Income Verification Documentation Pending Review

Borrower income verification policies frequently asked questions this document addresses frequently asked questions about fannie mae s policies regarding verification of borrower income selling guide b3 3 including updates in selling guide announcement sel 2014 16 and announcement sel 2015 07.

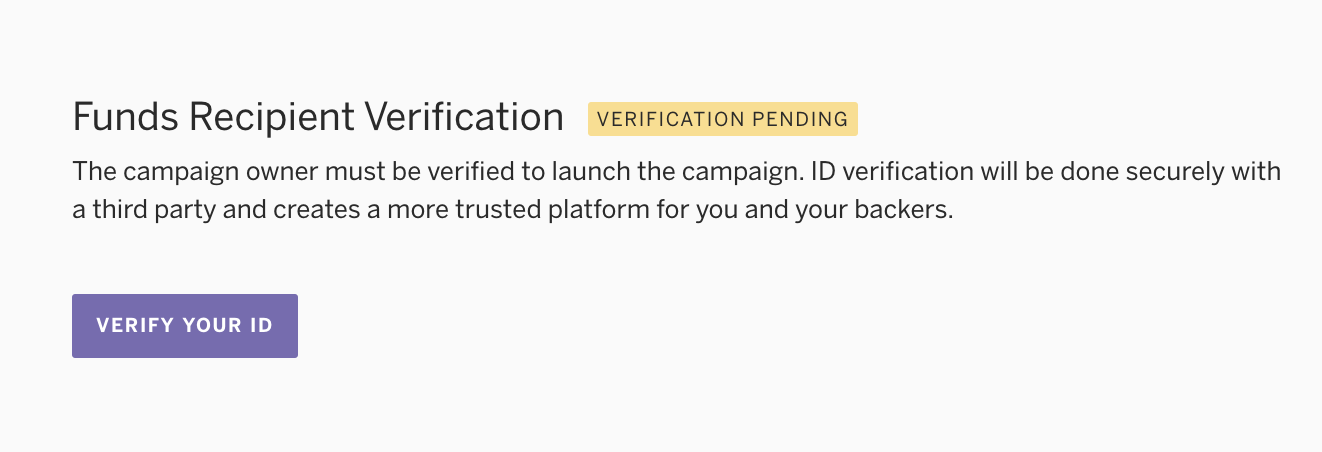

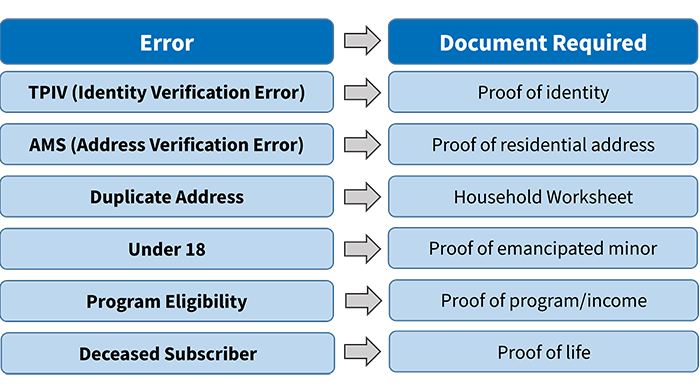

Income verification documentation pending review. Wages and tax statement w 2 and or 1099 including 1099 misc 1099g 1099r 1099ssa 1099div 1099ss 1099int. Income asset verification summary chart chart is a learning tool and is not all inclusive. For more information on home income requirements see 24 cfr 92 203. While it might seem a bit taxing to provide all this documentation it benefits you in the end as you won t end up with a monthly mortgage payment that you can t afford.

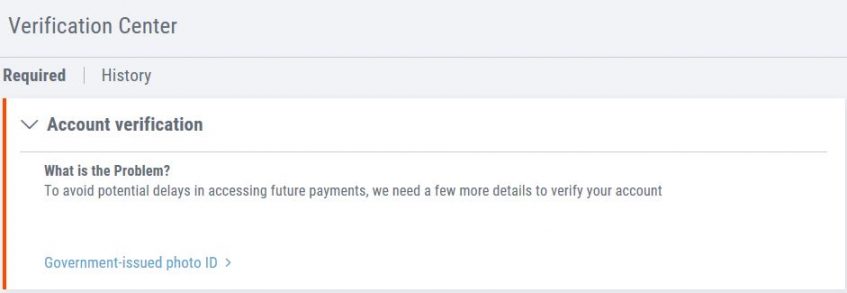

2 4 ceu review of chip application processing system. In order to get preapproved for a mortgage your mortgage lender will need to verify your income and asset information to determine how much home you can afford and the interest rate you ll pay on the loan. Types of information a review of documents b third party written c third party oral. 24 cfr 92 216 income targeting.

