Income Tax Rates Australia Future

Lowering the 32 5 per cent rate to 30 per cent in 2024 25 increasing the reward for effort by ensuring a projected 94 per cent of taxpayers will face a marginal tax rate of no more than 30 per cent.

Income tax rates australia future. Tax rates and codes you can find our most popular tax rates and codes listed here or refine your search options below. In australia financial years run from 1 july to 30 june of the following year so we are currently in the 2020 21 financial year 1 july 2020 to 30 june 2021. The package backdated by two years to july 2020 and which equates to almost 50 billion in business and personal income tax cuts was passed with the support of the opposition on friday. This was further modified by budget 2020 announcements to lift the 19 rate ceiling from 37 000 to 45 000 and the 32 5 tax bracket ceiling from 90 000 to 120 000.

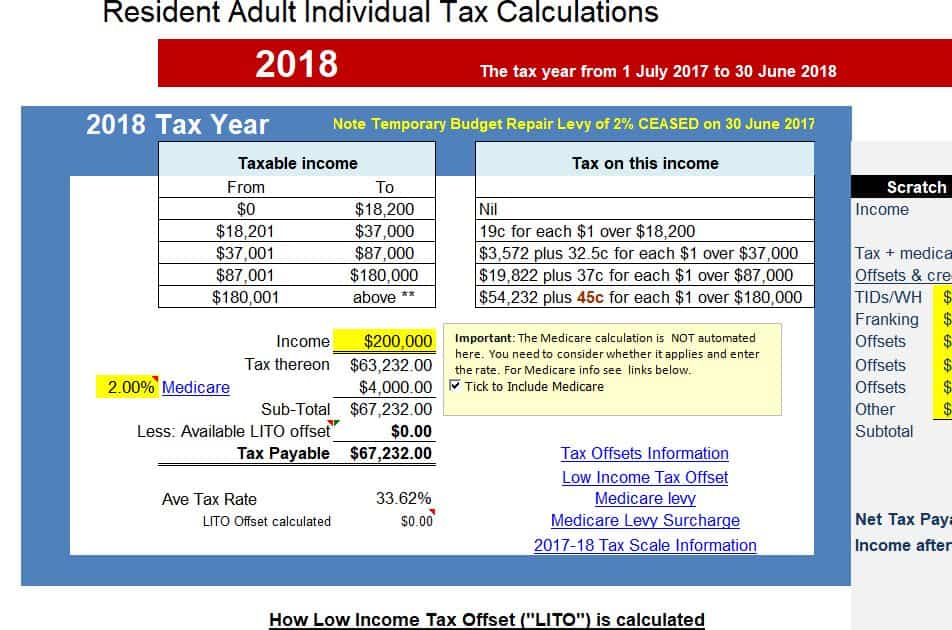

Australia 2020 tax tables. However for companies with an aggregate annual turnover of less than aud 50 million and that derive no more than 80 of their assessable income from base rate entity passive income the tax rate is 26 for the 2020 21 income year reduced from 27 5. Icalculators australia tax calculator provides a good example of income tax calculations for 2020 it includes historical tax information for 2020 and has the latest australia tax tables included. This tax table reflects the proposed new scale from 1 july 2020 as at 6 october 2020.

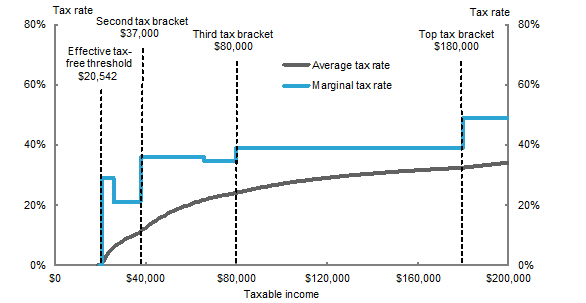

The tax free threshold is applied to the first 18 200 of income for australian residents. 19 cents for each 1 over 18 200. Income tax rates in 2020. However foreign residents pay a higher rate of income tax to the ato on their australian sourced income.

The australian tax office ato collects income tax from working australians each financial year. Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you need. Tax on this income. Even if you make 200 000 or more the first 18 200 is tax free.

This also means that if you earn less 18 200 you will pay no tax. If an individual is lodging a tax return in australia without a tax agent the deadline for the lodgement of the tax return with the ato is 31 october 2020. Immediate tax relief for low and middle income earners of up to 1 080 for singles or up to 2 160 for dual income families to ease the cost of living. The modified rates lifted the 32 5 rate ceiling from 87 000 to 90 000 from 1 july 2018.