Income Tax Definition India

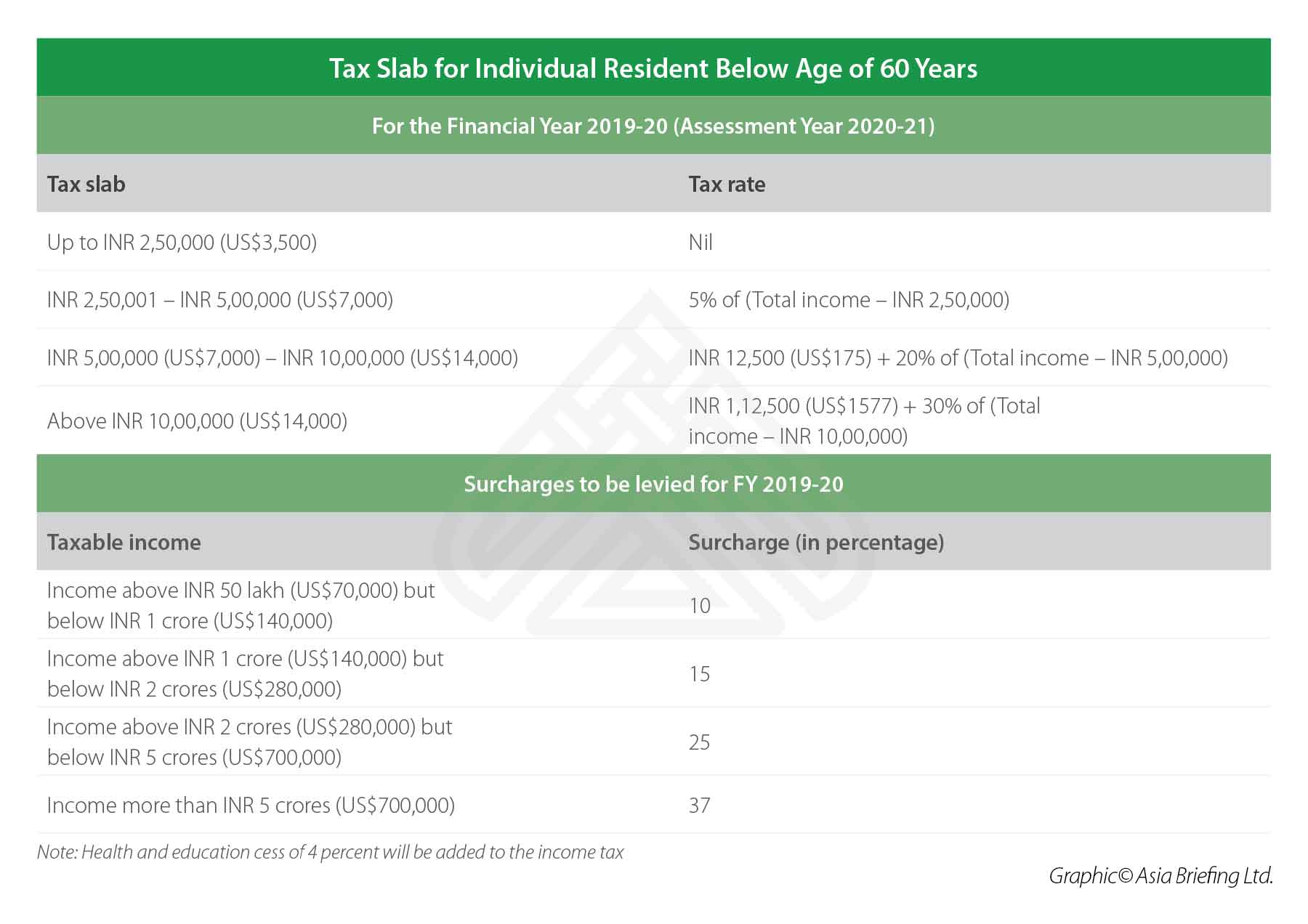

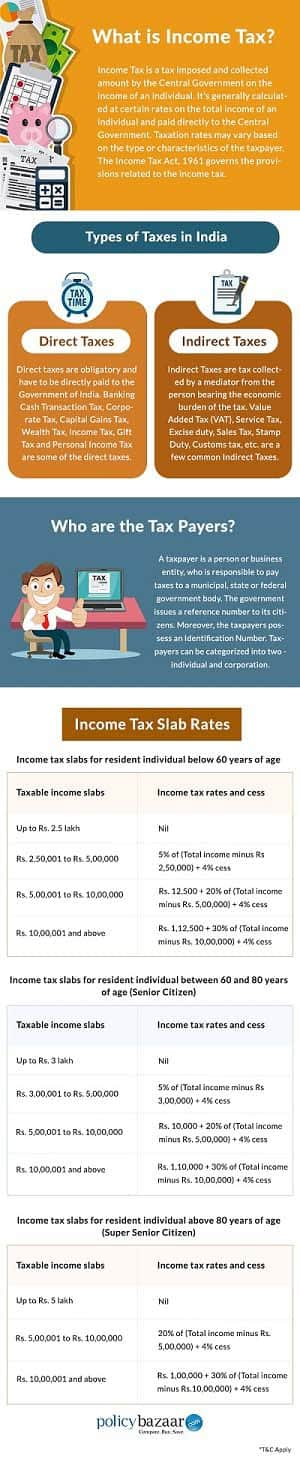

In india on the other hand there is a slab rate system where for income below inr 2 5 lakhs per annum the tax is zero percent for those with their income in the slab rate of inr 2 50 001 to inr 5 00 000 the tax rate is 5.

