Income Statement Format That Separates Cost Of Goods Sold Into Categories

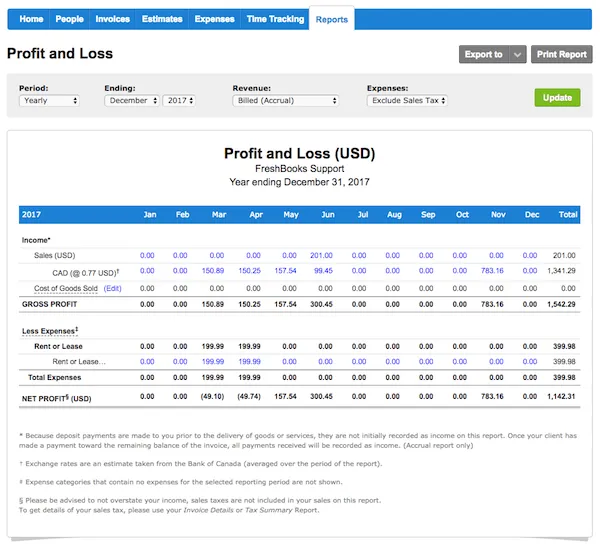

1 an income statement always represents a period of time like a month quarter or a year.

Income statement format that separates cost of goods sold into categories. Cost of goods sold is important statement use in business organization. The contribution approach separates costs into fixed and variable categories first deducting variable expenses from sales to obtain the contribution margin. The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement. Be careful not to confuse the terms total manufacturing cost and cost of goods manufactured with each other or with the cost of goods sold.

An income statement format that organizes costs by behavior. Income statement cash flow statement. Total revenues minus total expenses c. The contribution margin income statement separates expenses into fixed and variable categories.

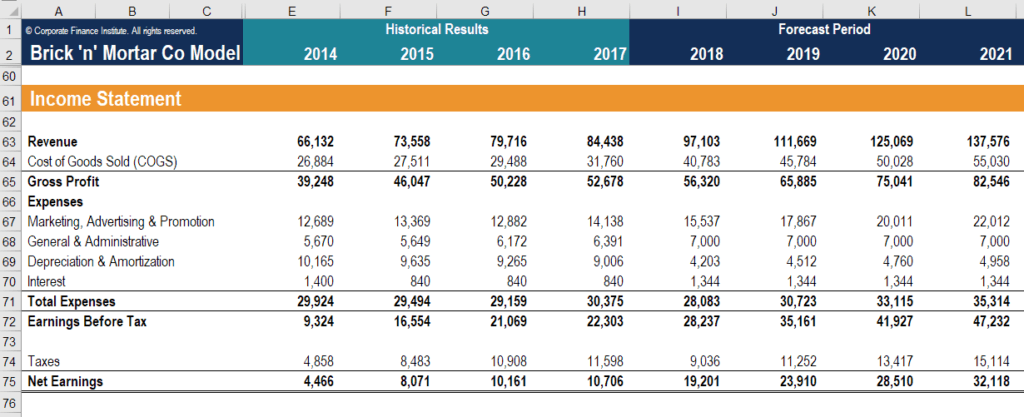

Income statement format that separates cost of goods sold into categories. Operating revenues minus operating expenses d. The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured. This contrasts with a balance sheet which shows account balances for one exact date.

Total revenues minus cost of goods sold total revenues minus total expenses operating revenues minus operating expenses revenues minus expenses plus. Net income equals. The traditional approach organizes costs into two categories cost of goods sold and selling and administrative expenses. Standard detailed expanded multi step.

Total revenues minus cost of goods sold b. The type of business that would report this kind of result is most likely to perform services and dividing the profit and loss statement into a gross profit and net profit section is irrelevant. Cost of goods sold all variable for a retailer 0 s a expenses 60 000 20 000 x 50 20 000. Multi step ans d.

In other words all the revenue you receive translates into gross profit. Cost of goods sold format is collection of sheet of word pdf and excel format. For a merchandising company cost of goods sold is a variable cost that gets included in the variable expenses portion of the contribution format income statement. The income statement above shows five full calendar years plus a last twelve months ltm period as of 9 30 13.

Revenues minus expenses plus income taxes ans b. Income statement format that separates cost of goods sold into categories. Costs are separated into variable and fixed categories rather than being separated into product and period costs for external reporting purposes.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-02-23bef448b8aa4c9bac46c8e15b2b9f0a.jpg)