Read chapter 5 income asset certification in tax credit compliance procedures manual and read all form instructions. Wages and salaries including pay stubs earnings statement or signed and dated form or letter statement indicating. 24 cfr 92 203 a 1 i income targeting. Copy of last year s federal tax return along with federal schedule e that accurately reflects current income can be federal or state.

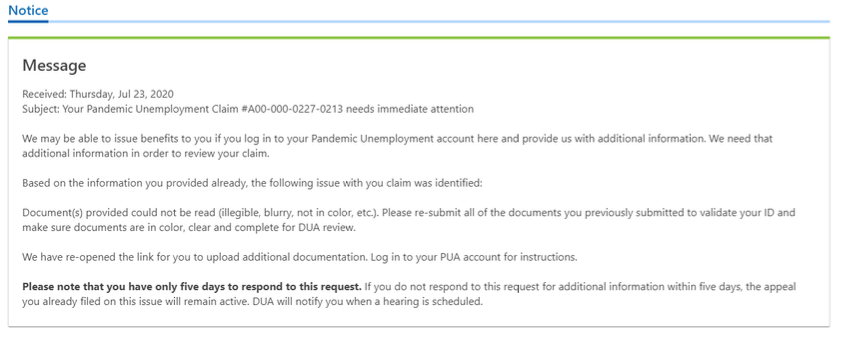

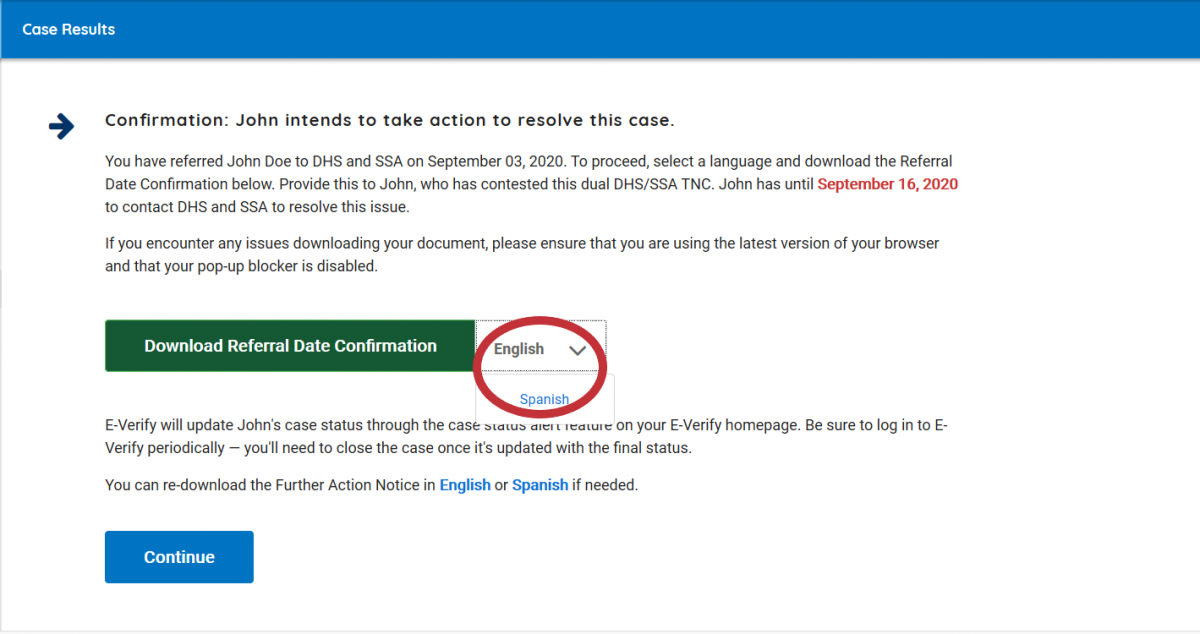

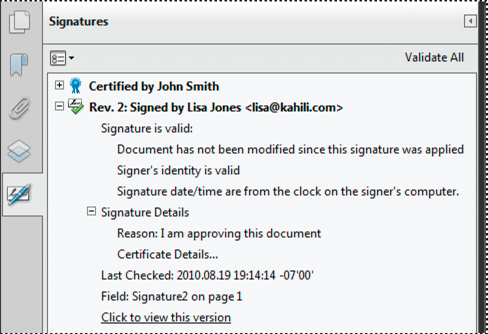

3 2 1 acceptable income verification documentation. Verification status as verified and the income discrepancy report s and supporting documentation must be retained in the tenant file for the term of tenancy plus three years. Wshfc compliance preservation division last revised july 2016 page 2 of 4 pension verification m rt type of income. Tenant based rental assistance and rental units.

41 2 5 citizenship and identity documentation received by the contractor. Home rules specify that initial income verification must be based on a review of reliable source documentation such as wage statements. Social security benefits letter.