Income Tax Brackets 2020 Uk

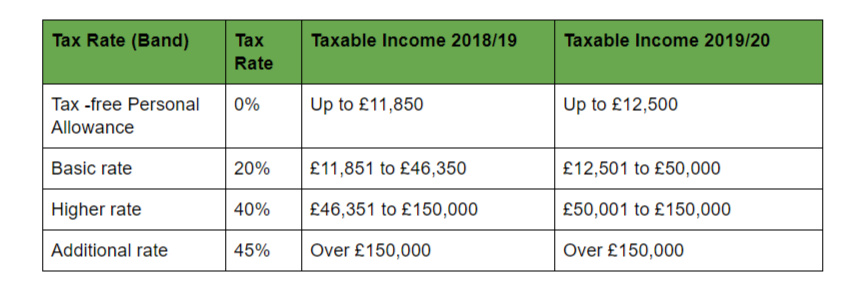

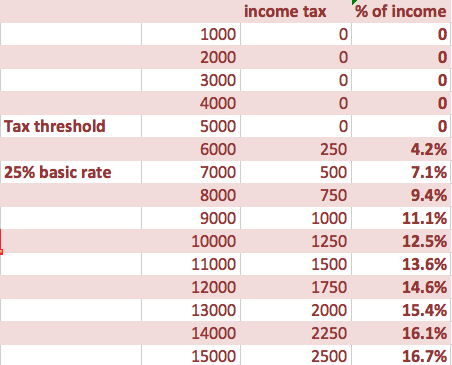

You pay 0 on earnings up to 12 500 for 2020 21.

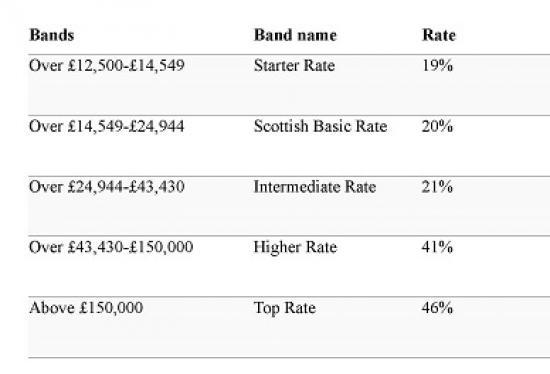

Income tax brackets 2020 uk. If you earn 150 001 and over you pay 45 tax. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Then you pay 20 on anything you earn between 12 501 and 50 000. Rates allowances and duties have been updated for the tax year 2019 to 2020.

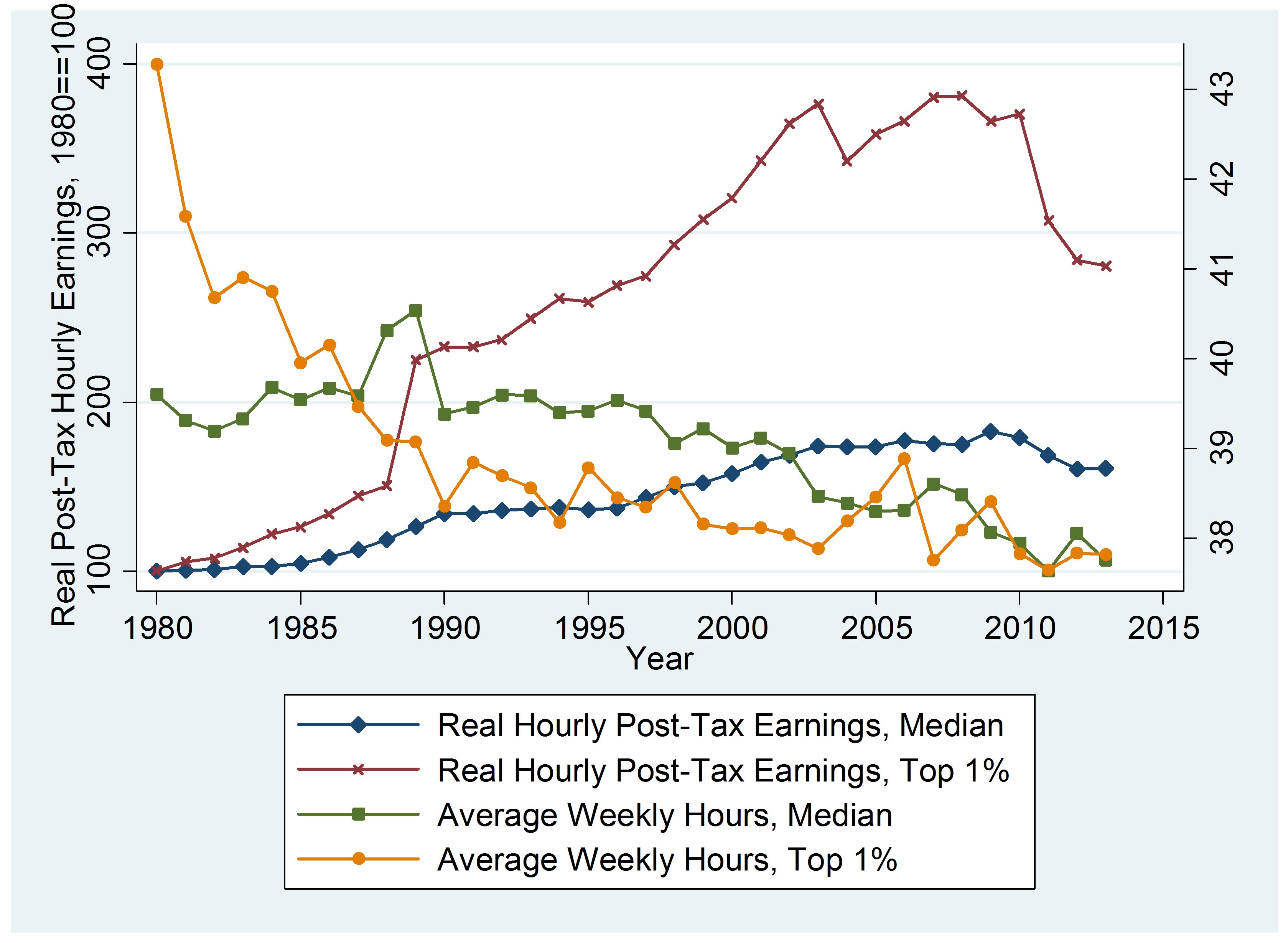

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. Add this to your taxable income. Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your.

For the 2020 21 tax year if you live in england wales or northern ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to. The new tax year in the uk starts on 6 april 2020. Because the combined amount of 20 300 is less than 37 500 the basic. You ll pay 40 income tax on earnings between 50 001 to 150 000.

The current tax year is from 6 april 2020 to 5 april 2021. Income tax rates for the year ended 31st december 2020. And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. Paye tax rates and thresholds 2020 to 2021.

Due to political impasse in spain the 2020 budget was not passed and therefore the 2018 2019 tax rates and allowances continue to be used for 2020. What percentage is tax. Tax rates and allowances have been added for the tax year 2020 to 2021. Once you know your personal allowance anything extra earned above that will be subject to income tax.

For the 2020 to 2021 tax year the allowance is 12 300 which leaves 300 to pay tax on. English and northern irish basic tax rate.