Income Tax Dependent Definition

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

A dependent is a person other than the taxpayer or spouse who entitles the taxpayer to claim a dependency exemption.

Income tax dependent definition. This add up to substantial savings on your tax bill. It8 number of dependent children 2020. Yogesh kumar verma auditor 20 february 2015. 15 net income or loss from business 2020.

The tax definition of child is the same as the sis definition except for a distinction between minor children and those over 18 years of age. The irs defines gross income as all taxable income in the form of money property and services it includes unemployment benefits and some scholarships but not welfare benefits or nontaxable social security benefits. For 2014 the exemption amount is 3 950. Also certain expenses of dependents may be deducted in whole or in part such as child care expenses education expenses and medical expenses.

Under the tax definition a child is considered to be a dependant of the deceased only if he or she is under age 18. 16 deferred non commercial business. Each dependency exemption decreases income subject to tax by the exemption amount. Every dependent claimed gets a standard deduction that reduces the taxes paid.

A qualifying dependent must be a u s. In this tax tutorial you will learn about dependents. 14 personal services income psi 2020. For tax years prior to 2018 every qualified dependent you claim you reduce your taxable income by the exemption amount equal to 4 050 in 2017.

If you had a child on december 31 you can claim them as an exemption for the entire year. If no person supplied more than half of the potential dependent s support the terms of any multiple support agreement you may have. A spouse can never be a dependent. A dependent must have a gross income of less than the amount of the exemption which in 2009 was 3 950.

Kindly tell me the section under which the definition of dependent children is covered under income tax act 1961. Spouse details married or de facto 2020. If you can be claimed as a dependent on someone else s tax return you cannot claim anyone as a dependent. Citizens or resident aliens for the entire tax year for which they re inquiring.

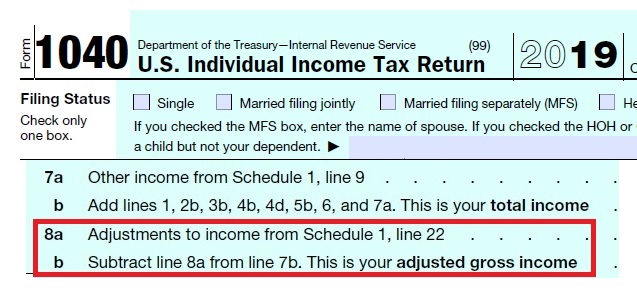

13 partnerships and trusts 2020. Basic income information such as your adjusted gross income. Beginning in 2018 exemptions have been replaced by. The tool is designed for taxpayers who were u s.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

:max_bytes(150000):strip_icc()/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)