Income Withholding For Support California

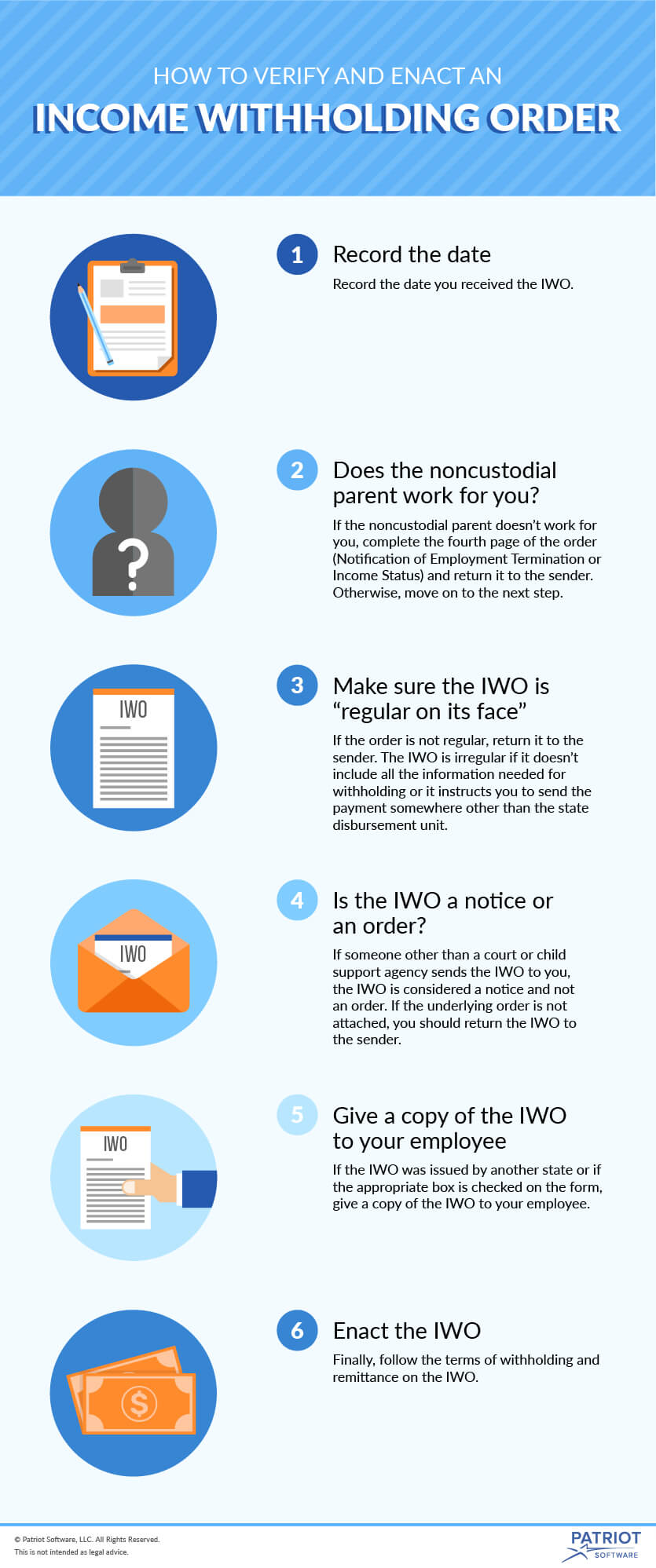

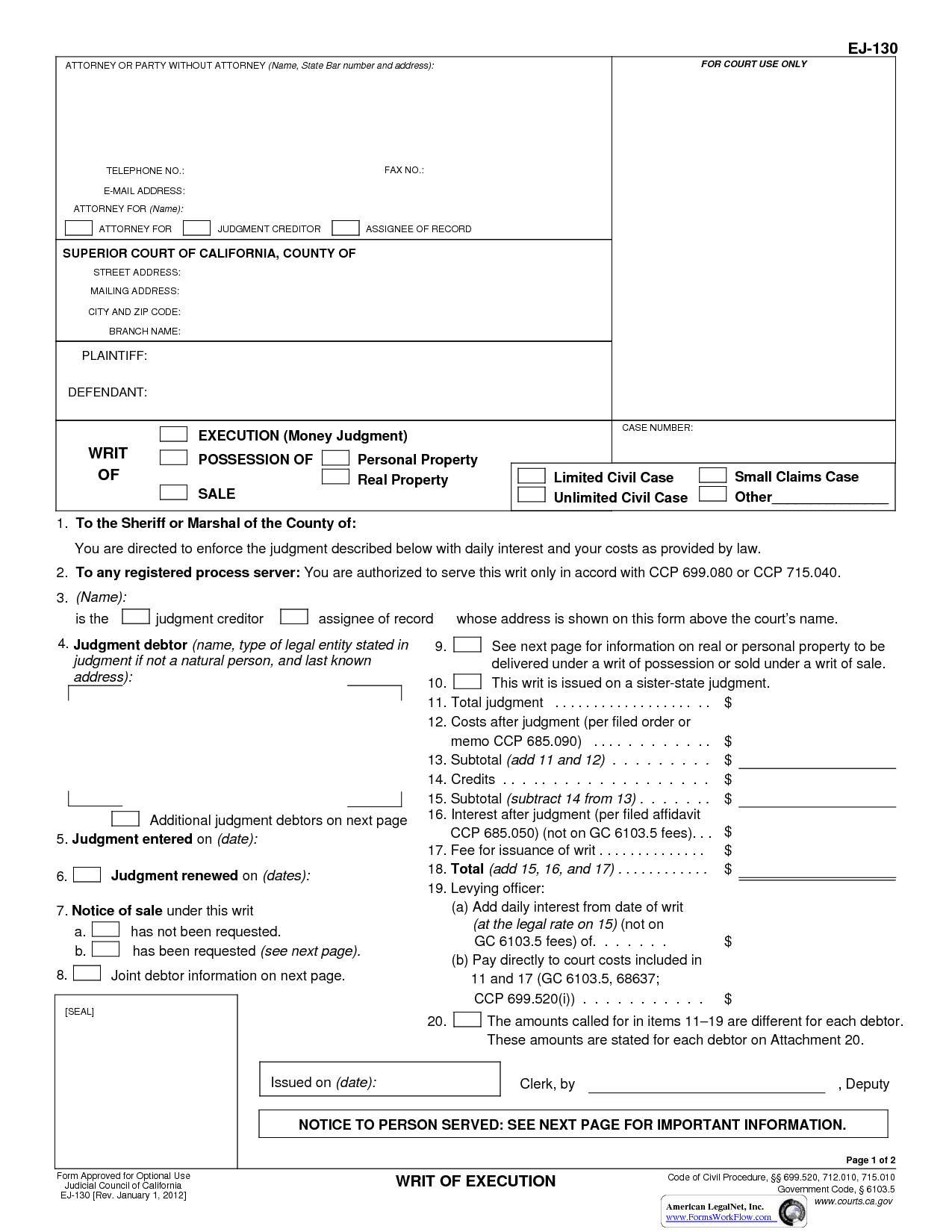

To find out how to handle wage garnishments in child or spousal partner support cases read the instructions on the forms you received.

Income withholding for support california. If a federal tax levy is in effect please notify the sender. This california fl 195 income withholding for support form is classified as a child custody form this page contains information about what this form is used for and who must file it as well as links to print or download the form as a pdf. California law states that an employer shall not use an income withholding order as grounds for refusing to hire a person or for taking disciplinary action against an employee. Have new employees complete withholding tax forms.

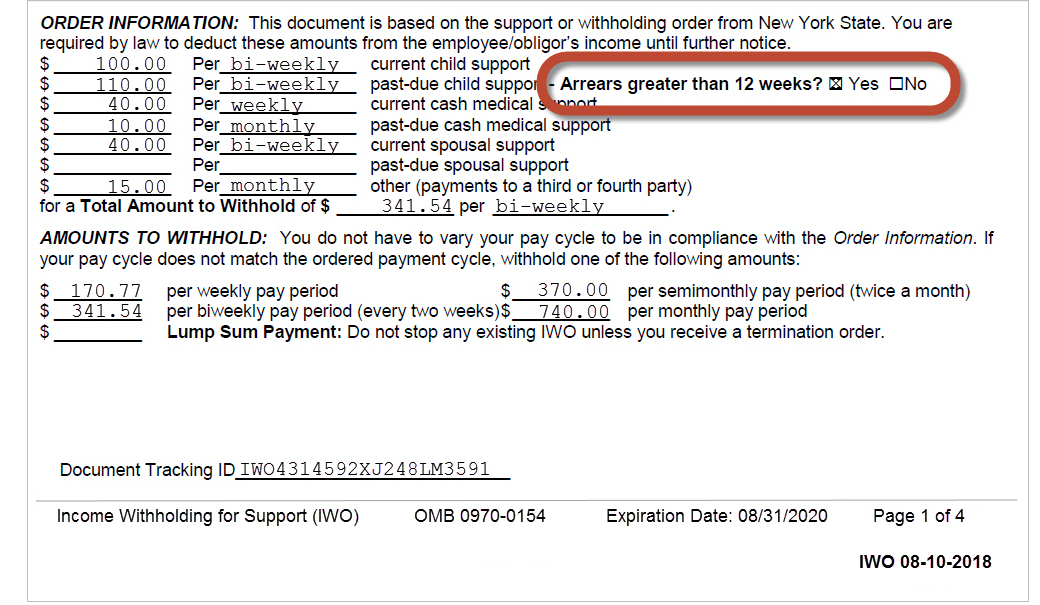

Income withholding for support iwo order notice. If a federal tax levy is in effect please notify the sender. Withholding for support has priority over any other legal process under state law against the same income section 466 b 7 of the social security act. Income withholding is the first resort for child support collections and does not infer any failure to pay on the part of the parent.

The iwo is the omb approved form used for income withholding in tribal intrastate and interstate cases as well as all child support orders that were initially issued in the state on or after january 1 1994 and all child support orders that were initially issued or modified in the state before january 1 1994 if arrearages occur. Form de 4 is used in relation to california personal income tax pit withholding. In addition a new employee may also need to complete the related california form de 4 employee s withholding allowance certificate. Income withholding order a document that tells an employer to withhold a specific amount of money from a person paying support s wages for support and to send it to the state disbursement unit.

Income withholding order iwo. The calculator is based on child support guidelines set by law in california.