Income Tax History Definition

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.

Income tax history definition. Income tax levy imposed on individuals or family units and corporations individual income tax is computed on the basis of income received. 114 re established a federal income tax in the united states and substantially lowered tariff rates. Income tax generally is computed as the product of a tax rate times taxable income. The only definition that has been found to be completely consistent and free from anomalies and capricious results is accrued income which is the money value of the goods and services consumed by the taxpayer plus or minus any change in net worth.

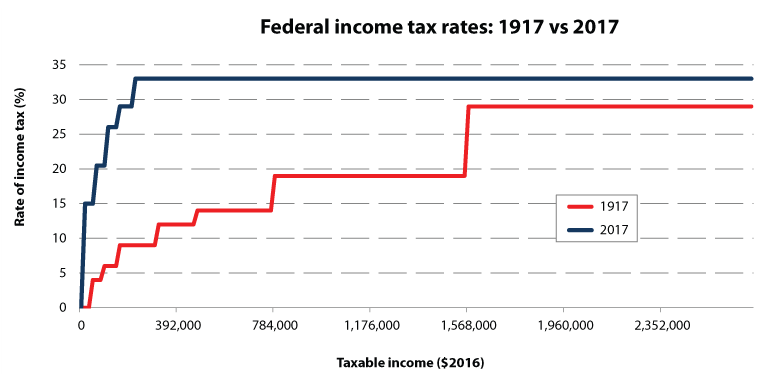

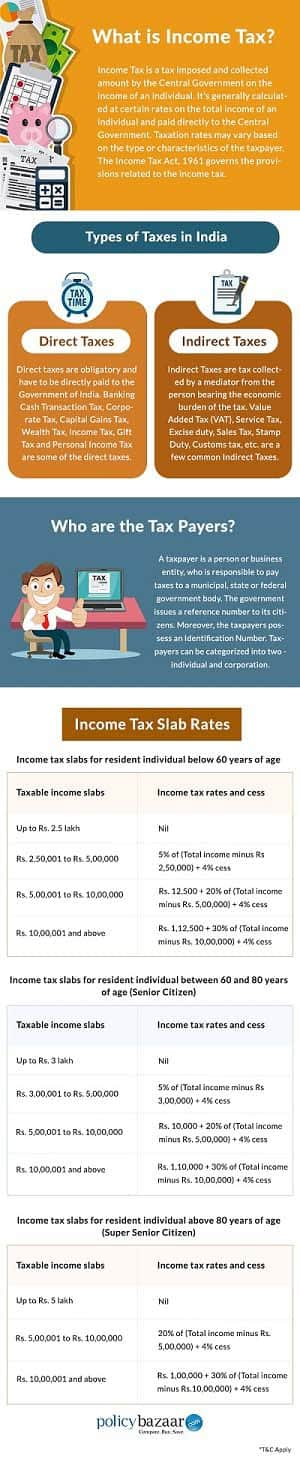

Taxation rates may vary by type or characteristics of the taxpayer. An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. The first federal income tax was created in 1861 during the civil war as a mechanism to finance the war effort. It is usually classified as a direct tax because the burden is presumably on the individuals who pay it.

Corporate income tax is imposed on net profits computed as the excess of receipts over allowable costs. The foundation of a proper system of administration was thus laid. The history of income tax in america is an unusual one. Income tax is used to fund public services pay government.

The income tax act 1922 gave for the first time a specific nomenclature to various income tax authorities. Other taxes the first estate tax was enacted in 1797 in. History through 1916 early history. The federal income tax as we know it was officially enacted in 1913 while corporate income taxes were enacted slightly earlier in 1909.

Income tax income tax the meaning of income. In addition congress passed the internal revenue act in 1862 which created the bureau of internal revenue a predecessor to the modern day irs. The history of taxation in the usa begins with the colonial protest against british taxation policy in the 1760s leading to the american revolution the independent nation collected taxes on imports whiskey and for a while on glass windows states and localities collected poll taxes on voters and property taxes on land and commercial buildings. The first attempt to tax income in the united states was in 1643 when several colonies instituted a faculties and abilities tax.

Tax collectors would literally go door to door and ask if the individual had income during the year. The act was sponsored by representative oscar underwood passed by the 63rd united states congress and signed into law by president woodrow wilson. In 1924 central board of revenue act constituted the board as a statutory body with.