Income Tax Rate Greece 2020

The scheme is expected to rival those of fellow southern european union countries.

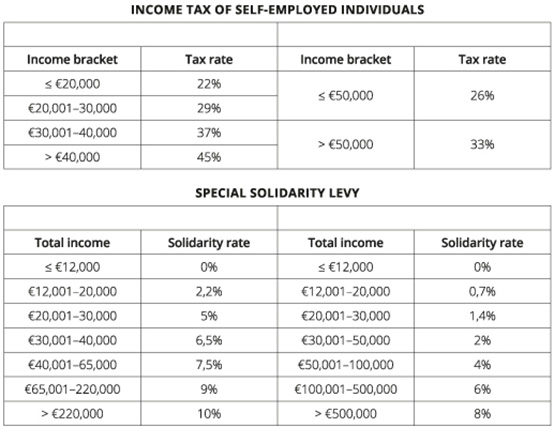

Income tax rate greece 2020. Individuals pay a short term rental income tax at rates from 15 to 45 depending on the income amount. Personal income tax rates as of 1 january 2013 income tax depends on the source of the income e g. How does the greece tax code rank. Greece currently applies a tax rate of 44 for earnings over 40 000 euros 47 000.

How to calculate your salary after tax in greece. Employment rental and is calculated accordingly. In addition on 8 may 2016 the law unified social security system reform of insurance and pension system income taxation and gaming taxation regulations has been adopted introducing. The first step towards understanding the greece tax code is knowing the basics.

The new incentives will apply for a maximum of seven years to workers who want to move their tax base to greece. The rental income tax rate depends on whether the income is obtained by a company or an individual. Personal income tax rate in greece averaged 42 98 percent from 1995 until 2020 reaching an all time high of 45 percent in 1996 and a record low of 40 percent in 2002. Profits of branches of foreign companies in greece are computed in the same way as profits of legal entities and are taxed at the same rate.

The maximum income tax rate in greece of 45 00 ranks greece as one of the ten highest taxed countries in the world. Greece highlights 2020 page 2 of 9 basis resident entities are taxed on worldwide income. Enter your salary and the greece salary calculator will automatically produce a salary after tax illustration for you simple. Taxes in greece in 2020.

Follow these simple steps to calculate your salary after tax in greece using the greece salary calculator 2020 which is updated with the 2020 21 tax tables. Till december 31 2022 greece will not levy a. Personal income tax in greece and tax credits. This page provides the latest reported value for greece personal income tax rate plus previous releases historical high and low short term forecast and long term.

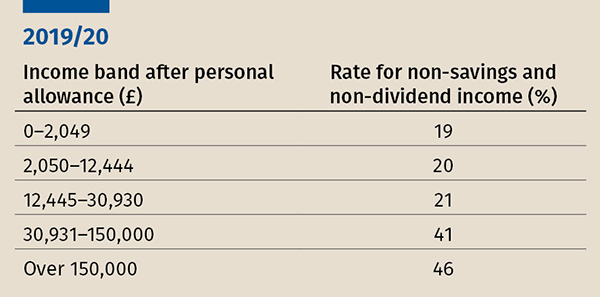

The personal income tax rate in greece stands at 44 percent. The income tax rates and personal allowances in greece are updated annually with new tax tables published for resident and non resident taxpayers. Below we have highlighted a number of tax rates ranks and measures detailing the income tax business tax consumption tax property tax and international tax systems. Countries with similar tax brackets include portugal with a maximum tax bracket of 46 00 austria with a maximum tax bracket of 50 00 and united kingdom with a maximum tax bracket of 50 00.

The government is formally inviting foreign pensioners to shift their tax residence to greece with the introduction of a single tax rate of 7 for their entire income obtained abroad. The tax tables below include the tax rates thresholds and allowances included in the greece tax calculator 2020.