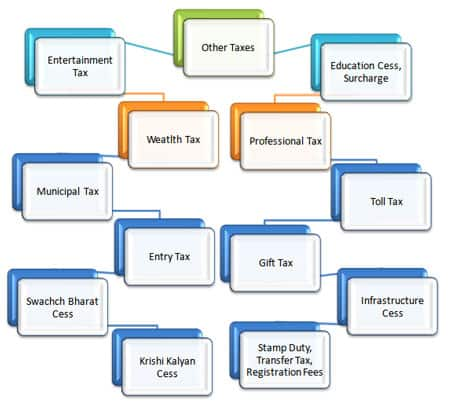

Income Tax Transfer Definition

From above definition we can understand that the term transfer under the income tax is mainly important to work out tax liability arising under the head capital gains from transfer of a capital asset.

Income tax transfer definition. Section 45 of the income tax act 1961 undisputedly provides that any profit or gains arising from transfer of a capital asset save as otherwise provided in section 54 etc. Recently we have discussed in detail section 62 transfer irrevocable for a specified period of it act 1961. A transfer tax may be imposed by a state county or municipality.

Source : pinterest.com

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)