Income Tax Rates Europe Comparison

List of countries by corporate tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data.

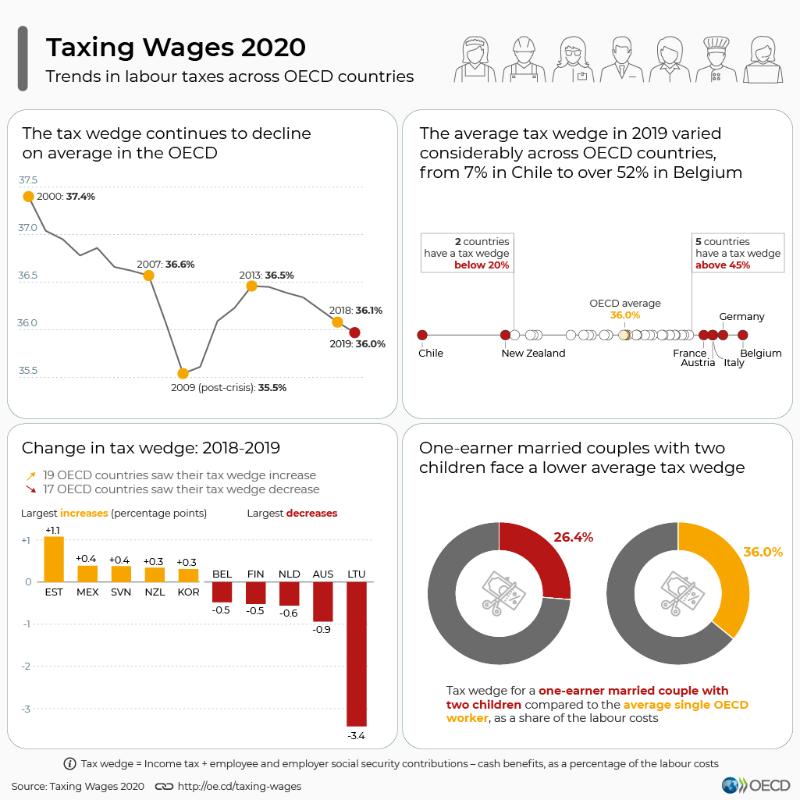

Income tax rates europe comparison. Income tax lowest marginal rate income tax highest marginal rate vat or gst or sales tax further reading. In 2000 the average corporate tax rate was 31 6 percent and has decreased consistently to its current level of 21 9 percent. European oecd countries like most regions around the world have experienced a decline in corporate income tax rates over the last decades. Today most european countries have rates below 50.

Follow on social media. Tax rate starts at 16 for incomes up to 8 021 going up to 50 for incomes over 70 907. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for list of countries by corporate tax rate. Estonia 21 3 percent latvia 21 4 percent and the czech republic 31 1 percent have the lowest top income tax rates of all european countries covered.

Slovenia 61 1 percent belgium 60 2 percent and sweden 60 2 percent had the highest top marginal income tax rates among european oecd countries in 2019. Most jurisdictions have lower rate of taxes for low levels of income. List of countries by personal income tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. 2016 corporate tax a european comparison pdf.

In 1980 the top rates of most european countries were above 60. There are two tax rates at 20 and 25 depending on income. The quoted income tax rate is except where noted the top rate of tax. The threshold at which the top income tax rate applies also plays an important role.

A comparison of tax rates by countries is difficult and somewhat subjective. Some countries also have lower rates of corporation tax for smaller companies. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for list of countries by personal income tax rate.

/2019GlobalTaxRateAveragesbyRegion-343a58758a514d4a8a64ee3e7b81e4bd.jpg)

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)