Income Tax Rate New York 2020

New york income tax rate 2019 2020.

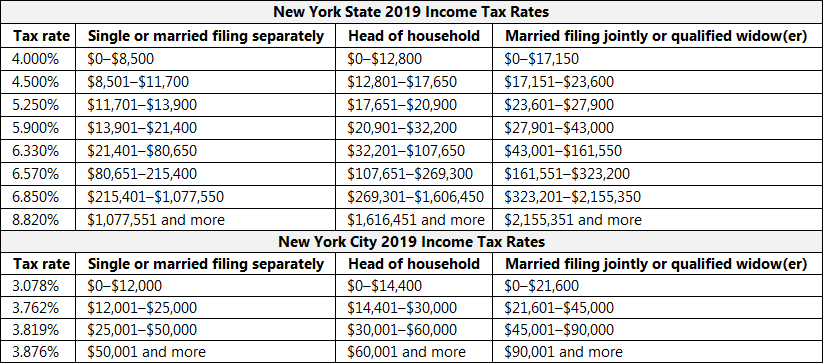

Income tax rate new york 2020. New york s income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. 2020 new york tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. The new york income tax has eight tax brackets with a maximum marginal income tax of 8 82 as of 2020. The federal corporate income tax by contrast has a marginal bracketed corporate income tax there are a total of twenty three states with higher marginal corporate income tax rates then new york.

The new york tax rate is mostly unchanged from last year. New york has a flat corporate income tax rate of 7 100 of gross income. You can take a refundable credit of 125 if you re married file a joint return and have income of 250 000 or less. New york state income tax forms for tax year 2020 jan.

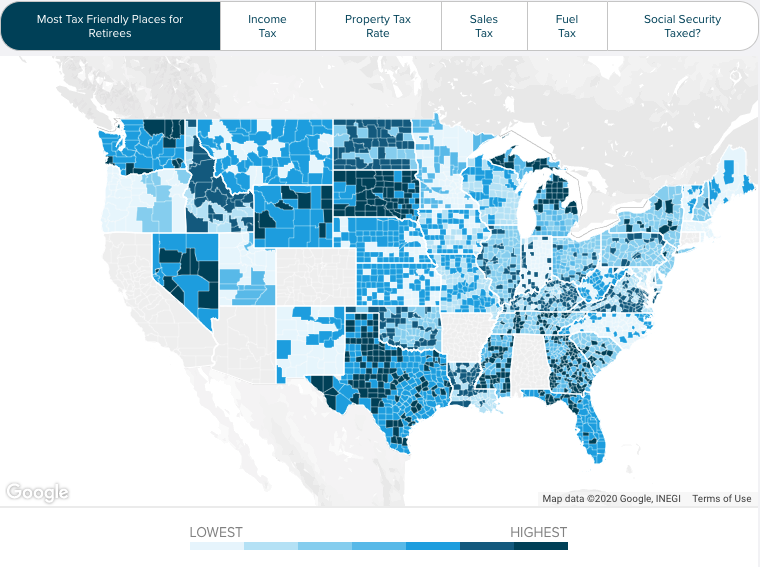

The ny tax forms are below. Withholding tax rate changes nys and yonkers withholding tax changes effective january 1 2020. The new york city income tax is one of the few negatives of living in this incredible city. New york s estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows.

The new york city school tax credit is available to new york city residents or part year residents who can t be claimed as dependents on another taxpayer s federal income tax return. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. New york has eight marginal tax brackets ranging from 4 the lowest new york tax bracket to 8 82 the highest new york tax bracket. For 2020 the exemption will rise to 5 85 million.

New york state income tax rate table for the 2019 2020 filing season has eight income tax brackets with ny tax rates of 4 4 5 5 25 5 9 6 21 6 49 6 85 and 8 82 for single married filing jointly married filing separately and head of household statuses. 2020 tax year new york income tax forms. Each marginal rate only applies to earnings within the applicable marginal tax bracket. New york estate tax.

Detailed new york state income tax rates and brackets are available on this page. 31 2020 can be e filed in conjunction with a irs income tax return. Today we ll explore what it is the rates for 2020 as well as deductions and available credits. The exemption for the 2019 tax year is 5 74 million which means that any bequeathed estate valued below that amount is not taxable.