Income Statement Items As A Percentage Of Net Sales

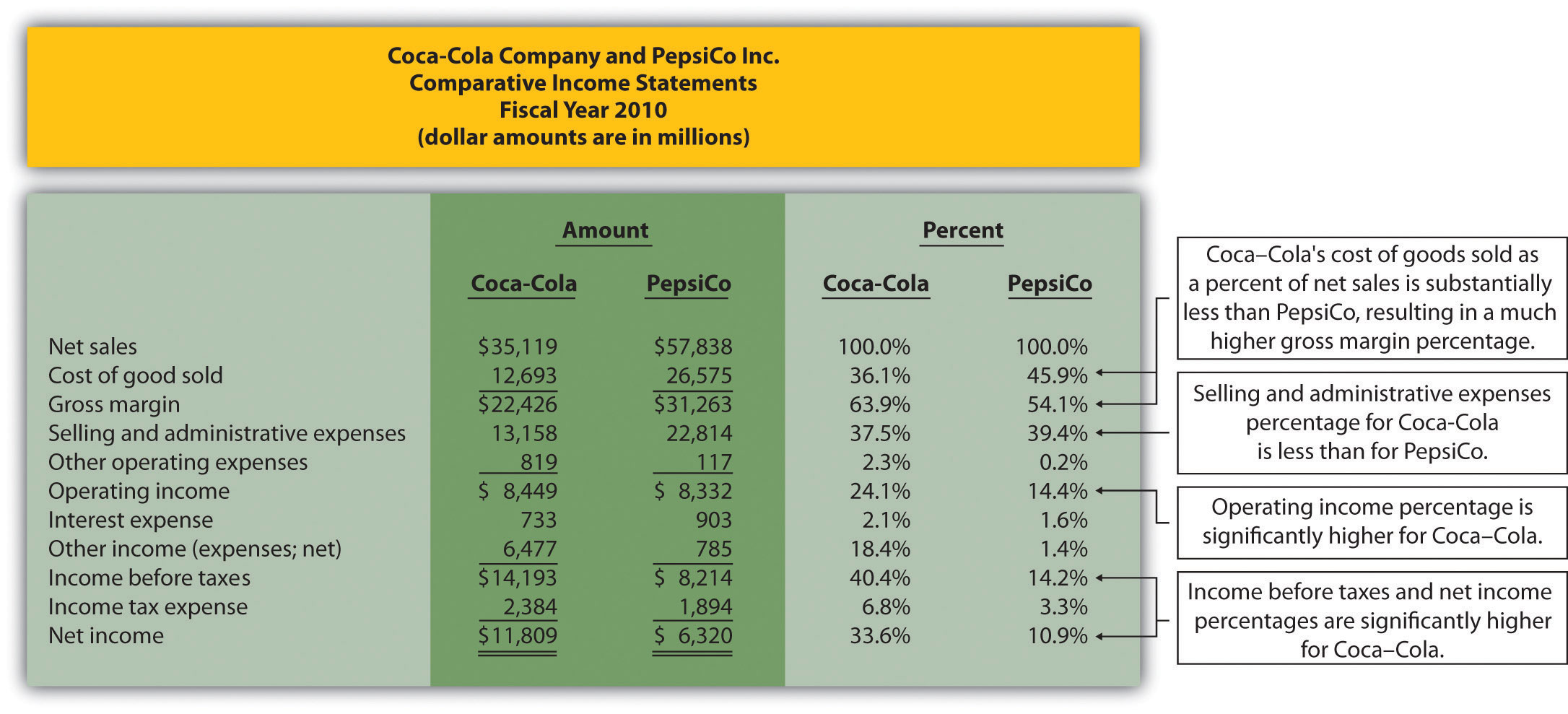

For example coca cola had net income of 11 809 000 000 and net sales of 35 119 000 000 for 2010.

