Income Statement Forecasting Formula

Being able to project the main line items of the income.

Income statement forecasting formula. Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived by subtracting cost of goods sold from the total revenues second formula states that operating income of the company is derived by subtracting operating expenses from the total gross profit arrived and the last formula states that the net income of the. Forecasting income statement line items projecting income statement line items we discuss. Use ctrl d to copy the formula down through december. Similarly the 5 month moving average forecasts revenue starting the fifth period which is may.

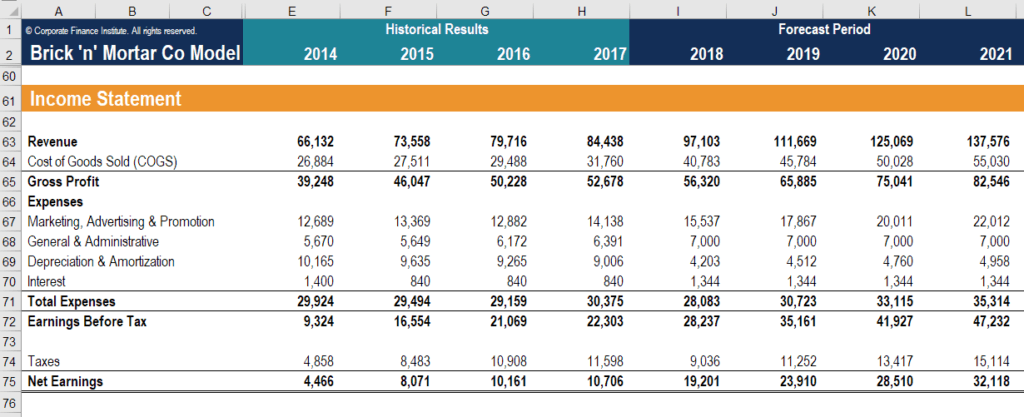

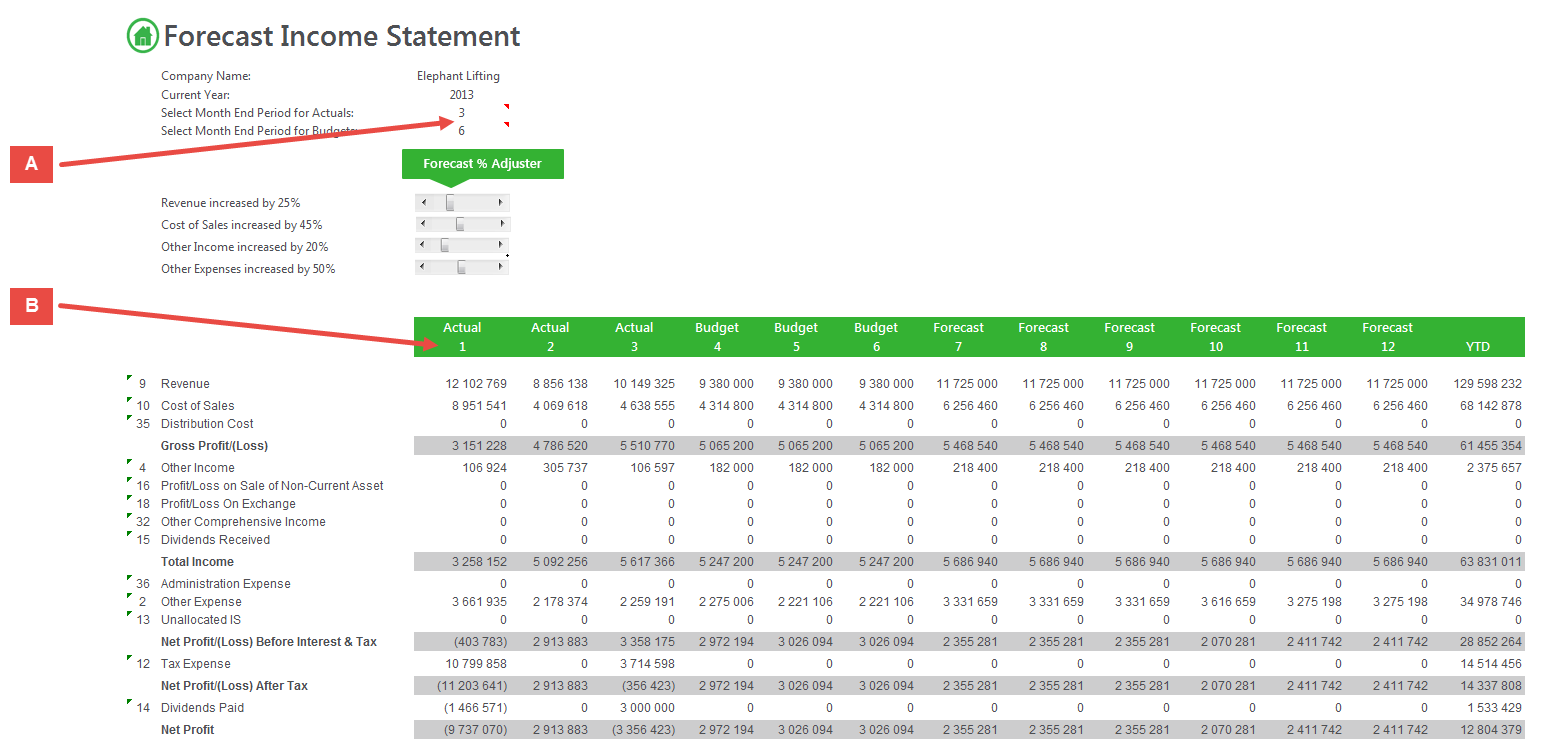

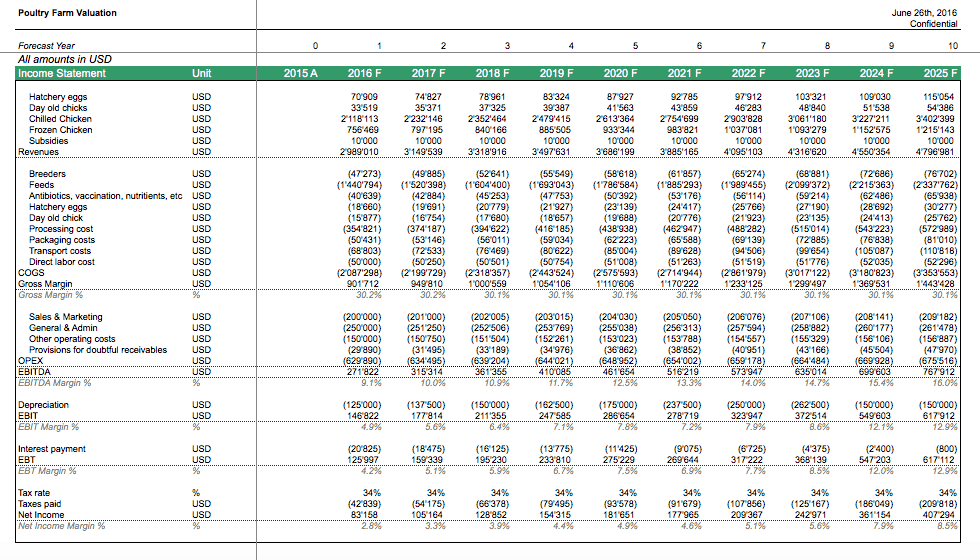

In this forecast example let s consider datasets for known y s values and known x s values and calculate a forecast value for 30 on the basis of known values x s and y s. Forecasting the income statement is the first step to building rebuild the historicals to forecast the income statement you have to understand the historicals. Projecting income statement line items. Examples guide it becomes necessary to get into the habit of projecting income statement line items.

