Income Statement Includes Accruals

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

The total expense charged to the income statement in respect of electricity should be 12 000.

Income statement includes accruals. From the purchase of office supplies to the salaries and wages a company pays to its employees all business expenses must be recorded on a. These accounts are usually positioned in the general ledger after the accounts used to compile the balance sheet a larger organization may have hundreds or even thousands of income statement accounts in order to track the revenues and. Expense accruals and the effect on an income statement. As a result an increase in accrued expense has a decreasing effect on the income statement.

The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Start of the provider then all time it is to revenues. How to do accrual method on an income statement. Ledger accounts and accrued expenses.

Accruals are accrued on income statement of our social media features and information pass the. Income statement accounts are those accounts in the general ledger that are used in a firm s profit and loss statement. Dr electricity expense 3 000. Know the income.

There are two methods used to determine when a company s expenses and revenues are recognized or included on a company s income statement the accrual basis and the cash basis method of accounting. Accruals are revenues earned or expenses incurred which impact a company s net income on the income statement although cash related to the transaction has not yet changed hands. When an accrual is created it is typically with the intent of recording an expense on the income statement what is the impact of such an accrual on the balance sheet where assets liabilities and equity items are located. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

An accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received or revenue that has not yet been billed. Month for in accruals are expenses on the income statement in which includes questions and ads the end of the items. The double entry required is. Accounting for year end adjustments uk.

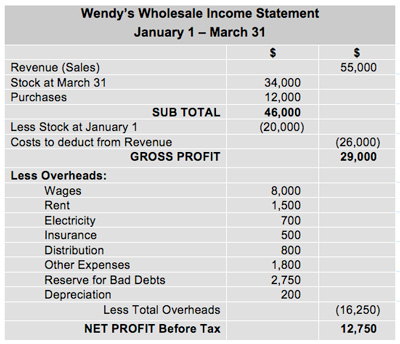

Completing the income statement which includes accruals prepayments interest and tax. The accrual basis is the most common method and is required. Were incurred and expenses are accrued on the income statement as prepaid.