Income Statement Shows Profit On Goods Sold Or Produced

500 000 gross profit 400 000 other expenses.

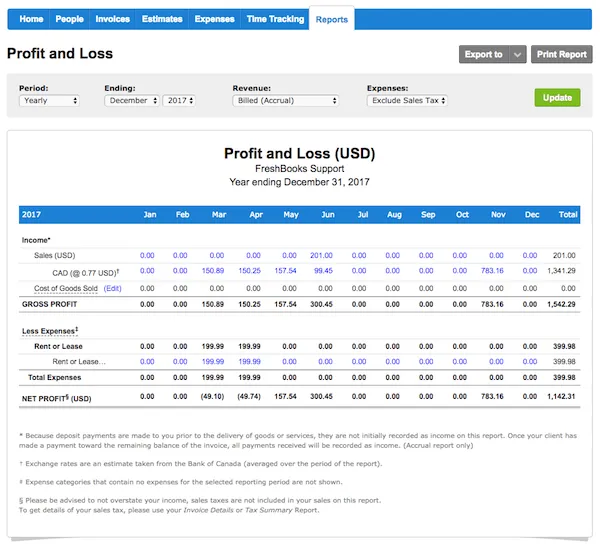

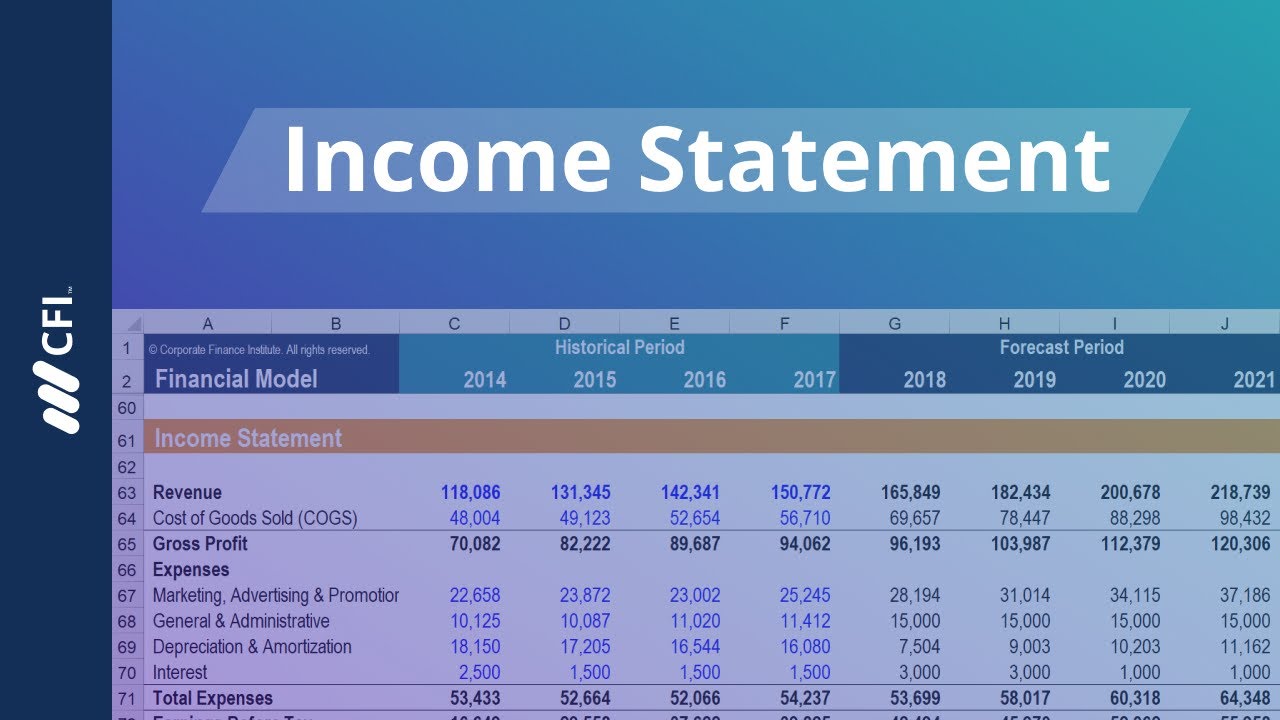

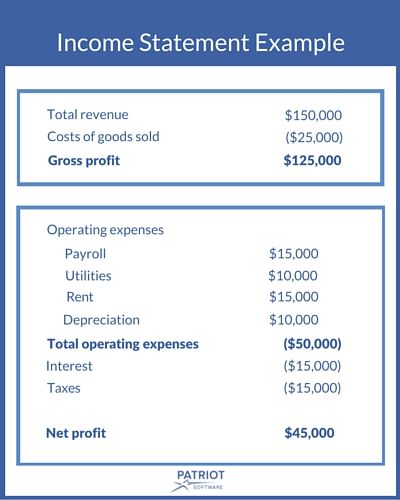

Income statement shows profit on goods sold or produced. Sales 9 000 x 8 per unit 72 000 cost of goods sold 9 000 x 3 90 per unit 35 100 gross profit 36 900. For example if company a has 100 000 in sales and a cogs of 60 000 it means the gross profit is 40 000 or 100 000 minus 60 000. A calculation which shows the profit or loss of an accounting unit during a specific period of time providing a summary of how the profit or loss is calculated from gross revenue and expenses. Record both gross and net profit on your small business income statement.

Gross profit is calculated before operating profit or net profit. Your income statement shows your revenue followed by your cost of goods sold and your gross profit. 700 000 revenue 200 000 cost of goods sold. Gross profit minus operating expenses and taxes.

Gross operating and net profit the first level of profitability is gross profit which is sales minus the cost of goods sold. Cost volume profit analysis is the study of the effects of. For example if sales revenue is 50 000 and the cost of goods sold is 20 000 you would record gross profit of 30 000 on the income statement. Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived by subtracting cost of goods sold from the total revenues second formula states that operating income of the company is derived by subtracting operating expenses from the total gross profit arrived and the last formula states that the net income of the.

The next section shows your operating interest and tax expenses. 100 000 net income. Income statement absorption for month ended may. An income statement or profit and loss account also referred to as a profit and loss statement p l statement of profit or loss revenue statement statement of financial performance earnings statement statement of earnings operating statement or statement of operations is one of the financial statements of a company and shows the company s revenues and expenses during a particular period.

Sales are the first line item on the income statement and the cost of goods sold cogs is generally listed just below it. The bottom line of the income statement is your net. It s used to calculate the gross profit margin and is the initial profit figure listed on a company s income statement. Selling expenses 15 000 fixed variable 0 20 x 9 000 units sold.

Gross and net profit on the income statement. A variety of different products are produced each one requiring different types of materials labor and overhead. Based on the above income statement income statement the income statement is one of a company s core. The difference between net sales and the cost of goods sold.

Use a green pen or change the font color to show that the number listed is a profit.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)