Income Tax Historical Definition

Income tax income tax the meaning of income.

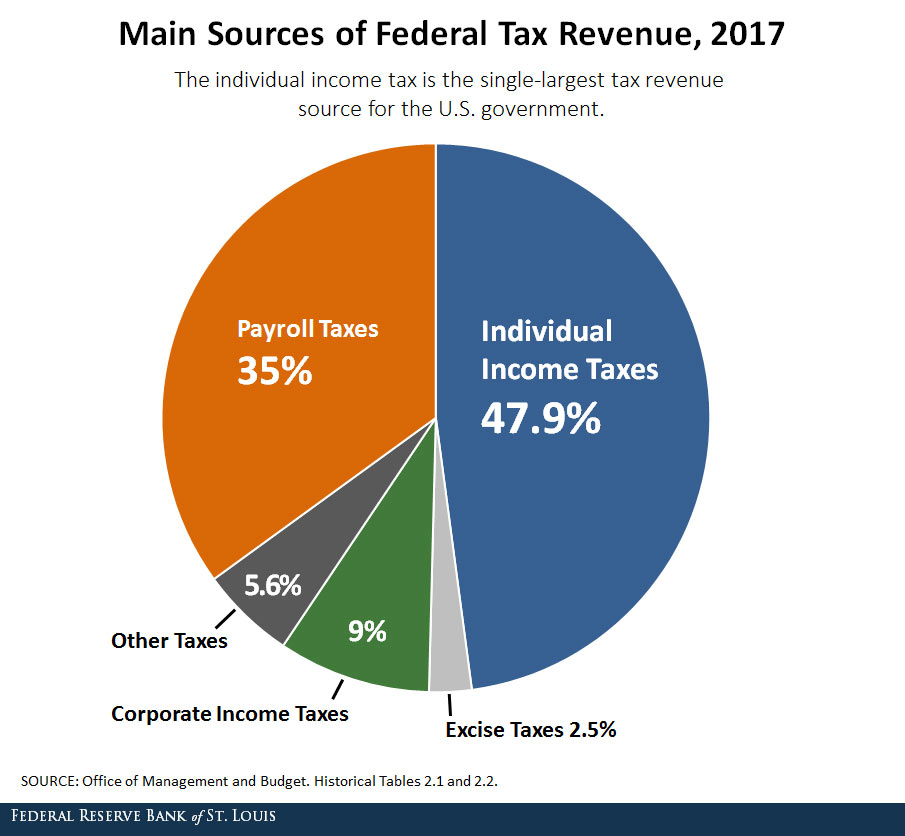

Income tax historical definition. Income tax generally is computed as the product of a tax rate times taxable income. Income tax levy imposed on individuals or family units and corporations individual income tax is computed on the basis of income received. Simply stated the more passive income the more tax credit can be used. Tax on 120 000 is 29 080.

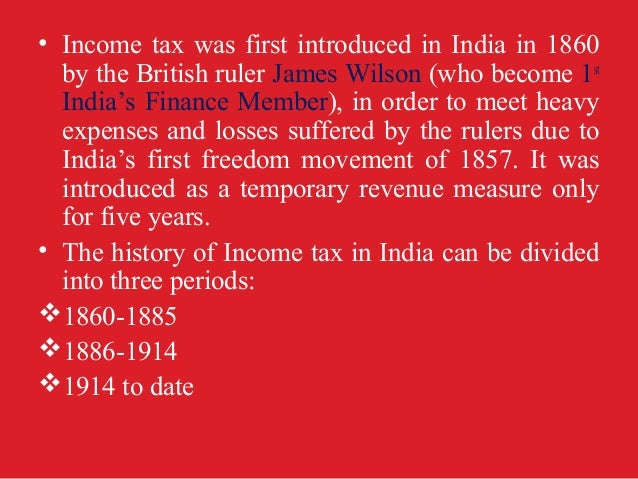

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. The organisational history of the income tax department starts in the year 1922. By 1918 the top rate of the income tax was increased to 77 on income over 1 000 000 equivalent of 16 717 815 in 2018 dollars to finance world war i. John can use passive credits up to 13 015 and carry forward unused credits of 29 985 43 000 13 015.

In 1924 central board of revenue act constituted the board as a statutory body with. For example when the federal income tax was implemented to help finance world war i in 1913 the marginal tax rate was 1 on income of 0 to 20 000 2 on income of 20 000 to 50 000 3 on. Congress enacted an income tax in october 1913 as part of the revenue act of 1913 levying a 1 tax on net personal incomes above 3 000 with a 6 surtax on incomes above 500 000. The tax rate for the bottom income tax bracket grew peaking at 22 2 in 1952.

Whether income is an accurate measure of taxpaying ability depends on how income is defined. The only definition that has been found to be completely consistent and free from anomalies and capricious results is accrued income which is the money value of the goods and services consumed by the taxpayer plus or minus any change in net worth. The additional 3 8 percent is still applicable making the maximum federal income tax rate 40 8 percent. Historical income tax rates historic lowest and highest tax rates 1913 2005 look at a detailed overview of income tax rates and income tax brackets and you will find that income tax rates continued to change throughout history and decades.

