Income Tax Rates Kenya 2020

Capital gains tax individual income tax.

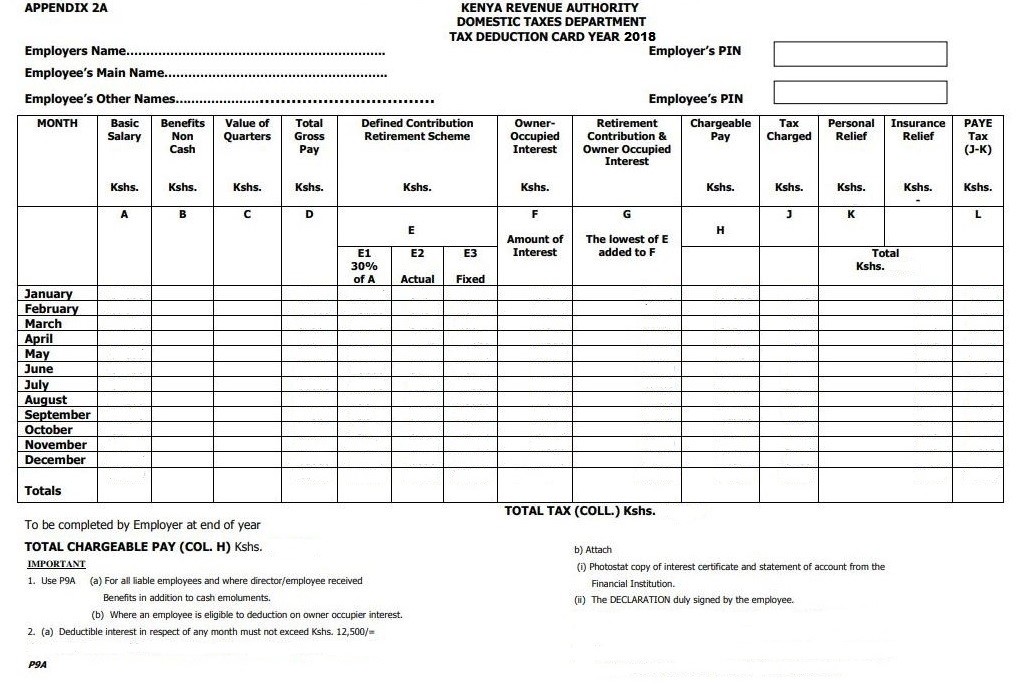

Income tax rates kenya 2020. Corporation tax tax rate. Individual income tax is charged for each year of income on all the income of a person whether resident or non resident which accrued in or was derived from kenya. The personal income tax rate from 25 th april 2020 has been reduced from 30 to 25 of taxable income. Review the full instructions for using the kenya salary after tax calculators which details kenya tax allowances.

Rates individual income tax rate taxable income kes rate up to 147 580 10 147 581 286 623 15 286 624 425 666 20 425 667 564 709 25 over 564 709 30 capital gains tax rate 5 residence individuals are resident in kenya if they have a permanent home in kenya and are present in kenya at any time during the year. Individual tax rates for 2020 are different from those in 2019 in april the government adjusted the tax rates to cushion kenyans against the economic impact of coronavirus. Any other rate is a variation of those two tax rates. 13 944 per year to ksh.

This is a change from the kenyan income tax brackets in 2016 and earlier. The monthly wage calculator is updated with the latest income tax rates in kenya for 2020 and is a great calculator for working out your income tax and salary after tax based on a monthly income. For tax residents and non tax residents. However the withholding tax rate on dividend payments to non residents has been increased from 10 to 15.

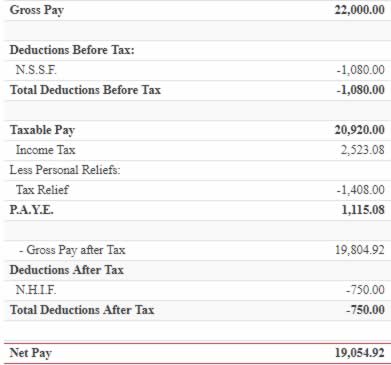

Posted on march 5 2019 january 4 2020 by taxkenya income tax rates in kenya. This act revised the tax rates and increased personal relief from ksh. The finance act 2020 increased the threshold for the annual gross rental income from kes 10 million or less to kes 15 million or less. Kenya paye calculator with income tax rates of april 2020 calculate kra paye deductions salary net pay personal relief nhif and nssf contributions.

For individual taxpayers whose income tax per year is more than kshs 40 000 they are expected to pay the tax on instalment basis four times by the 20 th of april 20 th of june 20 th of. The various tax incentives for new listings or introductions on an approved securities exchange have been eliminated. Individual tax bands and rates. Following the adjustments below were the final and verified tax rates in kenya for the year 2020.

The new rates took effect in january 2017. Kenya has two statutory income tax rates. In the new structure kra had widened the tax bands. With effect from 25th april 2020.

Corporation tax rate reduced from 30 to 25 effective 1 st january 2020. The calculator is designed to be used online with mobile desktop and tablet devices.

-20190201043639.png)