Income Tax Rate Texas 2020

Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate.

Income tax rate texas 2020. 10 tax rate up to 9 875 for singles up to 19 750 for joint filers 12 tax rate up to 40 125. Dallas houston and san antonio all have combined state and local sales tax rates of 8 25 for example. Texas state corporate income tax 2020 1 0 texas corporate income tax brackets tax bracket gross taxable income. Texas income tax rate 2020 2021.

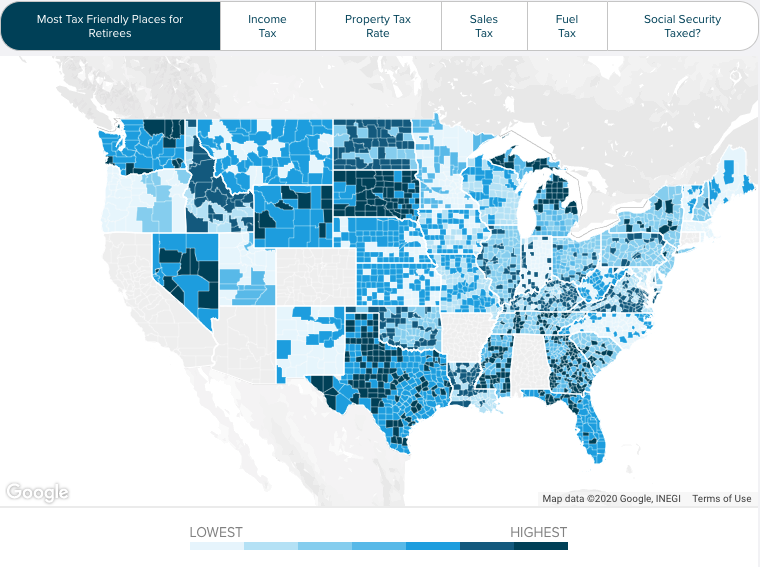

Detailed texas state income tax rates and brackets are available on this page. While there s no state income tax in texas there s a variety of other taxes you should make sure are taken care of. There are 126 days left until taxes are due. The interest tax rate is used to pay interest on federal loans to texas if owed used to pay unemployment benefits.

For 2020 texas unemployment insurance rates range from 0 31 to 6 31 with a taxable wage base of up to 9 000 per employee per year. While texas s statewide sales tax rate is a relatively moderate 6 25 total sales taxes including county and city taxes of up to 8 25 are levied and in most major cities this limit is reached. There is no bond obligation assessment rate for 2020. The texas income tax has one tax bracket with a maximum marginal income tax of 0 00 as of 2020.

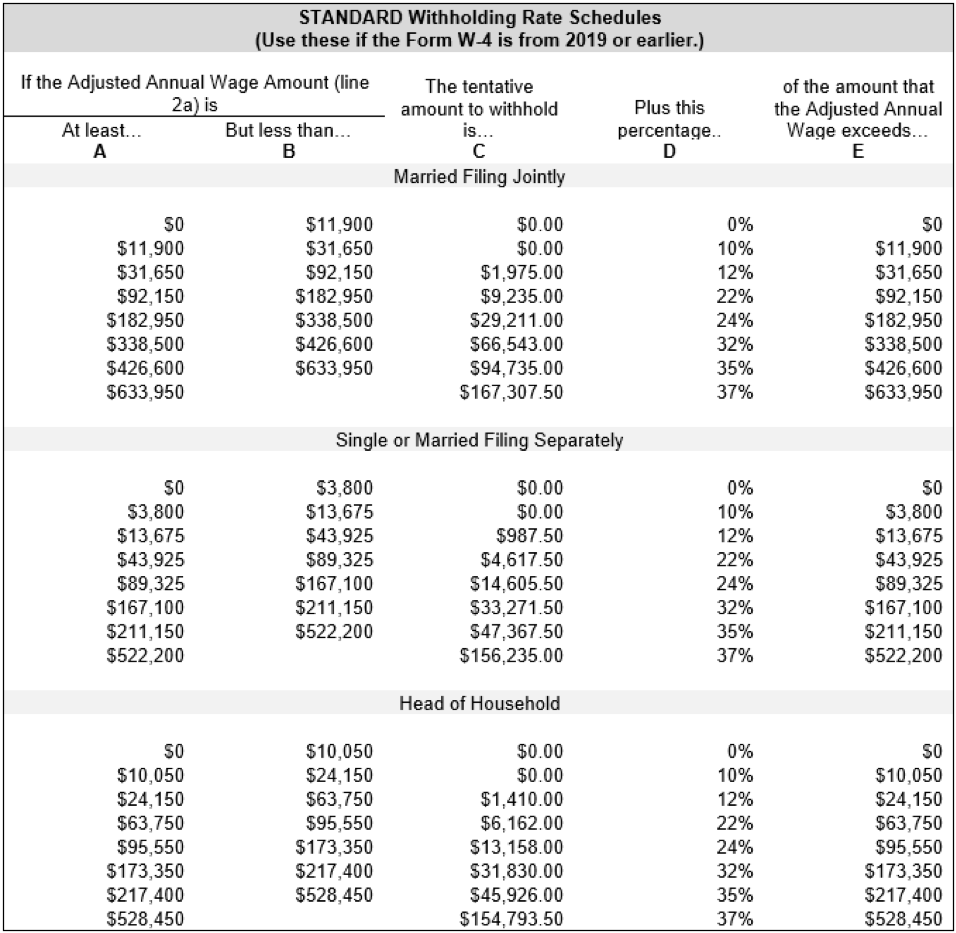

These numbers are subject to change if new texas tax tables are released. The 2020 federal income tax brackets on ordinary income. 7 500 25 of the amount over 50 000. 2020 federal income tax brackets and rates.

Before the official 2020 texas income tax brackets are released the brackets used on this page are an estimate based on the previous year s brackets. The interest tax is calculated according to commission rule. Start filing your tax return now. This percentage will be the same for all employers in a given year.

Texas state income tax rate table for the 2020 2021 filing season has zero income tax brackets with an tx tax rate of 0 for single married filing jointly married filing separately and head of household statuses. If you make 55 000 a year living in the region of texas usa you will be taxed 9 482 that means that your net pay will be 45 518 per year or 3 793 per month. Marginal corporate income tax rate.

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)