Income Tax Withholding Hawaii

Here are the basic rules on hawaii state income tax withholding for employees.

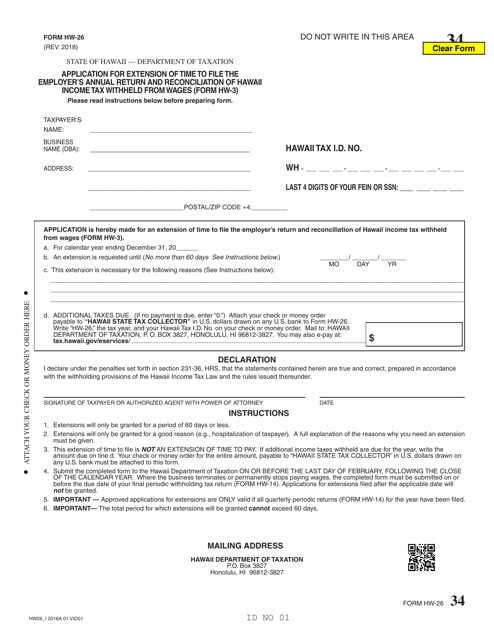

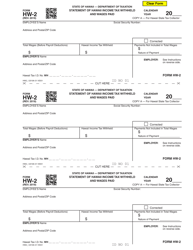

Income tax withholding hawaii. 2020 pdf 58 pages 438 kb 10 16 2020. For information on hawaii rates please refer to the appendix of booklet a employer s tax guide for tax withholding rates and tables. Withholding tax for employees. With rare exceptions if your small business has employees working in the united states you ll need a federal employer identification number ein.

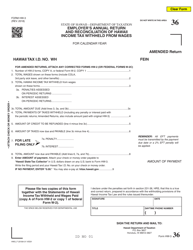

All withholding taxpayers need to file returns quarterly due april 15 july 15 october 15 and january 15 using form hw 14. You should obtain your ein as soon as possible and in any case before hiring your first employee. Employers need to withhold hawaii income taxes on employee wages. An employer s guide on state income tax withholding requirements including who must file tax returns which forms to use when the tax returns and payments are due and employer income tax withholding rates and tables effective january 1 2013.

Employers then pay the withheld taxes to the state of hawaii department of taxation dotax.