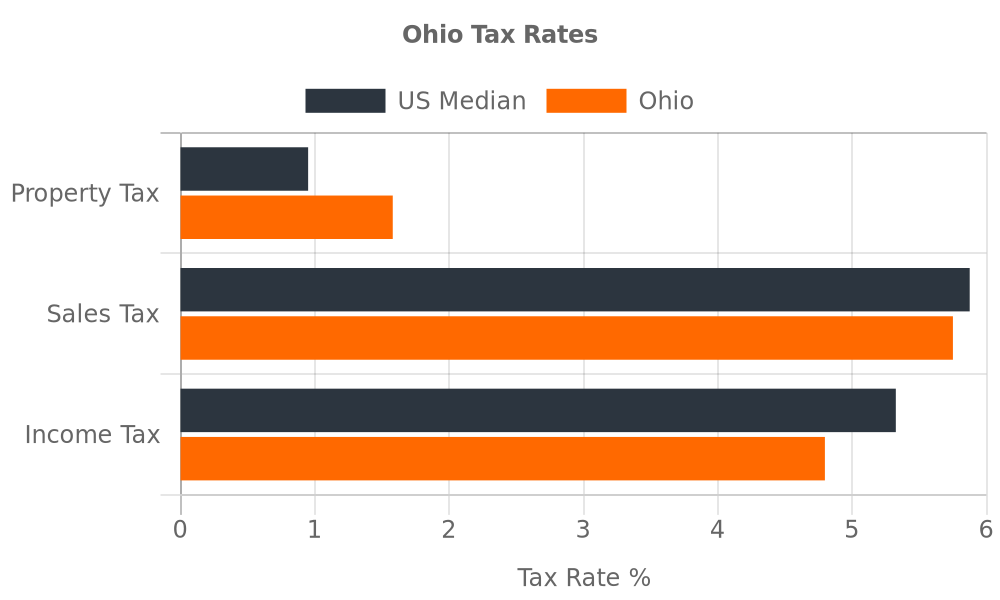

Income Tax Prices Ohio

Your ohio income is taxed at different rates within the given tax brackets below.

Income tax prices ohio. Ohio income tax rate 2019 2020. The ohio tax rate ranges from 0 to 4 797 depending on your taxable income. Ohio state income tax rate table for the 2019 2020 filing season has six income tax brackets with oh tax rates of 0 2 85 3 326 3 802 4 413 and 4 797 for single married filing jointly married filing separately and head of household statuses. Beginning with tax year 2019 ohio income tax rates were adjusted so taxpayers making an income of 21 750 or less aren t subject to income tax.

Ohio tax forms are sourced from the ohio income tax forms page and are updated on a yearly basis. The following are the ohio individual income tax tables for 2005 through 2020. What is ohio income tax rate. The 2020 state personal income tax brackets are updated from the ohio and tax foundation data.

Please note that as of 2016 taxable business income is taxed at a flat rate of 3. Any income over 82 900 would be taxes at the rate of 3 802. Taxpayers with 22 150 or less of income are not subject to income tax for 2020. Ohio 2019 income bracket rate and estimated taxes due.

The tax brackets have been indexed for inflation per ohio revised code section 5747 025. Also the tax brackets have been indexed for inflation.