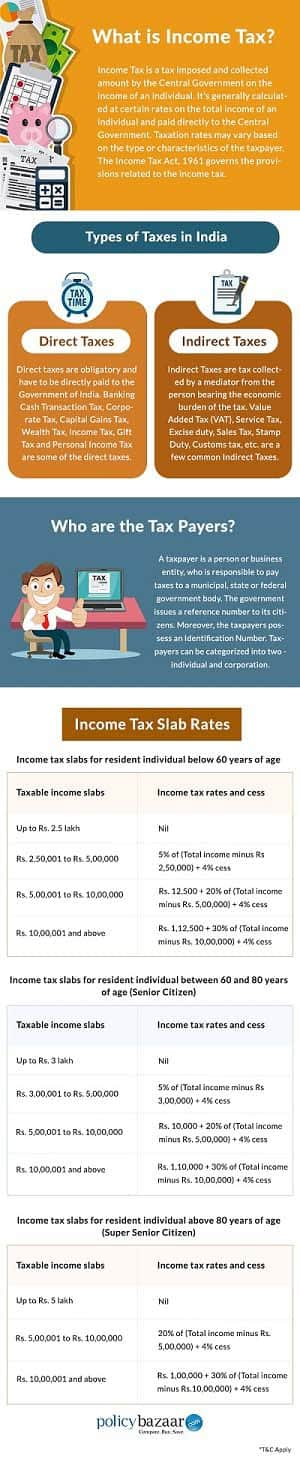

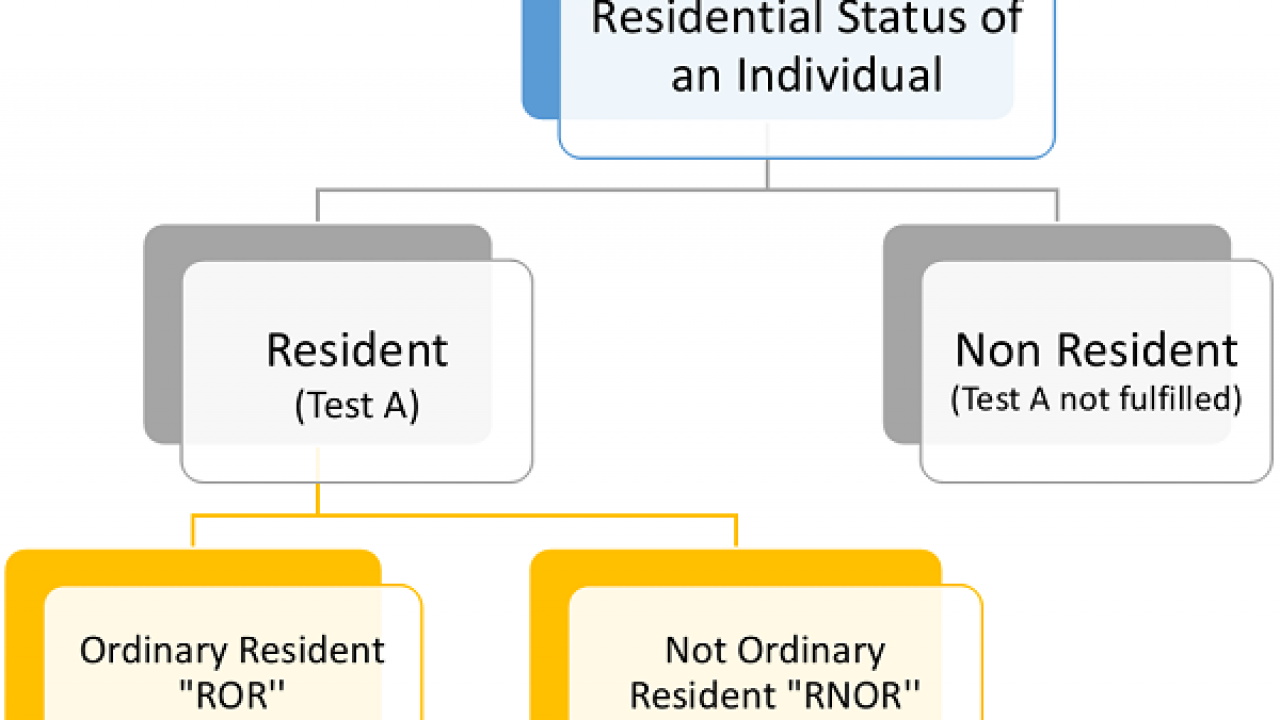

It is usually classified as a direct tax because the burden is presumably on the individuals who pay it. An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. Tax liability applicable to the passive activity is 13 015 42 095 29 080. The less passive income the less tax credit can be used.

The income tax act 1922 gave for the first time a specific nomenclature to various income tax authorities. Income tax is used to fund public services pay government. This history is important because it shows that the tax law is always changing. The highest income tax rate was lowered to 37 percent for tax years beginning in 2018.

Taxation rates may vary by type or characteristics of the taxpayer.