Income Tax Rates Victoria

32 5c for each 1.

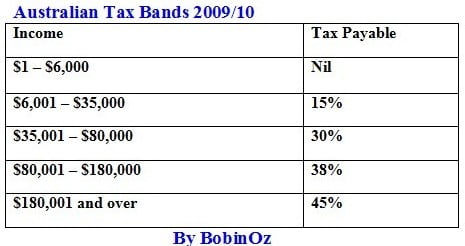

Income tax rates victoria. Income bracket tax on income. Tax tables for previous years are also available at tax rates and codes. The federal general corporate income tax rate is 15. Victoria county collects on average 1 79 of a property s assessed fair market value as property tax.

61 200 plus 45c for every 1 over 180 000. Average franking credit rebate yieldsthis document provides monthly franking credit and rebate yields on a share portfolio comprising the all ordinaries index. 19 cents for each 1 over 18 200. This legislation is administered by the.

19c for each 1 over 18 200. Australian non resident individual income tax rates current non resident tax rates 2020 2021. Australian income tax rates for 2020 21 residents income thresholds rate tax payable on this income. The income tax brackets and rates for australian residents for this financial year are listed below.

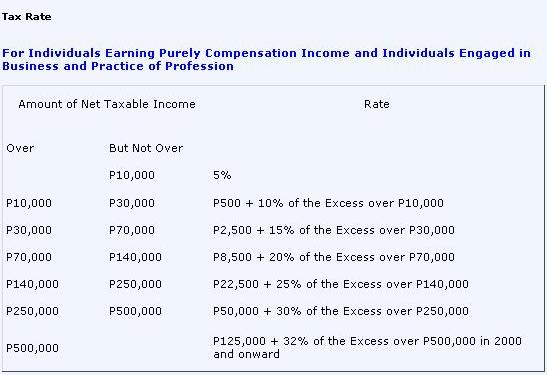

39 000 plus 37c for each 1 over 120 000. Income tax brackets 2020. Victoria introduces income tax on all income derived by a person and on the revenue of companies. Legislation for the granting management and collection of stamp duties is introduced.

19c for each 1 over 18 200. Income tax act 1895 no. Victoria county has one of the highest median property taxes in the united states and is ranked 602nd of the 3143 counties in order of median property taxes. An income tax office is established in the treasury to administer the new tax.

Resident tax rates for 2018 19. Tax on this income. In the table below you can see how different income tax brackets are assessed at increasing rates of tax. The link to the pdf is in the get it done section.

0 19 per 1 over 18 200. The median property tax in victoria county texas is 1 753 per year for a home worth the median value of 98 200. Tax on this income. No but dividends received by corporate shareholders out of the exempt surplus of foreign affiliates are not taxable.

To get a copy of the pdf select the tax table you need and go to the heading using this table. 3 572 0 325 per 1 over 37 000. Tax on this income. Provincial and territorial general corporate income tax rates range from 11 to 16.

Resident tax rates 2020 21.