Income Tax Rates In Canada 2019

Taxable income marginal rate on ontario 1.

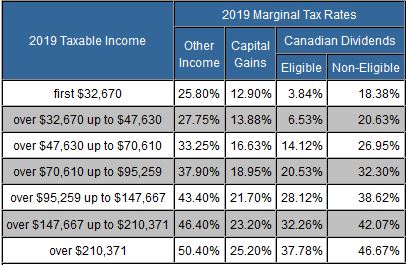

Income tax rates in canada 2019. How do the tax brackets work in canada. The tax rates include the provincial surtaxes and reflect budget proposals and news releases up to 15 june 2019. The 2019 tax rates and tax brackets for canada can be found below. 33 these amounts are adjusted for inflation and other factors in each tax year.

The 2019 tax year in canada runs from january 2019 to december 2019 with individual tax returns due no later than the following april 30 th 2020. To find the quebec provincial tax rates go to income tax return schedules and guide revenu québec web site. Choose your province or territory below to see the combined federal provincial territorial marginal tax rates. Use these to determine how much you may owe at tax time.

2019 income tax in canada is calculated separately for federal tax commitments and province tax commitments depending on where the individual tax return is filed in 2019 due to work location. Tax rates marginal income tax rates for 2019 and 2020 personal income tax rates for canada and provinces territories for 2019 and 2020. You will find the provincial or territorial tax rates on form 428 for the respective province or territory all except quebec. The rates do not include the ontario health premium see note 5 below.

The basic personal amount is the income level below which no taxes are levied.