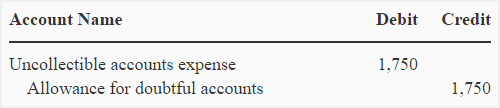

The income statement approach to estimating uncollectible accounts expense is used by kerley company. On february 28 the firm had accounts receivable in the amount of 437 000 and allowance for doubtful accounts had a credit balance of 2 140 before adjustment. With an income statement approach the bad debt expense is calculated and the allowance account is the. Prepare the journal entry for the income statement method of bad debt estimation.

Net credit sales for february amounted to 3 000 000. Having established that an allowance method for uncollectibles is preferable indeed required in many cases it is time to focus on the details. There are two general approaches to estimate uncollectible accounts expense. The first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach journal entry to recognize uncollectible accounts expense.

Compute bad debt estimation using the income statement method where the percentage uncollectible is 5. The first method percentage of sales method focuses on the income statement and the relationship of uncollectible accounts to sales. On february 28 the firm had accounts receivable in the amount of 437 000 and allowance for doubtful accounts had a credit balance of 2 140 before adjustment. Estimating uncollectible accounts accountants use two basic methods to estimate uncollectible accounts for a period.

The sales method or income statement approach of estimating uncollectible accounts is simple and easy to employ but is considered a less accurate and less reliable technique when compared with the aging method. The various methods can be classified as either being an income statement approach or a balance sheet approach. There are two primary methods for estimating bad debt expense.