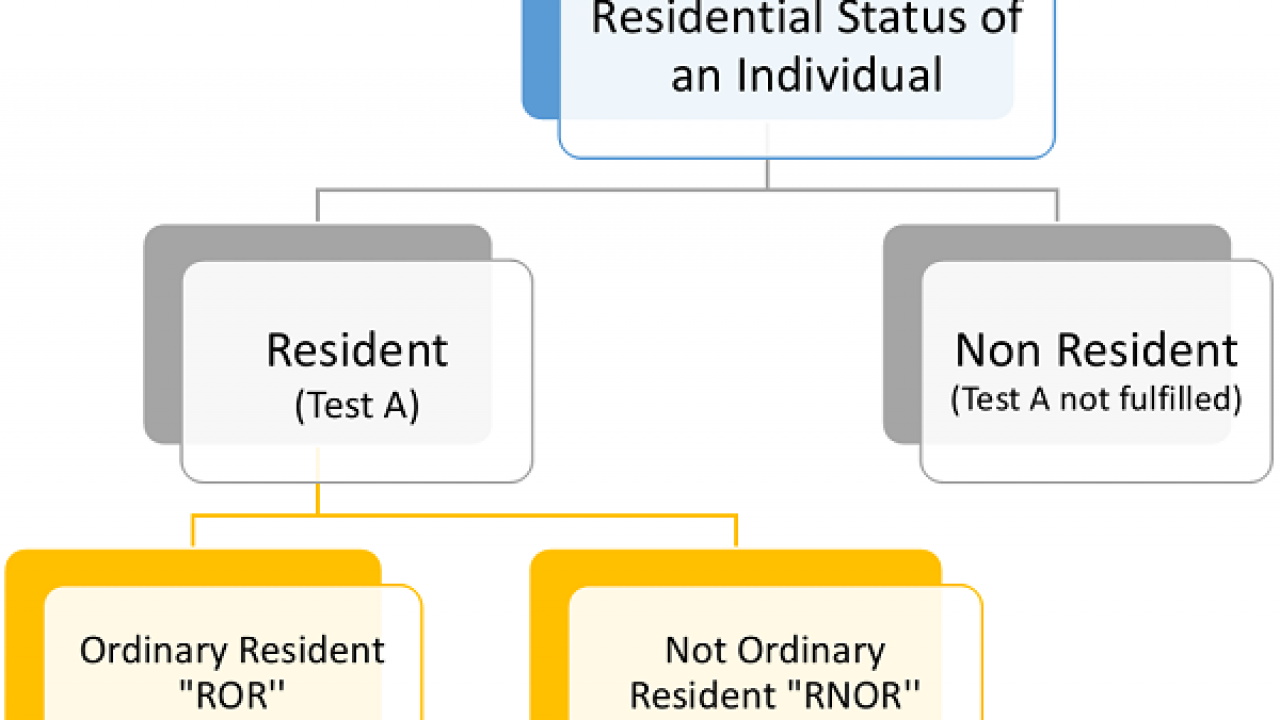

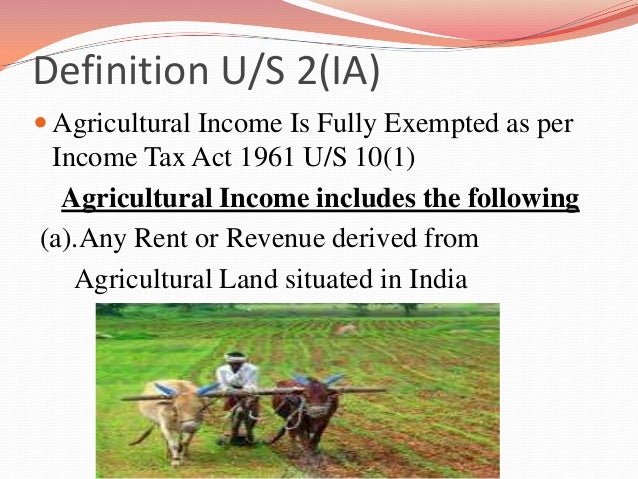

Income tax definition india. In this act unless the context otherwise requires 1 agricultural income means a any rent or revenue derived from land which is used for agricultural purposes and is either assessed to land revenue in india or is subject to a local rate assessed and collected by officers of the government as such b any income derived from such land by. What is income tax. Salary wage commission dividend bonus etc. Rors are subject to tax in india on their worldwide income wherever received.

The income tax return filling is the process of declaring the total income of an individual or a firm to the income tax department of india at the end of each financial year. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. However now that you have started working it is essential to know the exact income tax definition. Income tax is used to fund public services pay government.

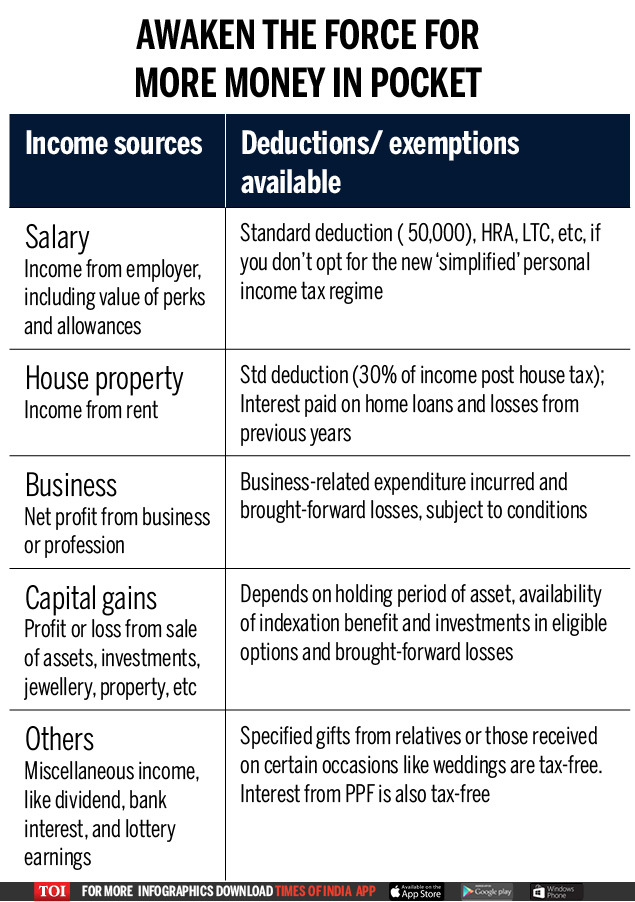

For each assessment year the rate of tax levied on different income levels as prescribed in the slab is defined in the union budget finance act. The income tax is the annual charge levied on the income viz. Of an individual company or a firm. There are various kinds of income tax deductions that can be used to reduce the taxable income in india.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. E filing home page income tax department government of india. Rnors are subject to tax in india only in respect to income that accrues arises or is deemed to accrue arise in india or is received or deemed to be received in india or is from a business controlled in or a profession set up in india. There are 19 ways in which tax deductions can be availed ranging from public provident funds to life insurance and loans.

The types of income include income from salary wage commission interest on the bank account dividend from shares rent royalties on which no tax is. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.