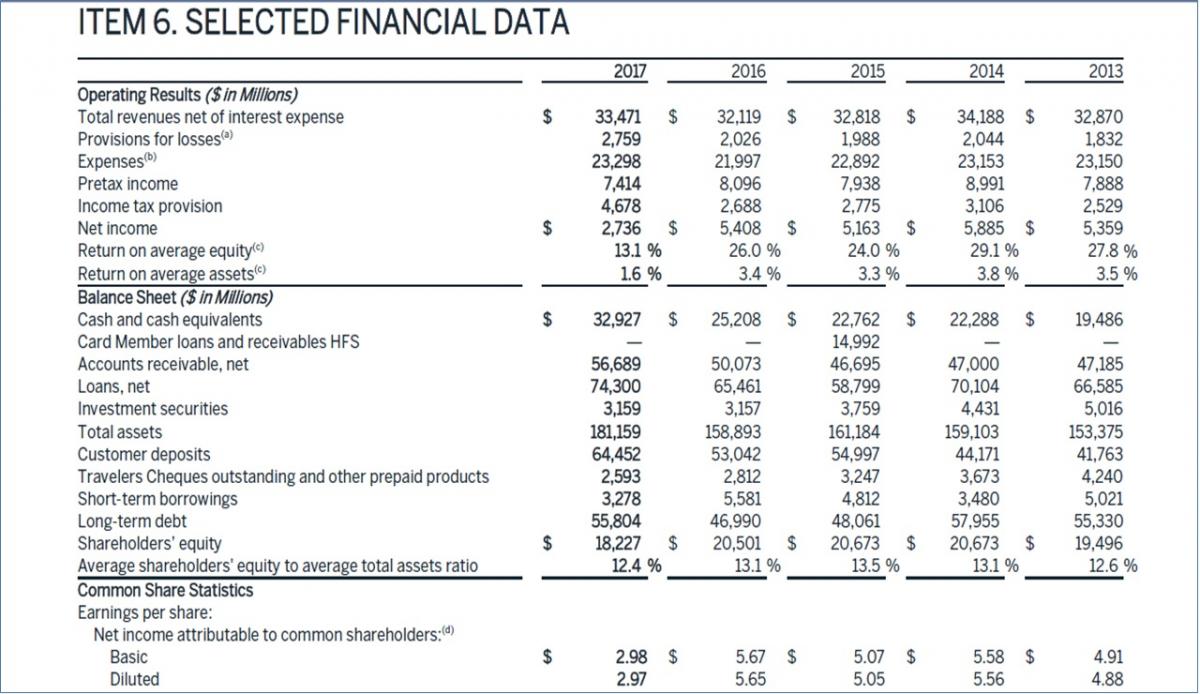

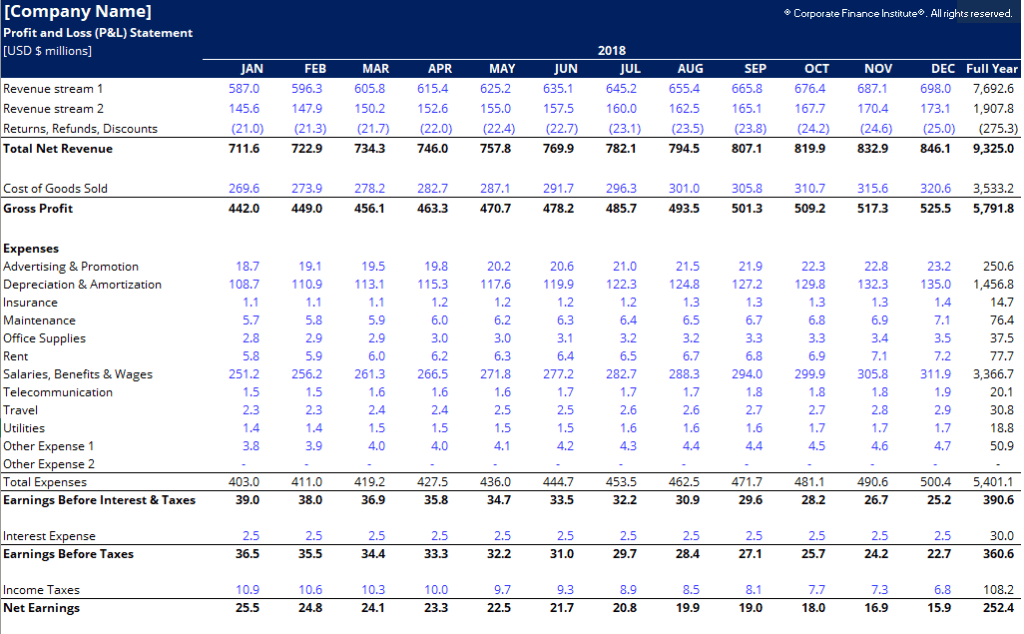

When building a three statement model 3 statement model a 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. The income statement forecast shows a business s financial performance over an accounting period. The correct answer is b. By completing the forecasting for three to five years of your cash flow statement you ve completed most of the necessary legwork for your income statement and balance sheet for the same period.

Forecast formula in excel can be used as a worksheet function and as a vba function. The formula used is average b4 b6 which calculates the average revenue from january to march. The accounting period can be any length but is usually a month or a year. Forecasting the income statement is a key part of building a 3 statement model because it drives much of the balance sheet and cash flow statement forecasts.

The only change is to add the required profit target to the fixed costs. On the income statement template that you downloaded above input the same amounts for revenue lines 9 through 12 and costs lines 16 through 22. Forecast function as worksheet function. Forecasting a company s future net income and cash flow often begins with a top down sales forecast in which industry sales and the company s market share are forecasted.

In this guide we address the common approaches to forecasting the major line items in the income statement in the context of an integrated 3 statement modeling exercise. Target volume price and contribution margin per unit are the key inputs to a sales forecast. Forecasting the income statement. This means taking the given values and adding formulas where necessary.

Forecasting a company s future net income and cash flow often begins with a projection of expenses. If you want to give it a shot highly recommended you can download continue reading how to forecast the.