Income Tax Brackets 2020 Illinois

The federal corporate income tax by contrast has a marginal bracketed corporate income tax illinois maximum marginal corporate income tax rate is the 4th highest in the united states ranking directly below minnesota s 9 800.

Income tax brackets 2020 illinois. The income tax rate in illinois is 4 95 after an increase from 3 75 in 2017. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. To determine the tax due for tax years ending on or after july 1 2017 refer to informational bulletin fy 2018 02. 2019 form il 1040 instructions page 1.

Effective july 1 2017. Detailed illinois state income tax rates and brackets are available on this page. Corporations 7 percent of net income. Illinois income tax rates were last changed four years ago for tax year 2016 and the tax brackets have not been changed.

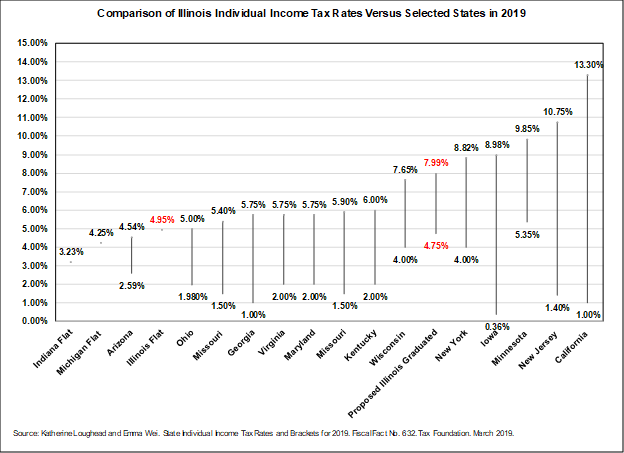

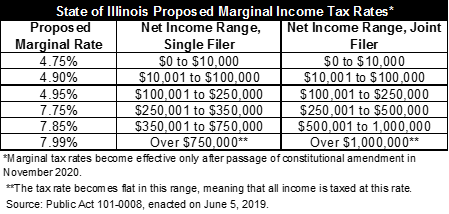

Top state income tax rates range from a high of 13 3 percent in california to 1 percent in tennessee according to the tax foundation study which was published in february. Illinois income tax rates were last changed four years ago for tax year 2016 and the tax brackets have not been changed since at least 2001. The state of illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Illinois house votes to put pritzker s progressive income tax amendment on 2020 ballot accessed jan.

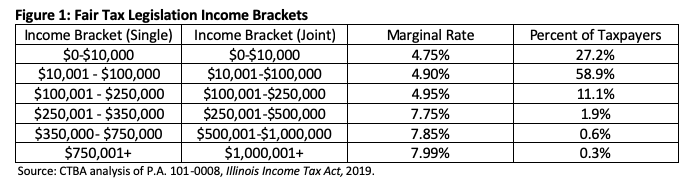

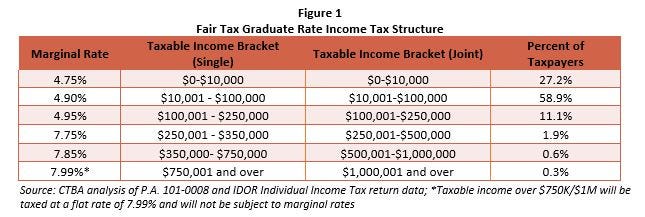

Pritzker d signed sb 687 which would change the state s income tax from a flat rate to six graduated rates beginning on january 1 2021. In june 2019 gov. Trusts and estates 4 95 percent of net income. Illinois department of revenue.

Income taxes accounted for 37 percent of state tax revenues in fiscal year 2017 the analysis said. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. Tax types current tax rates prior year rates.

Illinois has a flat income tax rate which applies to both single and joint filers. The federal income tax in contrast to the illinois income tax has multiple tax brackets with varied bracket width for single or joint filers. Illinois has a flat corporate income tax rate of 9 500 of gross income. That makes it relatively easy to predict the income tax you will have to pay.

Click here for a look at the. The illinois income tax has one tax bracket with a maximum marginal income tax of 4 95 as of 2020.