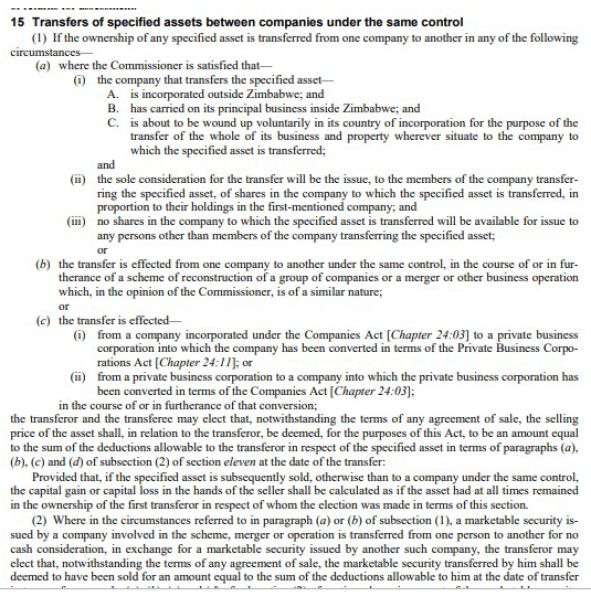

Income Tax Act Of Zimbabwe

Zimbabwe amendments to the income tax act and introduction of new transfer pricing regulations february 2019 the new minister of finance issued a number of proposals to the income tax act chapter 23 06 most of which take effect from 1 january 2019.

Income tax act of zimbabwe. 7 2019 finance act no. 63547 y constitution of zimbabwe amendment hb. And for matters incidental thereto. 2 interpretation 1 in this act affiliate in relation to a petroleum operator has the meaning given by subsection 4 of section thirty two.

What was proposed in the 2019 budget. Source is the place where income originates or is earned not the place of payment. Section 2 interpretation of the income tax act chapter 23 06 is amended by the insertion of the following definition 5 new. 1st april 1967 part i preliminary 1 short title this act may be cited as the.

Enacted by the parliament and the president of zimbabwe. Amendments to income tax act chapter 23 06 4 amendment of section 2 of cap. An act to provide for the taxation of incomes and for other taxes. 8 of 2020 to make further provision for the revenues and public funds of zimbabwe and to provide for matters connected therewith or incidental thereto.

This act may be cited as the income tax act chapter 23 06. Income derived or deemed to be derived from sources within zimbabwe is subject to tax. 23 2019 63547 y constitution of zimbabwe amendment hb. And to provide for matters incidental thereto.

It has been indicated that zimbabwe is considering moving to a residence based system during the current tax reform exercise.