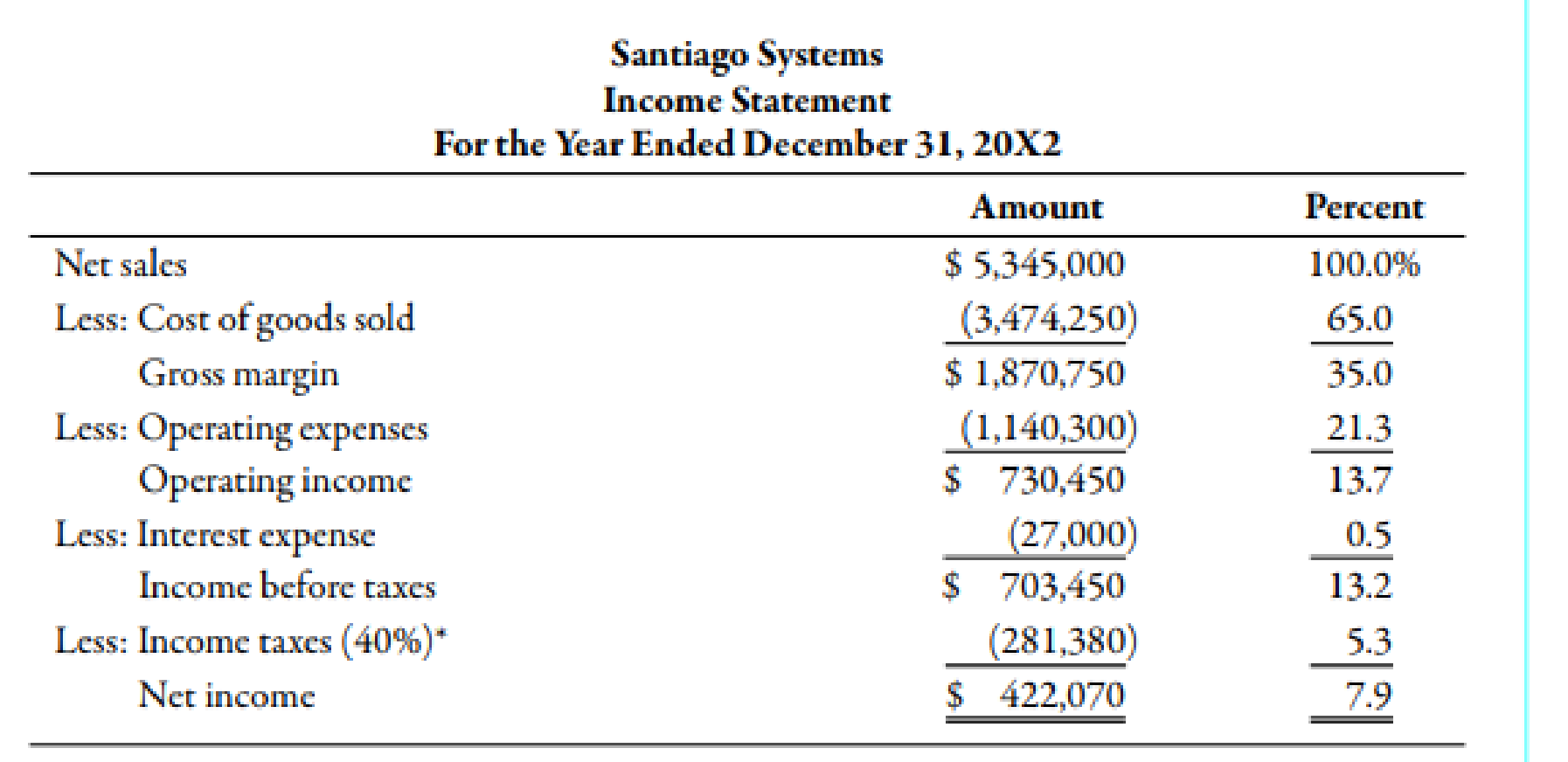

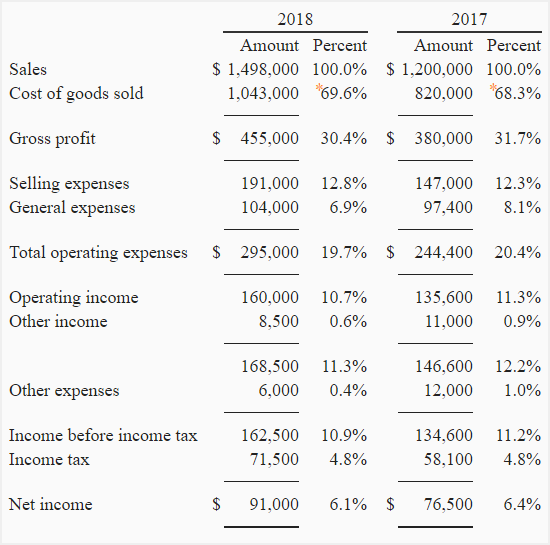

Income statement items as a percentage of net sales. This is done by stating income statement items as a percent of net sales and balance sheet items as a percent of total assets or total liabilities and shareholders equity. The increase in net sales and related increase in cost of goods sold resulted in an increase in gross margin of 2 524 000 000 or 12 7 percent. The percentage of sales method is used to calculate how much financing is needed to increase sales. Vertical analysis of the income statement shows the revenue or sales number as 100 and all other line items as a percentage of sales.

For example the sellers that transfer all kind of risks that associate with the goods to. The common size percent is simply net income divided by net sales or. These terms refer to the value of a company s sales of goods and services to its customers. While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement.

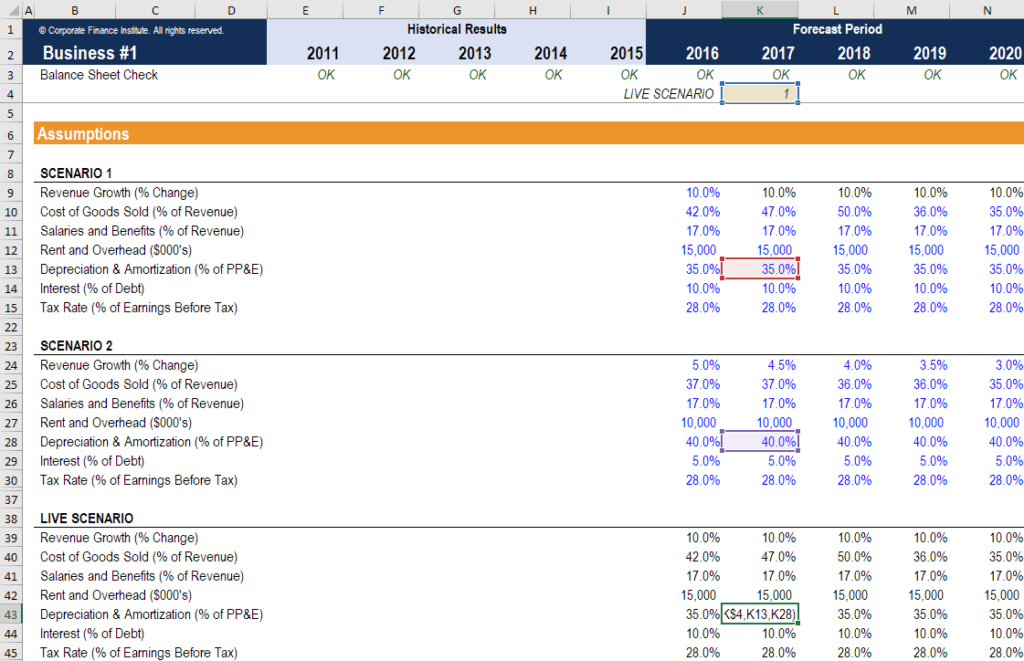

For example if the historical cost of goods sold as a percentage of sales has been 42 then the same percentage is applied to the forecasted. The method allows for the creation of a balance sheet and an income statement. Net income net income net income is a key line item not only in the income statement but in all three core financial statements. On the balance sheet each item is expressed as a percentage of total assets the base amount by dividing each number on the balance sheet by total assets.

In the case of an income statement it is revenue net sales. Although a company s bottom. On the income statement each item is expressed as a percentage of net sales the base amount by dividing each number on the income statement by net sales. All the line items in a vertical analysis are compared with another line item on the same statement.

Is calculated by deducting income taxes from pre tax income. Net sales or total revenues could recognize in the income statement as long as the entity could prove that there is probable of future economic benefit associated with the items of sales will flow to the entity and those sales could measure reliably. Income statement accounts multi step format net sales sales or revenue. The net sales percentage will always be 100.

The percentage of sales method is used to develop a budgeted set of financial statements each historical expense is converted into a percentage of net sales and these percentages are then applied to the forecasted sales level in the budget period.

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)