On The Income Statement Gross Profit Is Defined As

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Answer operating profits minus operating expenses gross profit minus operating expenses sales revenue minus cost of goods sold sales revenue minus operating expenses.

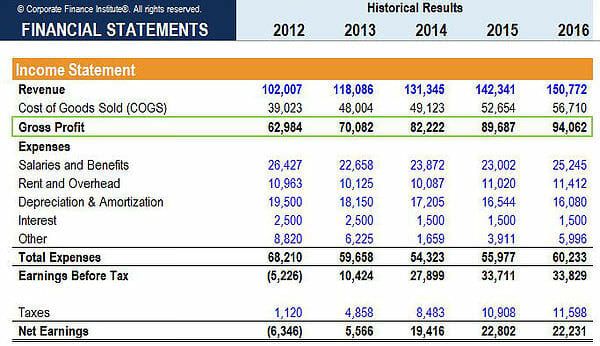

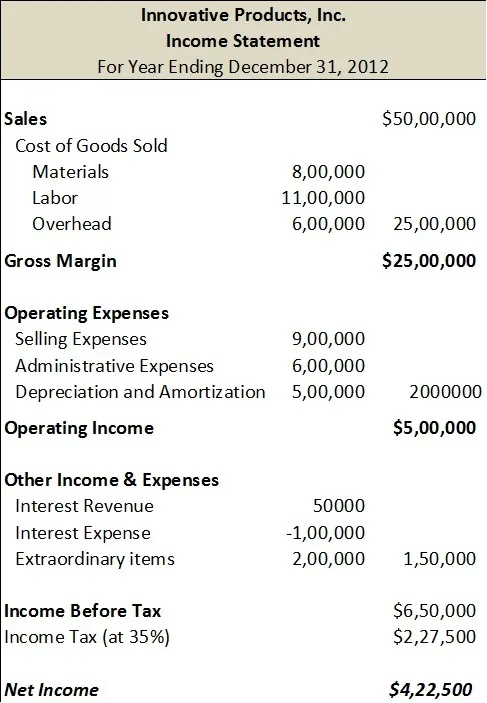

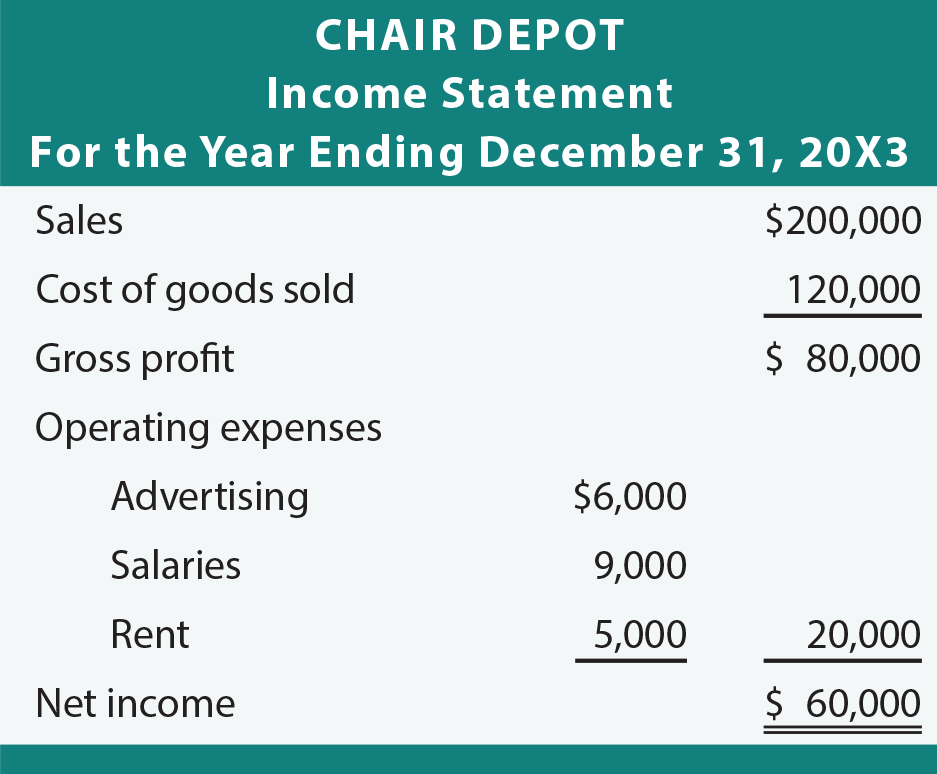

On the income statement gross profit is defined as. Sales revenue minus cost of goods sold question 11 2 out of 2 points. For example if you re a self employed window washer your margin would be all the money you make for washing windows minus the. For companies gross income is interchangeable with gross margin or gross profit. The first portion of a corporate income statement called gross profit seeks to calculate the profitability of a company s operations after direct costs.

Gross profit minus operating expenses is best defined as. Sales revenue minus cost of goods sold correct answer. On the income statement gross profit is defined as. These figures can be found on a company s income statement.

Here s the income statement for the first quarter of this year for a new local football association. Gross profit on the income statement gross profit is defined as by jianta maya maret 25 2018 in accounting gross profit gross margin sales profit or credit sales is the difference between revenue and the cost of making a product or providing a service befo re deducting overheads payroll taxation and interest payments. To understand an income statement let s use an example. Its ultimate goal is to determine the company s gross margin.

While net income is a company s earnings gross profit can be defined as the money earned by a company after deducting the cost of goods sold. The income statement line gross profit will appear on which income statement format. The gross profit of a business is simply revenue from sales minus the costs to achieve those sales. A company s gross income found on the income statement is the revenue from all sources minus the firm s cost.

Gross profit will appear on a company s income statement and can be calculated by subtracting the cost of goods sold from revenue sales. Or some might say sales minus the cost of goods sold it tells you how much money a company would have made if it didn t pay any other expenses such as salary income taxes copy paper electricity water rent and so forth for its employees. Best answer 100 7 ratings previous question next question get more help from chegg. The certificates include debits and credits adjusting entries financial statements balance sheet income statement cash flow statement working capital and liquidity financial.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

:max_bytes(150000):strip_icc()/Screenshot2019-08-21at10.58.51AM-049e1ab335434a16ab7ddc69664758a7.png)