Income Statement Indicates A Net Loss

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

While a balance sheet provides the snapshot of a company s financials as of a particular date the income statement reports income through a particular time period and its heading indicates the.

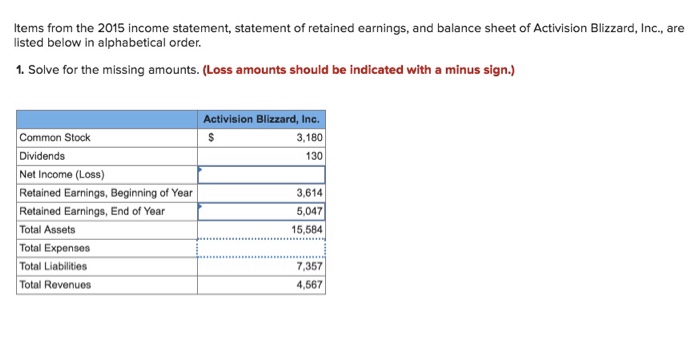

Income statement indicates a net loss. The amount calculated is the balancing figure to be put on the credit side as a part of balancing the account. Net income is what remains after a company deducts all of its production or service delivery overhead expenses interest and taxes from its revenue. A net loss is when expenses exceed the income or total revenue produced for a given period of time. Due to owner contributions net income and net loss.

Net income net income net income is a key line item not only in the income statement but in all three core financial statements. The income side it is said to have earned a net loss. The expense side is greater than the credit side i e. So if you have more debits than credits you have more expenses than revenues.

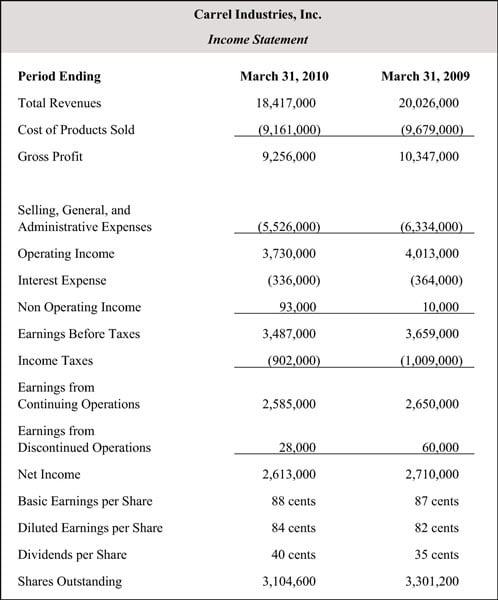

Example profit and loss statement p l. Refer to the image below. The income statement reflects the nominal accounts like rent salaries wages sales revenue etc and as per the golden rule for nominal accounts all expenses and losses are debited to the income. Which situation indicates a net loss within the income statement columns of the worksheet.

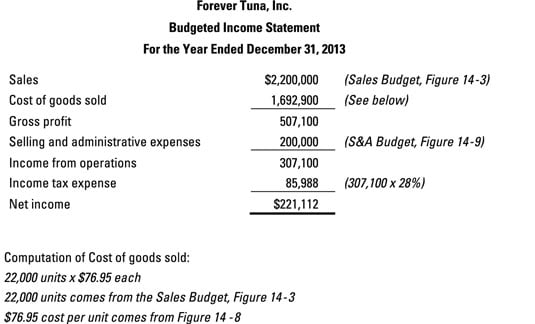

Reports revenues and expenses and calculates net income or net loss during the period. Which situation indicates a net loss within the income statement of a worksheet. Net losses are commonly experienced when a business is just start. Which situation indicates a net loss within the income statement section of the worksheet.

It is sometimes called a net operating loss nol. Net income loss is the difference in the total debits and the total credits in the income statement columns. A negative number net loss indicates the company lost money. Process by which companies produce their financial statements for a specific period.

For example revenues of 900 000 and expenses of 1 000 000 yield a net loss of 100 000. Which of the following adjusted balances would appear in the balance sheet credit column of a worksheet. A positive number net income or profit means the company was profitable for that period. While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement.

All expenses are included in this calculation including the effects of income taxes. Total debits exceed total credits. B total debits exceed total credits.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)