Income Withholding Order Mn

You must file 0 returns if you have an active withholding tax account under your minnesota tax id number.

Income withholding order mn. Withholding tax applies to almost all payments made to employees for services they provide for your business. You then send this money as deposits to the minnesota department of revenue and file withholding tax returns. Please send the income withholding order or similar document to dfas at the address or fax number below. 32 36 1 1 0 0 0 0 0 0 0 0 0 36 40 1 1 0 0 0 0 0 0 0 0 0.

Income withholding for support iwo order notice. Income withholding only services do not include. An income withholding order iwo is an order that directs you the employer to withhold a specific amount from the paychecks of an employee. The withholding amounts are used to pay child support spousal support medical support or other types of support.

You do not need to send the underlying order e g a divorce separation decree. You withheld minnesota income tax from your employees wages. 2 income withholding the deduction of a current basic support child care support medical support or spousal maintenance obligation and arrears from an obligor s wages or other sources of income. Automatic cost of living adjustments modifying a support order.

It is the responsibility of the private parties to start modify and voluntarily terminate income withholding on their income withholding only case. A if income withholding is ineffective due to the obligor s method of obtaining income the court shall order the obligor to identify a child support deposit account owned solely by the obligor or to establish an account in a financial institution located in this state for the purpose of depositing court ordered child support payments. Box 998002 cleveland oh 44199 8002. Income withholding of support payments most new or modified child support orders require employers and payors of funds to automatically withhold basic support medical support and child care support obligations from a parent s paycheck or other sources of income.

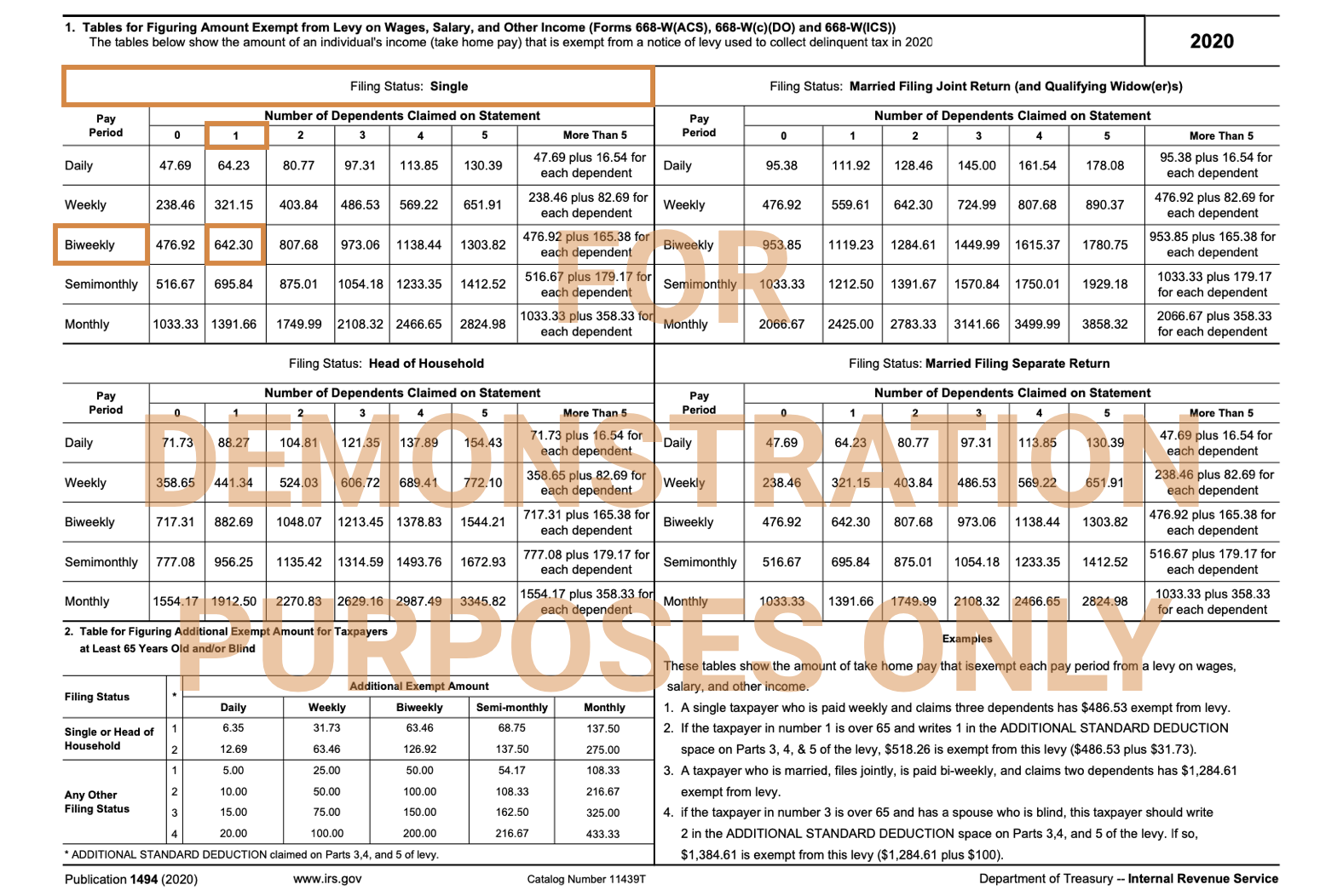

The iwo is the omb approved form used for income withholding in tribal intrastate and interstate cases as well as all child support orders that were initially issued in the state on or after january 1 1994 and all child support orders that were initially issued or modified in the state before january 1 1994 if arrearages occur. Sending income withholding notices to the other parent s employer. You did not have employees or withhold minnesota income tax. Number of withholding allowances the amount to withhold in whole dollars or more if the employee s wages are but less than 16 0 24 0 0 0 0 0 0 0 0 0 0 0.

You must file withholding tax returns even if you already deposited the tax with us.